Grayscale’s Bitcoin Trust Premium turns negative for first time since launch

Grayscale has been at the head of a lot of Bitcoin-related developments over the past few months. It is in the news again today after its GBTC premium turned negative for the first time after its launch in 2013. The aforementioned premium represents an “overpayment” on behalf of mostly institutional buyers that seek Bitcoin exposure, while remaining compliant with regulations.

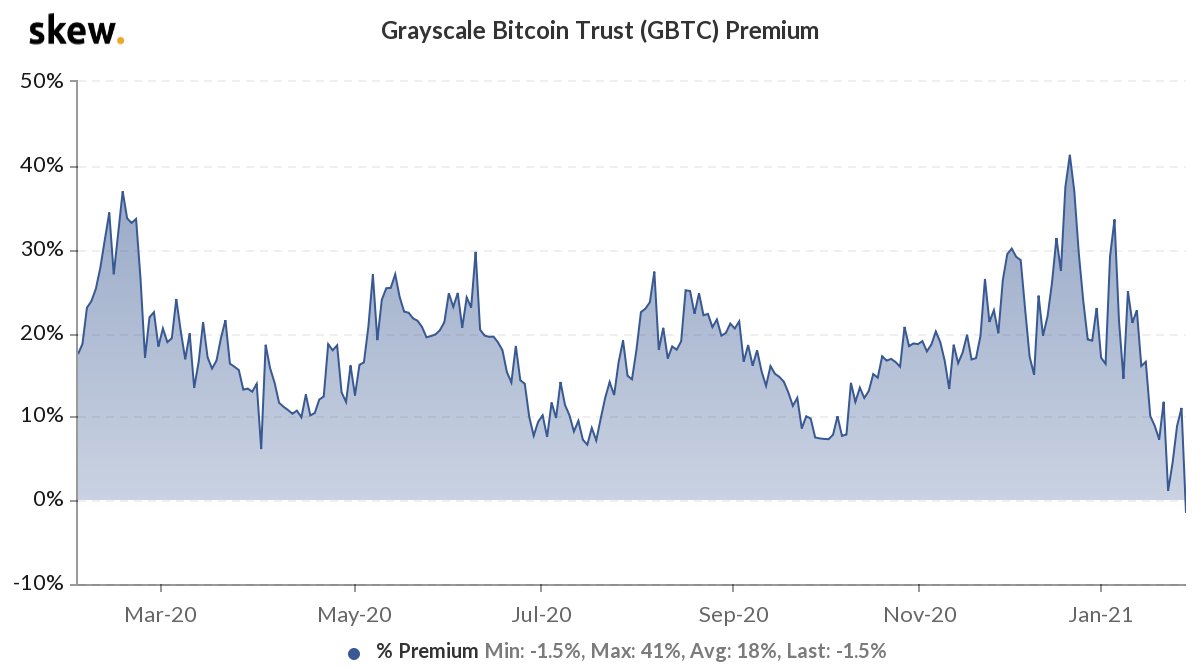

Source: Skew

Historically, the GBTC premium has been considerably high, with the same measured to be about 40% just last month. On the 2nd of February, however, data from Skew confirmed that it had fallen to -1.5%, before rebounding slightly to note positive figures again.

The drop in the premium may have been caused by increased selling from accredited investors realizing their premium or a lack of demand for GBTC from non-accredited investors at this price. This lack of demand for GBTC may, in fact, have been caused by increased competition in the market, driving demand elsewhere.

In fact, the same was highlighted by a recent article which said,

“…. institutional buying is an investment in GBTC, and institutions are buying GBTC for a premium. Once the premium drops, the demand is expected to drop, and the same is what has happened. What does this entail? Well, the drop in demand suggests that there may be a pause, or worse, a stop in institutional buying of GBTC, and this also highlights the possibility of the siphoning off of Bitcoin demand.”

Despite the fact that the SEC is yet to approve a Bitcoin ETF in the United States, a number of companies have recently submitted filings signaling their intent to offer a Bitcoin investment trust vehicle – the most recent being BlockFi after it submitted its filing on 29 January.

Investing in GBTC has long been a popular trade for many institutions across quarters. In fact, just recently, Three Arrows Capital publicly declared a position of over $1.2 billion in Grayscale’s Bitcoin Trust.

Given the current scenario, however, the downside of GBTC trading at a discount could be quite significant.

As highlighted by one analyst on Twitter,

“If GBTC goes to a discount, there is a risk that lenders will sell the collateral in an effort to limit their losses. Unless margin calls are met by the traders.”