Is this the right time to invest in COMP

DeFi’s popularity may have diminished slightly in comparison to the DeFi Summer that took place in 2020. However, that doesn’t mean that the space isn’t filled with coins that have been performing substantially well. At the time of writing, there is around $49.06 billion locked in DeFi and in comparison to April of 2020, the growth in TVL amounts to a whopping 6190 percent. In DeFi the top three tokens include Compound, Maker, and Uniswap and while their gains are rather impressive, it is important to take a look at COMP’s performance in the recent past.

Compound has over $9 billion in TVL and in many ways may be an alternative for many traders’ portfolios in the current market. In the cryptocurrency market, the top two coins Bitcoin and Ethereum continue to attract the most significant amount of investors and attention. However recent price action suggests that both have seen their momentum stall and for new traders entering the digital assets market there may be gains to be made in the short term, however, looking beyond BTC and ETH may be key.

In such a scenario, Compound’s price action and on-chain fundamentals look extremely promising. According to data provided by Glassnode, COMP added over 2.3k new non-zero balance holders bringing the total to over 148k addresses in the past week, an increase of 1.5%. Interestingly, over the same period, COMP’s price has more than doubled from $227 to over $540. However, it is also important to note that just like many of the market’s altcoins, COMP is also susceptible to corrections as part of the larger altcoin market that continues to be highly correlated to Bitcoin. This was evident in the past few days, as the token endured a slight price correction and continues to head back upwards from a price point of around $460.

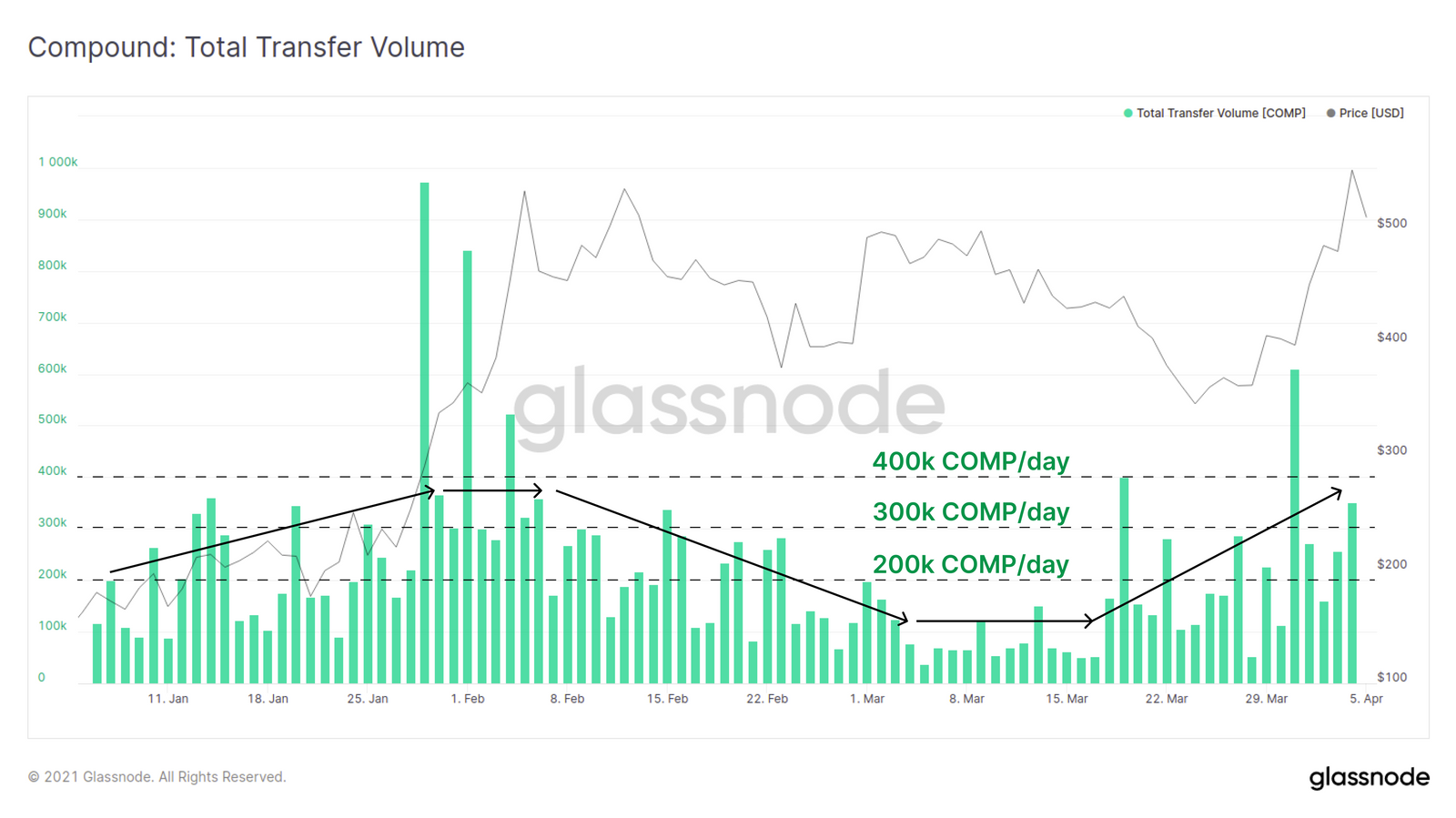

Taking a look at the coin’s transaction volume also illustrates this growth COMP has been witnessing. According to Glassnode,

“after a lull in on-chain activity through early March. At present, 200k to 300k COMP are transacted daily which is approaching transaction volumes similar to early Feb when COMP was hitting its all-time-high price of $564.81.”

While for Bitcoin and ETH coins moving away from exchanges is seen as a good sign in terms of long-term hodler sentiment, it doesn’t have to mean the same across the spectrum. In the case of COMP, the balance held on exchanges has risen alongside the token’s price for the last two weeks. Around 41.1k COMP have been deposited to exchanges this week amounting to an increase in exchange balance of around 20%. From a price point of view, it goes to show that more traders are actively trading COMP and are active participants in the current market with healthy trading volume.

COMP has seen tremendous growth in the past few months and that trend may continue, however, it doesn’t mean the larger market’s impulses and sentiment doesn’t affect the coin. COMP underwent a slight correction and has swayed to Bitcoin’s tune – a characteristic found in many of the market’s altcoins. However as the price heads towards its ATH once again, traders can benefit from allocating COMP in their portfolios and looking beyond top coins like BTC and ETH. As 2021 progresses it will also be interesting to see whether or not the crypto market will go beyond the market leaders.