Ethereum vs Cardano? Which performs better for traders

The conflict between Ethereum and Cardano has jolted crypto Twitter for the past week. Ever since the Berlin upgrade was announced, there is anticipation that Ethereum’s price will rally, however, the opposite is observed on spot exchanges.

Altcoins with low to mid-market capitalization like DOT, ADA, LINK, FIL, THETA have made a comeback. Now, these top altcoins have dropped in price, just as Ethereum but their 24-hour trade volume is increasing every day.

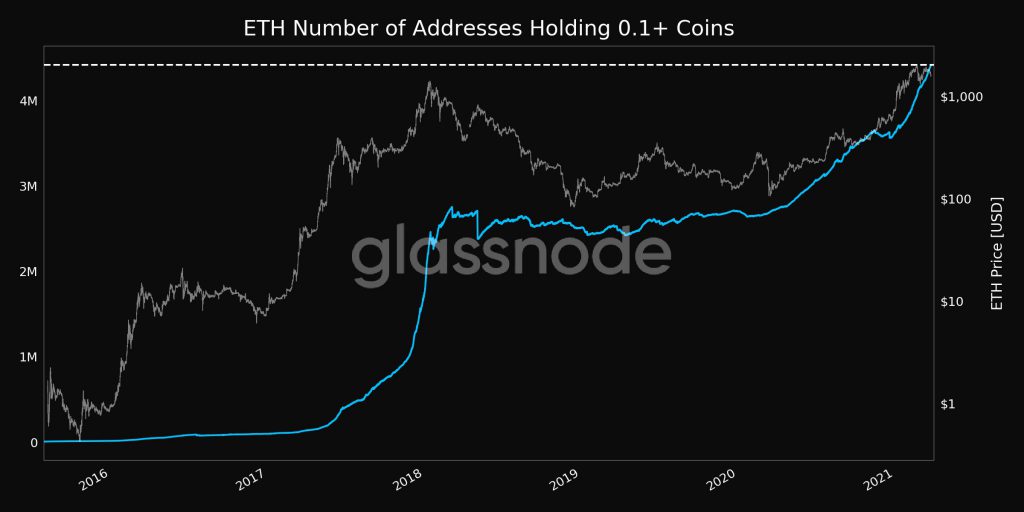

Q1 2021 metrics for Ethereum pose a clear picture and provide an on-chain recap of Ethereum. With over 586k daily active addresses on average, 4.44 Million increase in addresses with a balance, $933.6 Billion Ethereum being transacted on-chain, and 96.67% YTD average addresses profitability, Ethereum was expected to make the comeback.

However, in this quarter over 3.986 Million ETH was left exchanges. This may have built the shortage narrative, but it didn’t have an impact on the price. The increasing volume showed that there is liquidity however this has not affected the price, and it continues to drop at the time of writing.

ETH number of addresses hodling 0.1+ ETH || Source: Twitter

However, for Cardano, the asset’s market capitalization is nearly nine times since the past quarter. Market dominance was 2.17% and the current price is 22.9% away from ATH. Just like Ethereum, Cardano’s trade volume was up over 68% in the past 24 hours.

For Cardano, the sentiment continues to remain bearish, just as it is for Ethereum. However, in the case of Ethereum, the sentiment is currently leaning towards neutral, based on the options activity. At the first glance, it may seem clear that Ethereum is a winner since 95% of HODLers in ETH are profitable against 55% of Cardano.

What’s interesting from the intotheblock on-chain analysis however is that net network growth is positive and relatively higher in the case of Cardano. In the case of ETH, it may have arrived at saturation due to delays in the launch and rollout of updates.

Derivatives exchange activity has had an impact on ETH’s price, but when comparing the two assets in a retail trader’s portfolio, the profit percentage largely depends on the point of entry and buying price for each asset. Though it may be intuitive to assume that ETH has a stronger network effect, miners, and community, so it is winning this tussle; but it may not necessarily be true.

Cardano has been rolling out updates faster than Ethereum and of the 55% HODLers, not all are selling unlike the case with Ethereum at the current price level. There may be another alternative to winning the war, balancing ETH and ADA in the portfolio and retail traders may be seen employing dollar-cost averaging to lower the unrealized losses from ETH over time.