After 59k, what’s in store for Bitcoin?

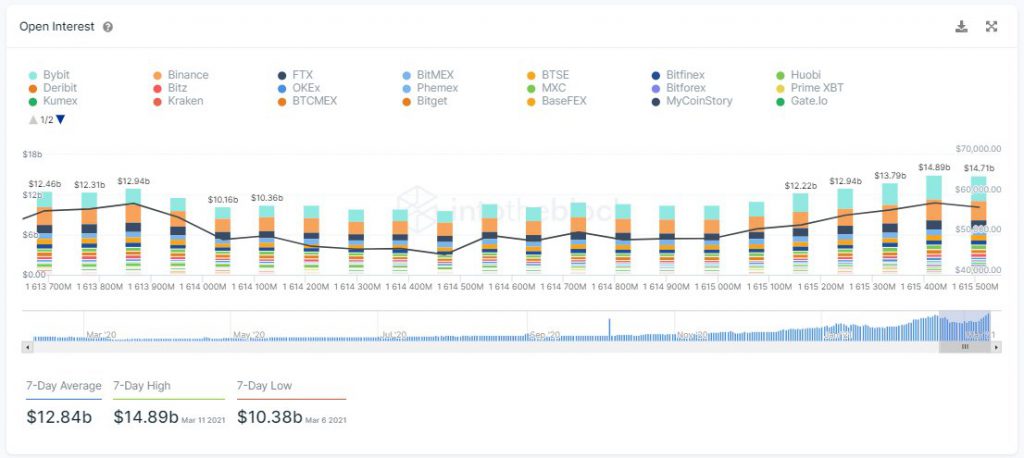

Bitcoin is currently trading around the $59000 level at the time of writing and the price is continuing to rally upwards. The investment inflow in Bitcoin has increased and a large volume of money is flowing into the Bitcoin derivatives markets based on data from IntoTheBlock. Perpetual Swaps’ Open Interest across major exchanges is currently sitting on the verge of breaking the $15 billion mark and 53% of that volume goes to the top exchanges – Bybit, Binance, and FTX.

Source: Twitter

The institutional inflow comes from MicroStrategy’s purchase of an additional 262 Bitcoins for $15 Million in cash and recently Purpose Bitcoin ETF bought over 125000 Bitcoin and Grayscale holds 655360 Bitcoin as of now. Additionally, on-chain analysis is looking bullish, up from neutral and the increasing inflow has increased the liquidity. Interestingly, Bitcoin changed hands from HODLers who were recently active to HODLers who aren’t selling and this seems to have reduced the selling pressure and the price may no longer be rangebound in the near term.

Rangebound price action for over two weeks came from both a drop in volatility and increased inflow from miners to top spot exchanges. Though inflows have not dropped, there is more demand to absorb the inflow on top exchanges like Binance, OKEx, and Huobi.

Both institutional and retail demand is up, and this is based on Bitcoin options and spot exchange activity from the past week. The concentration of Bitcoin in wallets has increased, and despite the Netflow being relatively higher at the $56000 price level, the selling pressure has dropped. Additionally, a key metric the Mayer multiple is currently at 2.26 and it is higher than 94% of history.

The Mayer Multiple has been known to predict trend reversals and key turnarounds in the price rally based on historical data. So far, it hasn’t moved into the right tail of the distribution and it has to increase steadily to make room for the price to increase. These signals from the metrics and the on-chain activity signal that the price may no longer remain rangebound during the weekend. Given the data, one can argue that there may be a further increase in price, as it moves above $59000 making room for further price discovery.