Where is Ethereum’s price rally headed next?

Though Ethereum is trading in a tight range, the relatively strong selling pressure may have an impact on the price of the asset. The selling pressure has contributed to the sell-off and the drop in Ethereum’s price. The coin traded in a relatively tight range on Saturday and closed the day in the positive territory but came in under strong selling pressure on Sunday. As of writing, ETH was trading at $1429, losing around 27% of its value during the course of the past week.

Source: CoinGecko

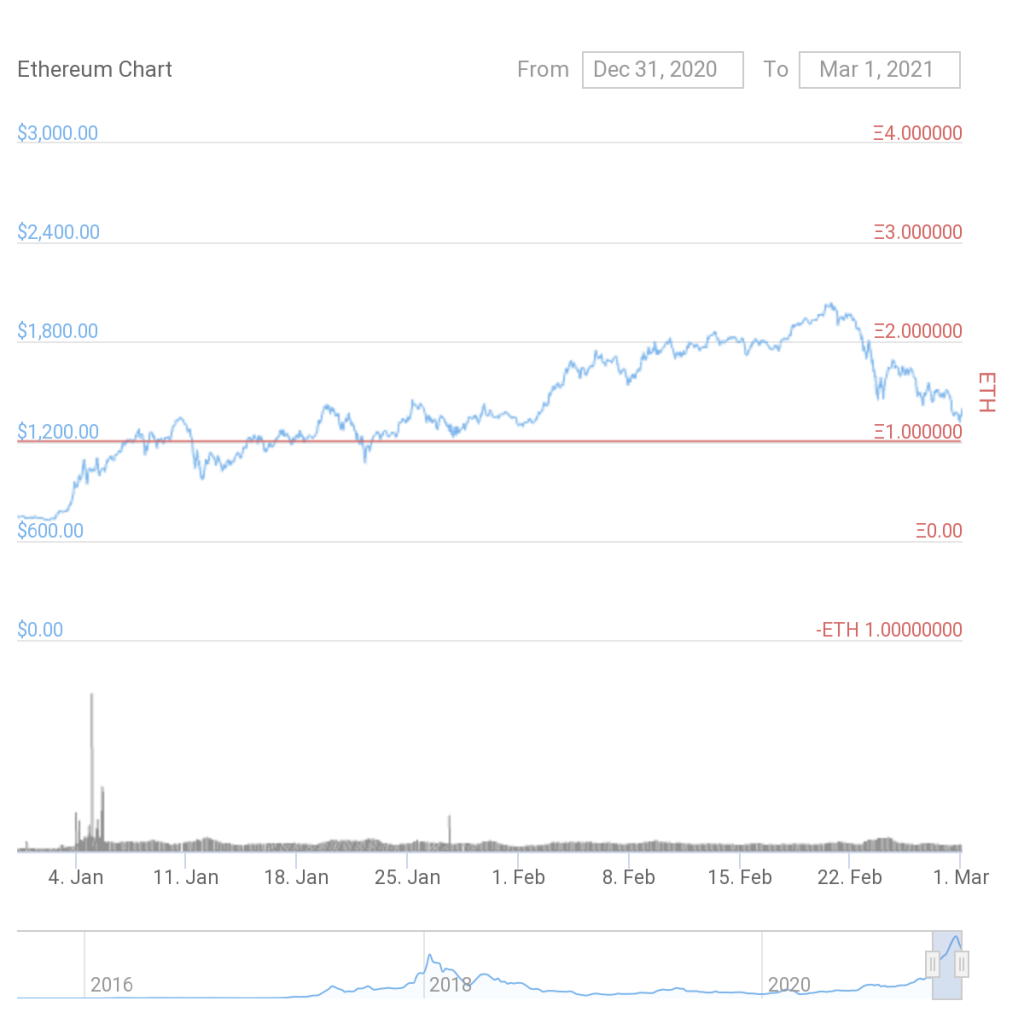

The change in Ethereum’s price may be noticed on derivatives exchanges first when the activity on CME ETH futures increases. Until then, the reserves of Ethereum on spot exchanges signal a further drop in price, in the current market cycle. Ethereum’s price hit an ATH with the altcoin rally, however, the price has endured corrections several times.

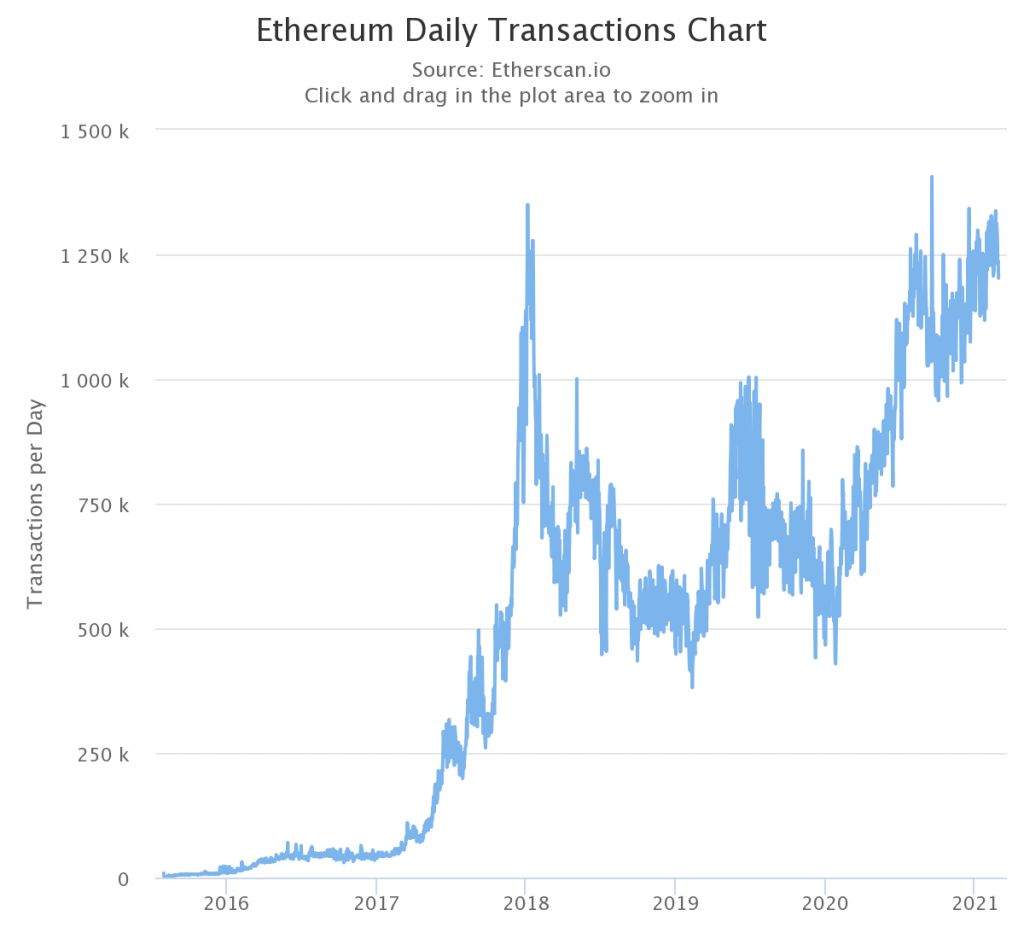

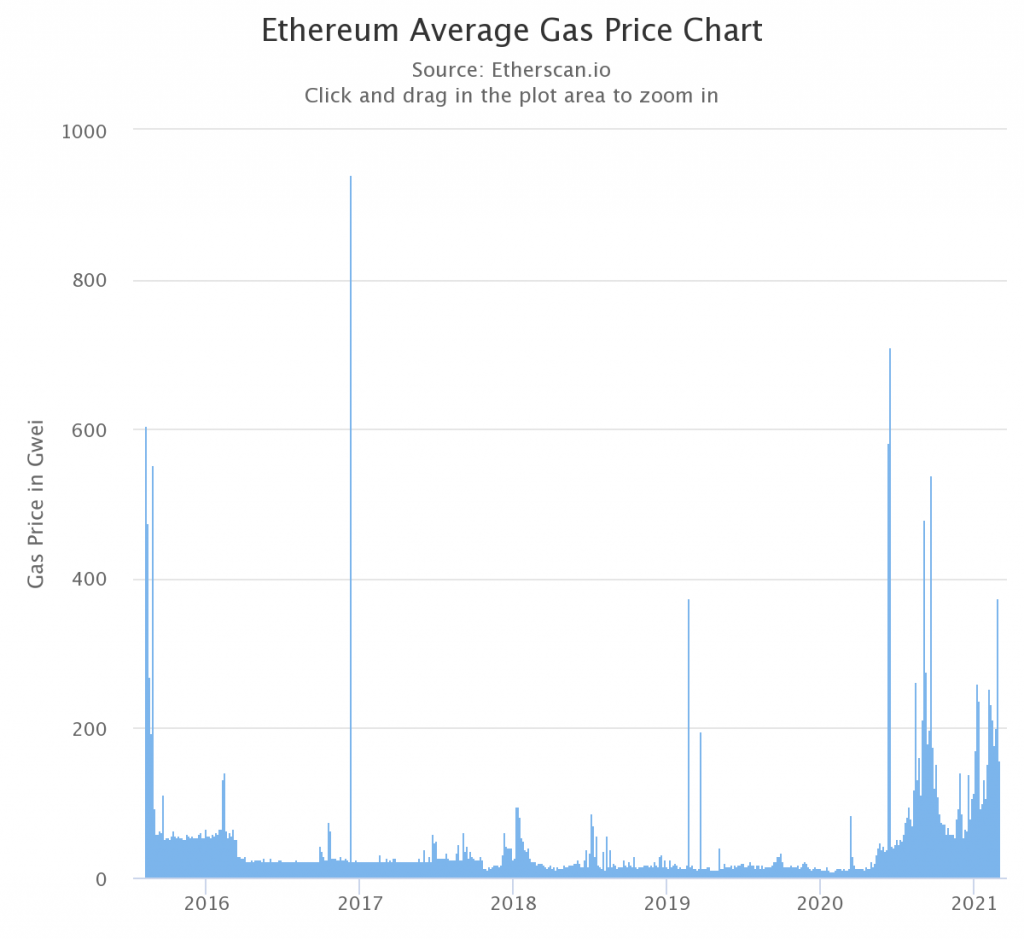

Currently, the correlation with BTC is high and this may be the leading cause for the correction. Since CME ETH futures and Top exchanges account for institutional investment flow in Ethereum, currently, there is a drop. More ETH is hitting exchanges and with the recent announcement on GAS prices, it is likely that the price may drop even further. ETH’s price has an impact on the rest of the altcoins as well and currently, the burning question is that will the killing of CHI and GST2 mean that there may be lower activity on the Ethereum network.

Source: Etherscan

The drop in activity may signal a drop in Ethereum’s demand, and consequently the price in the short term. Currently Gas is low on Ethereum and the question is will removing some “floor usage” have a negative impact on Ethereum’s price and trader’s portfolio?

Source: Etherscan

A 10% drop in 24 hours in Ethereum’s price is unexplained when ETH 2.0 has reached a major milestone the same day. ETH 2.0 has reached 100000 Validators + 3 Million in staked, at this point in the market cycle a divergence of 10% may be considered a bearish signal. Though usually, a divergence of 10% is considered normal in an alt season or a given market cycle. The current view of traders on spot and derivatives exchanges is bearish on ETH, there may be a larger price drop in the future, and this is primarily due to a shortage of buyers. In the short term, it is expected that there may be a further correction.