Why do you need to keep an eye on Defi tokens SUSHI, UNI, AAVE?

The altcoin season may have become a cliche now, and what’s more, DeFi tokens are rallying to the extent of leading the most recent alt season. Bitcoin has traded sideways several times in the current market cycle, and altcoins with large market capitalization like ETH and XRP have rallied in response. However, the alt rally hasn’t sustained over a week.

In the previous phases of the current bull run, altcoins like Ethereum and XRP have led the rally. However, the gains from the top 10 DeFi tokens, including Vesper with 32.71%, have higher chances of leading the altcoin rally. There have been increased investments from institutions in large market capitalization tokens.

However, in DeFi tokens, there is a limited inflow of investments. Despite that, there is higher, more than double-digit returns on a retail trader’s portfolio from DeFi tokens. With a weekly gain of 13.41%, UNI is among the top 10 altcoins. While UNI is gathering selling pressure, other DeFi tokens are currently in the buy zone, trading over 10% below the price from last week.

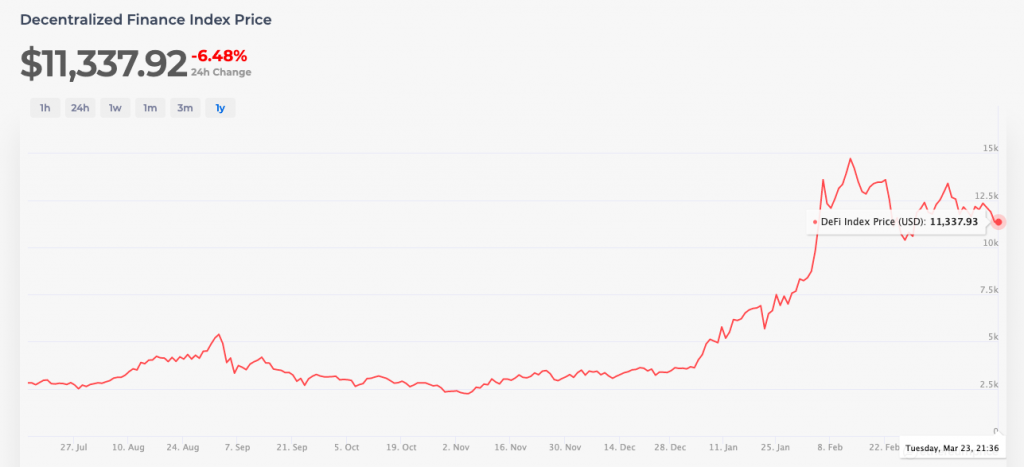

This includes tokens like AAVE, MKR, COMP, SUSHI, and YFI. The DeFi Index is an indicator of the sentiment among traders and the trend reversal in the price rally of top DeFi tokens. Currently, the index stands at 11337.93 and it has dropped 15% in the past two weeks.

Source: Ethereumprice.org

This means several DeFi tokens are in the accumulation phase, and ROI on these tokens may hit double digits when Bitcoin starts trading sideways. There is evidence of dropping supply, among top tokens like SUSHI, thereby creating a shortage and increasing buying pressure.

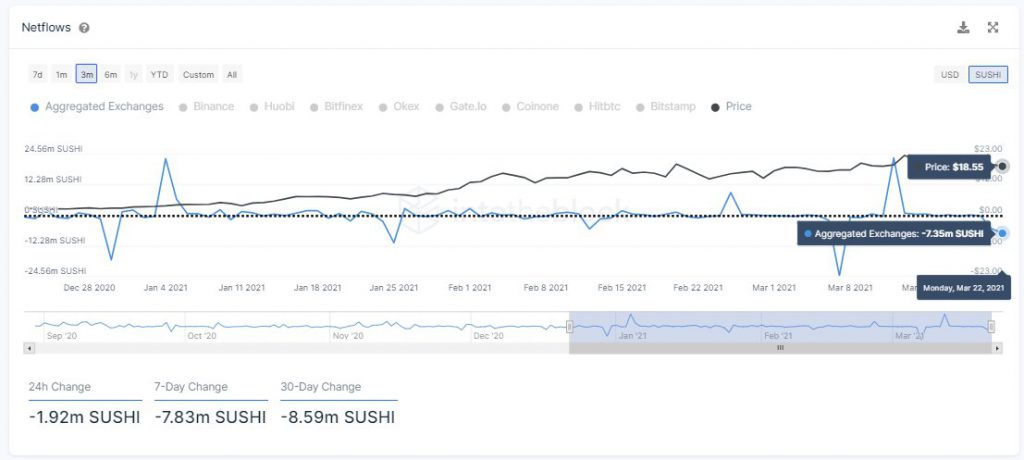

Despite the recent downward price action (a drop of over 7% in the last 24 hours), 7.35 million was SUSHI left in centralized exchanges yesterday. This is based on data from intotheblock shown in the chart below.

Source: Twitter

SUSHI’s trade volume is up 32% in the past 24 hours; a SUSHI price rally is likely before the weekend. The drop in supply could signal a delayed price rally as well, but with the DeFi index and its drop over the past two weeks, it is likely that the asset will rally, hitting a new ATH before the weekend.