Should USDT_ETH keep looking over its shoulder?

Months before the commencement of the bull run in December 2020, DeFi was receiving all the attention in the summer. Decentralized applications were building a new financial system on Ethereum, and the demand for block space on ETH was rapidly increasing. Soon, yield farming became a common term and the popularity of DeFi triggered further activity on Ethereum.

In Summer 2020, most of the DeFi activity was carried out with USDT transactions. However, after its bullish momentum slowed down, transactional activity declined as well.

Interestingly, recent stablecoin issuance alongside rumors of another DeFi rally may point to a possible change in guard, with TRON likely to sneak into the picture.

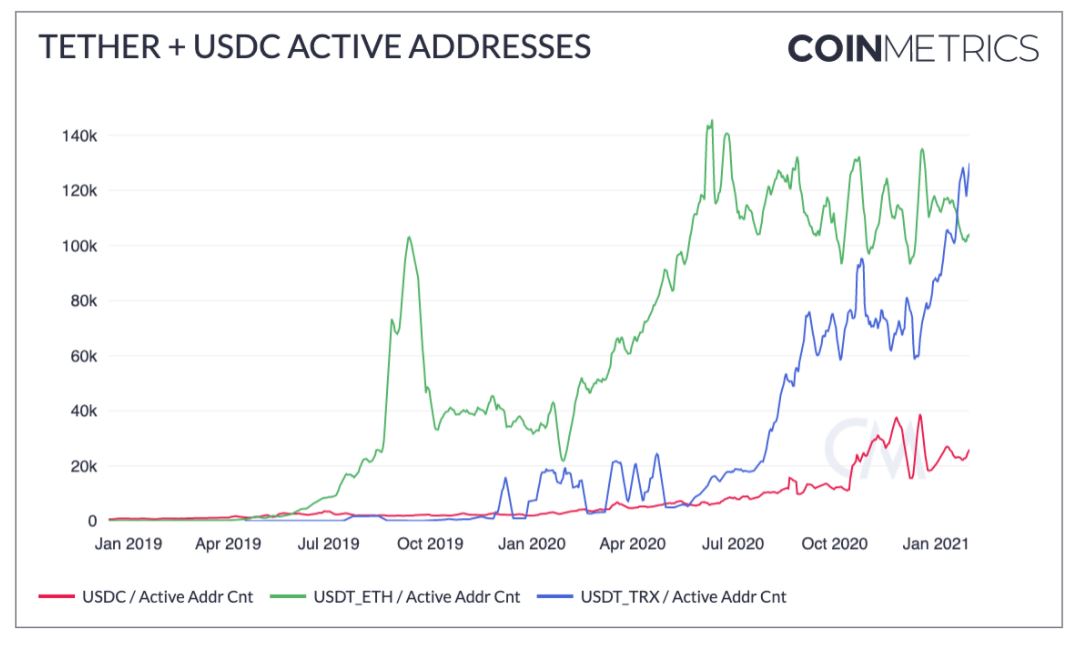

Stablecoin active addresses rise in 2021

According to the latest CoinMetrics report, stablecoin daily active addresses climbed to a new all-time high in 2021, with USDT constituting a majority of the active addresses.

However, Tether activity is increasingly shifting more of its activity onto the TRON_USDT version of the stablecoin.

As can be observed from the attached chart, TRON_USDT active addresses have eclipsed USDT_ETH addresses since the start of 2021, with USDC_USDT lagging behind both Ethereum and Tron.

Such a shift in trend might be taking place for a couple of reasons that were blatantly observed in 2020 – a) less congestion and, b) minimal transaction fees.

In 2020, due to increasing demand for block space on Ethereum, transaction gas fees skyrocketed to carry out DeFi transactions on the ETH network. During peak activity times, users would have to pay more than $60 worth of gas to get their transactions processed.

With TRON_USDT, such concerns can be limited since the TRON blockchain involves minimum fees and the congestion is significantly reduced.

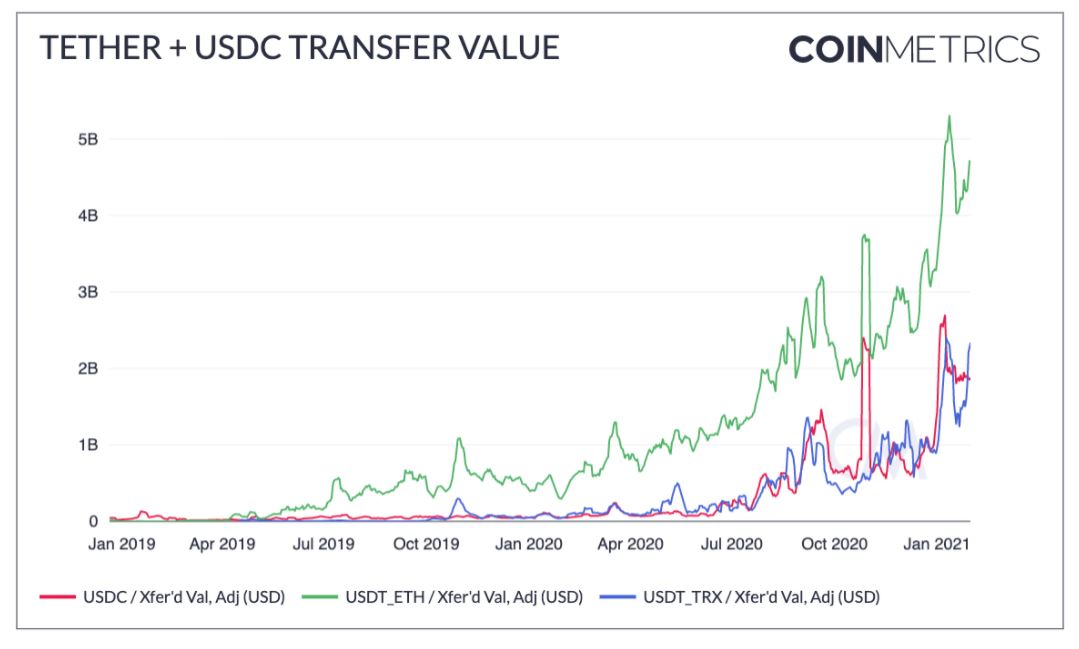

Does Ethereum need to worry?

Not yet. While TRON_USDT may have outpaced ETH_USDT in terms of active addresses, the average transfer valued processed through Ethereum is much higher than Tron.

In fact, data suggests that the medium transfer value for TRON_USDT is currently about 10x smaller than the median transfer value for ETH_USDT. Users might be using the TRON network for small transactions, hence, lower fees and possibly a less reliable network is not a massive drawback.

For now, Ethereum remains the hotspot for DeFi transactions via USDT, but its position can be subject to change in the future.