Here’s how Bitcoin turned an important corner before breaching $50k

After news broke out last week regarding Tesla’s $1.5 billion investment in Bitcoin, the cryptocurrency was at the end of one of its biggest price hikes in recent memory after it surged by 18.45% in a single day.

Having acquired the said bullish momentum, however, BTC soon registered major corrections on the price charts, with the crypto falling below $47,000.

This wasn’t the case at press time though, with Bitcoin, thanks to news that MicroStrategy is intending to buy even more BTC, climbing to touch a new ATH above $50,000. In fact, the crypto-asset may have turned an important corner before amassing a position above $50k.

Bitcoin: Plot of Natural Sellers and Coin movement

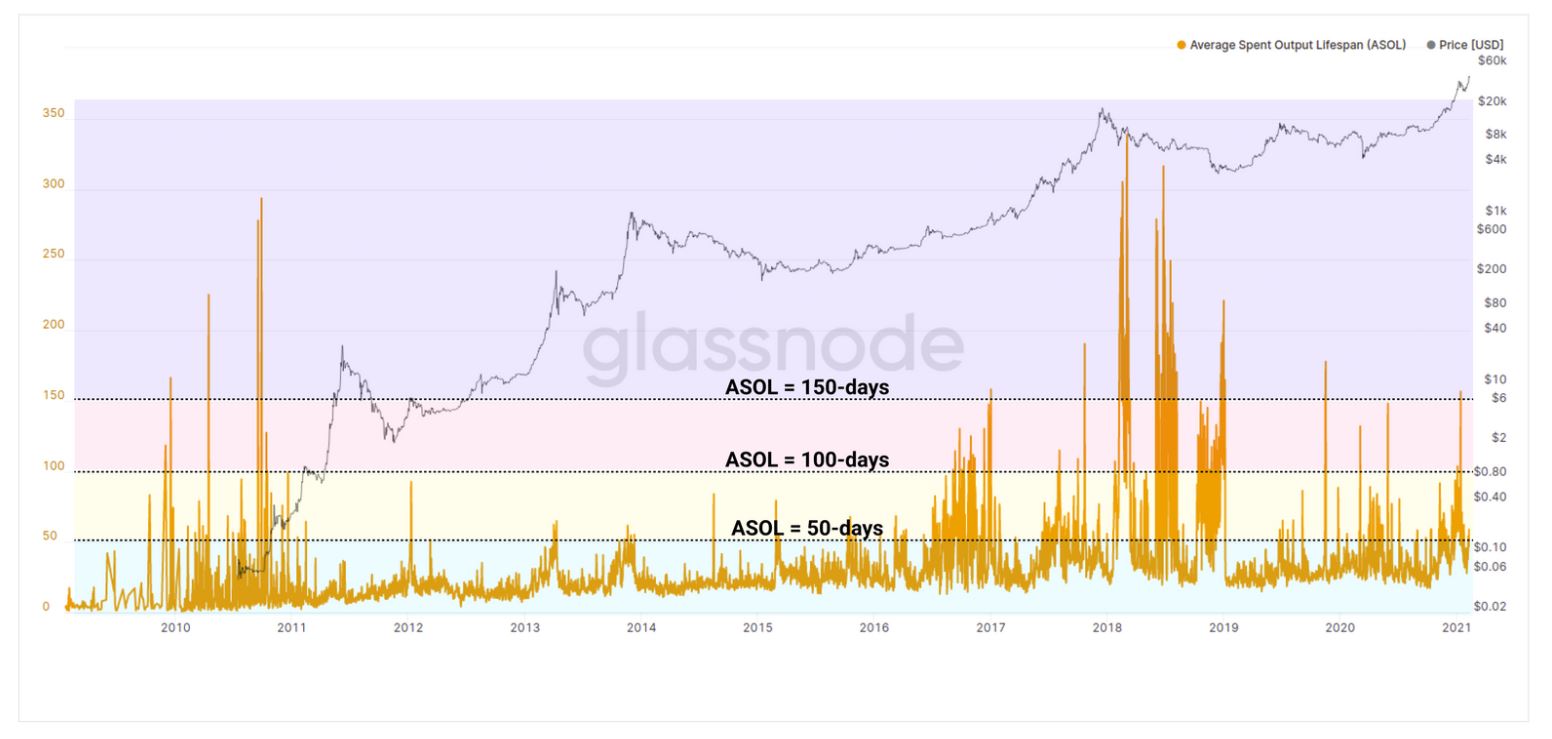

According to Glassnode’s latest weekly report, a major change was noted before the most-recent spike above $50,000. The said report also explained the importance of natural sellers during a Bitcoin bull run.

The report noted that during a positive rally, miners and holders of older coins who have accumulated over a long time tend to sell their tokens in order to realize profits. Now, according to data, Bitcoin’s recent price movements pushed the average age of coins spent from 30 days to 58 days on the Average Spent Output Lifespan indicator (ASOL).

Now, ASOL is a metric that allows an observer an understanding of long-term and smart money hodlers. The ASOL calculates the average age of spent coins. So, if the ASOL value is of days, it means that coins spent on the day were relatively young and acquired recently. Here, 50-day would mean an average of coins bought close to 1-3 years ago in the last bear market.

Historically, whenever the ASOL has crossed the 50-day level on the chart, it had indicated the start of another bullish rally. The fact that the ASOL is just above 50-day right now suggests that we are far away from a long-term top for Bitcoin. Hence, the crypto-market may be hinting at a 2nd bull wave for Bitcoin over the next few weeks.

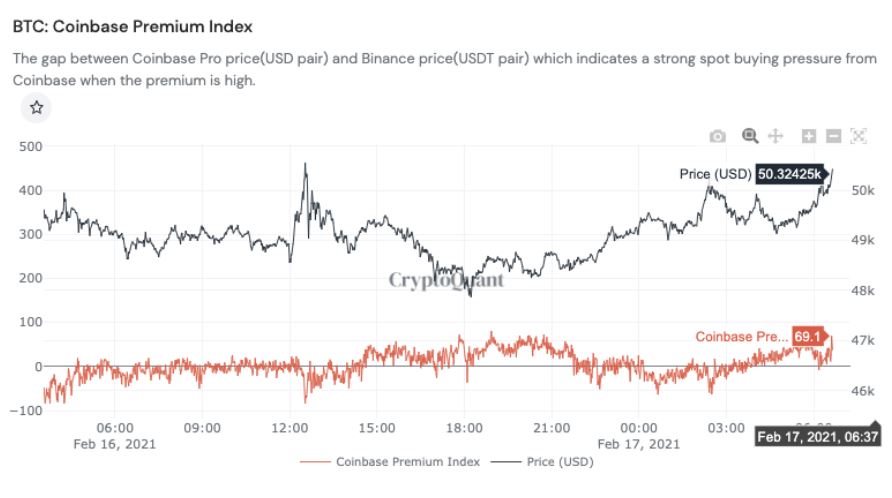

Bitcoin: Coinbase Premium agrees

As highlighted by Ki-Young Ju, CEO of CryptoQuant, Bitcoin’s Coinbase premium is also indicative of a positive scenario after the crypto recently broke past $50,000, showing little signs of a bearish pullback on the charts.

Ergo, Bitcoin may have turned an important corner with the ASOL indicator, with the crypto-asset looking to re-gain bullish dominance in the market.