Should you be worried about Ethereum’s latest price dip?

Ethereum registered a lot of bullish momentum on the charts as 2020 came to a close. On the back of Bitcoin’s bull run, 2021 has also been very promising for the cryptocurrency. In fact, even as Bitcoin struggled to maintain the $32,000-price level, Ethereum ended up securing its latest ATH.

However, since then, the situation has taken a bearish turn for the world’s second-largest cryptocurrency, with Ethereum trading at $1,298 at press time after corrections set in.

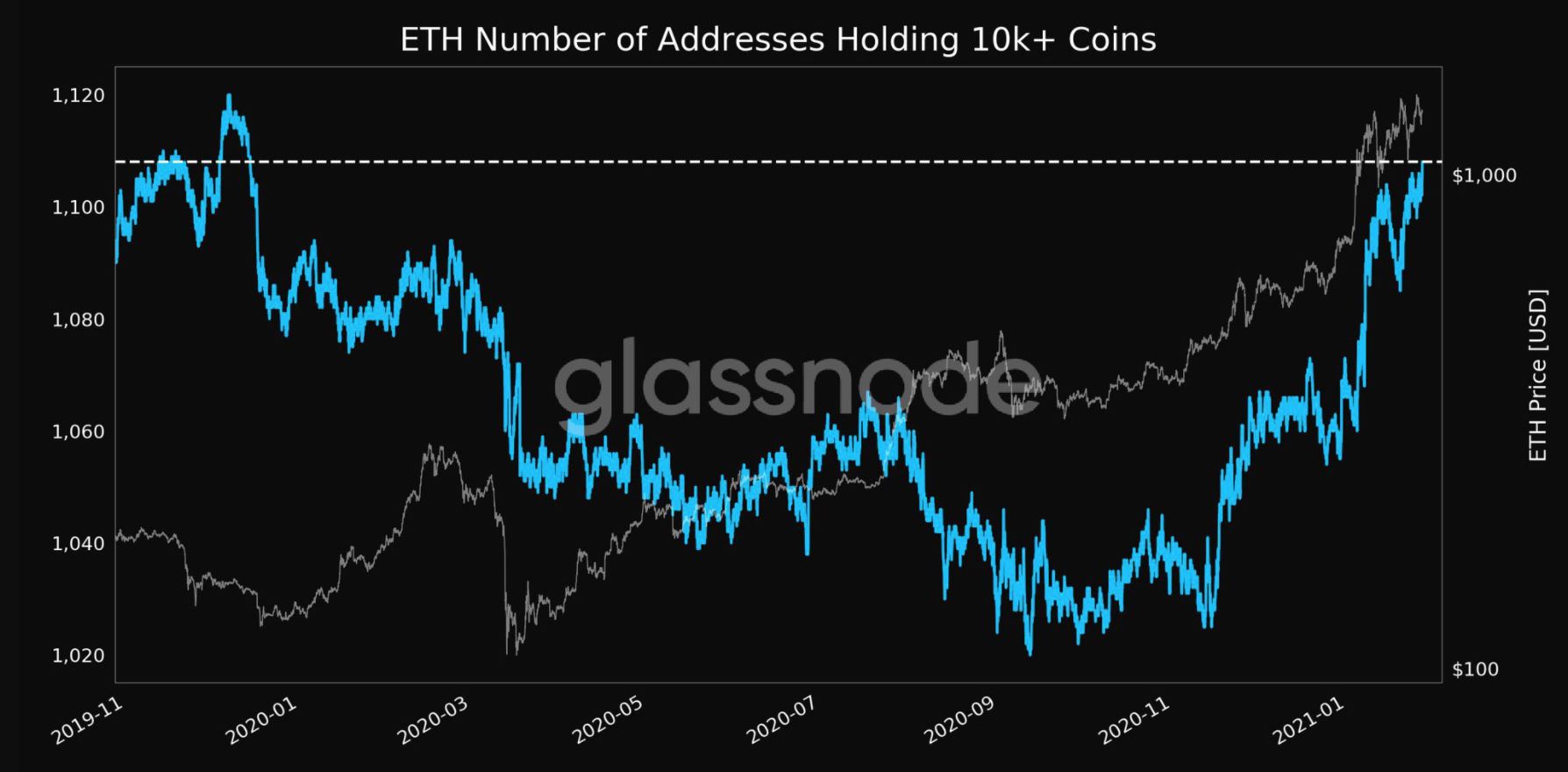

Source: Glassnode

While its recent price performance might be deemed troubling, an interesting development is taking shape for Ethereum. According to data provider Glassnode, the number of whale addresses holding 10,000 $ETH has climbed to a 13-month high. The number of whale addresses for Ethereum is now close to its late-2019 levels and is likely to impact its price in a positive way as the selling pressure slowly fades away.

Taking a look at past precedents, one can argue that the price is likely to react in the upwards direction for Ethereum. As 2020 came to a close and the price started to climb on the charts, Ethereum saw these whale addresses hike. Interestingly, since the beginning of 2020, 35 new ETH whale addresses have been created, with these addresses together controlling around $447 million worth of Ethereum in the market today.

Ergo, while many might believe that the market has taken a bearish turn, the reality is ETH is merely going through a phase of correction, something that implies that reversal will soon follow.

Strong hodling sentiment is vital for most cryptocurrencies and it tends to push the price upwards. According to Glassnode’s data regarding Ethereum balance on exchanges, the coin has seen an extremely high volume of exchange withdrawals over the past week. In fact, over one million ETH left exchanges as investors bought into the long-term approach by shifting their ETH to private wallets to hodl the coin.

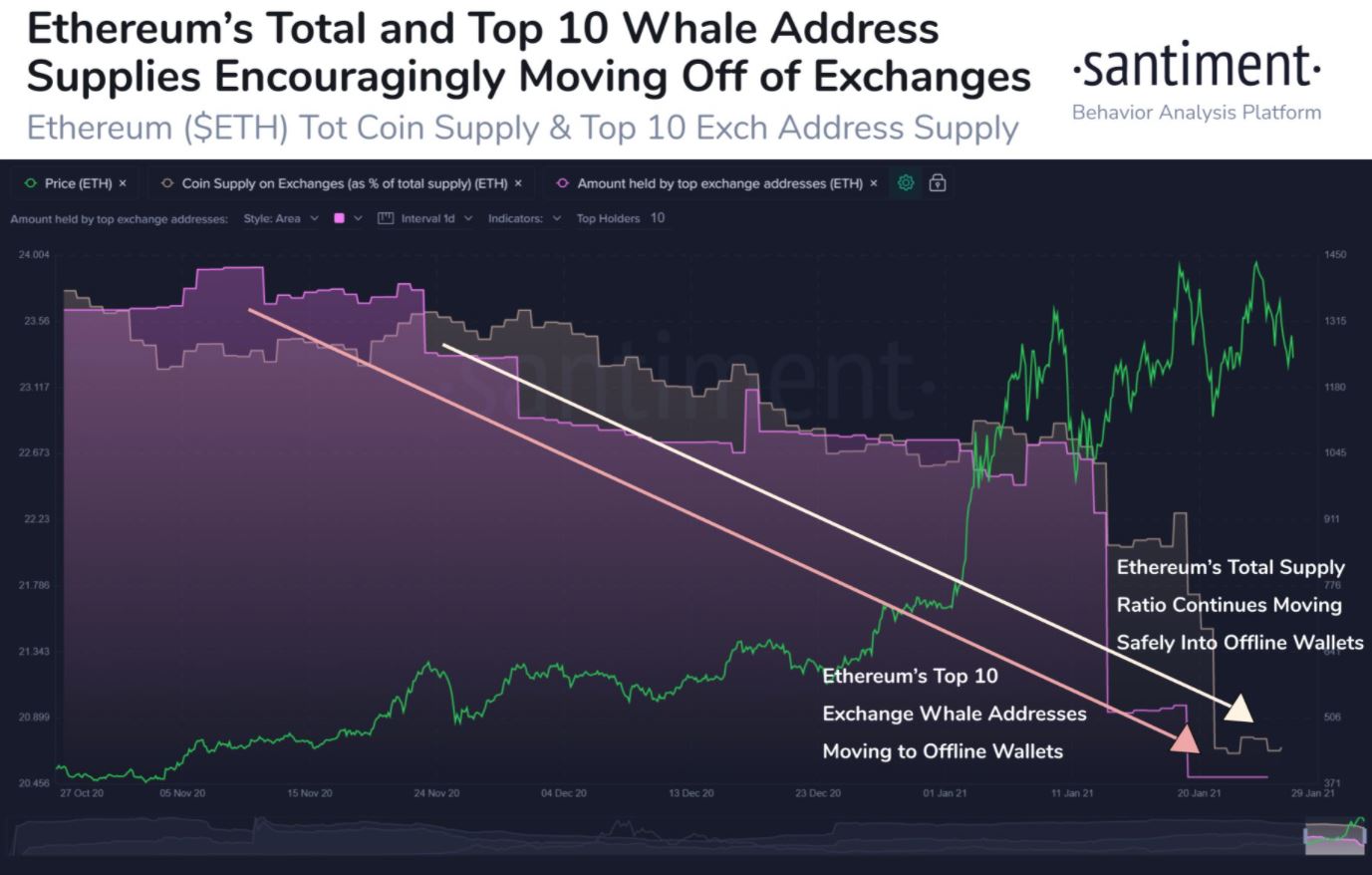

Source: Santiment

This is a strong bullish signal for the cryptocurrency in the long run as it highlights investor confidence in Ethereum’s ability to grow and see its price appreciation in the longer-term. It is also interesting to note that despite the aforementioned corrections, large addresses are moving their respective stashes into private wallets. The ratio of Ethereum on exchanges, as well as coins held by the top-10 whale exchange addresses, sat at a 26-month low, at press time.

Ethereum has seen its whale addresses steadily increase lately and the same demographic has also been positioning itself as long-term hodlers. This is extremely bullish for Ethereum and if these trends continue, minor price corrections may not really hinder the coin’s growth, making the likelihood of a new ATH extremely feasible.

Keeping these factors in mind, one can see the rationale behind Galaxy Digital’s Mike Novogratz terming ETH to be a ‘growth asset.’ A few days back, it was revealed that as per documents shared with investors, Galaxy Digital will be launching ETH-focused funds next month, a development that again will push ETH’s value higher.

Source: Coinstats