Monero, Aave, Enjin Price Analysis: 27 January

Monero succumbed to yet another support level as the price moved below $134.4. Aave retraced from record levels, but the market still belonged to the bulls and the price could surge to fresher highs over the next few trading sessions. Finally, ENJ showed signs of a bearish pullback and a southbound move could see the price test the $0.375-support level.

Monero [XMR]

Source: XMR/USD, TradingView

After dropping below the $152.7-mark, Monero fell below several support levels and was unable to revisit the levels seen in mid-January. A look at its 4-hour chart showed a bear market for XMR as the price traded below the 200-SMA (green). The bearishness also had a negative result on the price as XMR found itself among the top losers for the month. At the time of writing, the price had slipped below yet another support level at $134.4 and was heading towards the next line of defense at $128.8.

The MACD’s bearish crossover suggested that sellers could control the price moving forward.

The Relative Strength Index headed lower towards the oversold zone, underlining the weakness in price.

Aave [AAVE]

Source: AAVE/USD, TradingView

Aave seemed to cool off from its all-time high as buying activity and trading volumes dipped slightly over the last 24 hours. However, momentum was still strong on the bullish side and an extended rally could see AAVE hit fresher highs over the next few sessions. On the other hand, a fall below the $244.9-support could indicate a reversal and a shift in momentum towards the bears.

The Awesome Oscillator showed that momentum remained strong on the bullish side.

Although the On Balance Volume moved slightly lower over the last few sessions, it still presented a healthy number of buyers in the market.

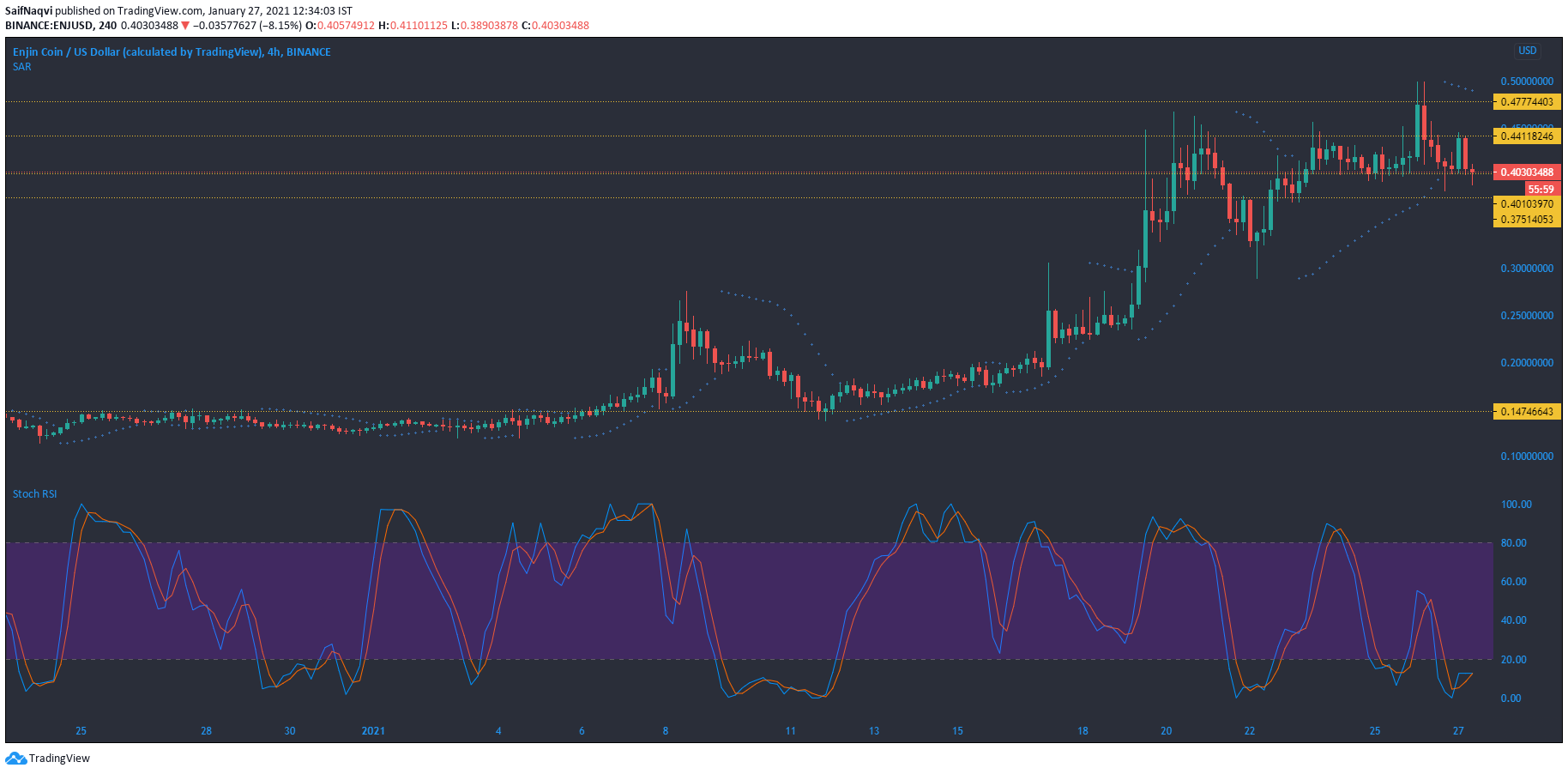

Enjin [ENJ]

Source: ENJ/USD, TradingView

Despite Enjin falling by over 13% from its all-time high, the gaming token’s price soared by 184.5% in the last 30 days. The uptrend can also be seen on the charts as ENJ snapped higher highs and higher lows. While the bulls were in control of the market, some selling pressure was witnessed over the past couple of days as the price traded close to the $0.402-support. A deeper correction could see ENJ fall below its press time support level and move towards the next barrier at $0.375.

Although the Stochastic RSI traded in the oversold zone and seemed primed for a reversal, a bearish crossover meant that the index could linger in the area before changing direction.

The Parabolic SAR’s dotted markers were above the candlesticks, a sign that ENJ was bearish over the last few days.

Enjin coin made the news recently after it was granted legal status by the Japan Virtual Currency Exchange Association – Japan’s crypto-regulator. The platform also announced a listing on Coincheck, a Japanese exchange platform.