Bitsgap introduces combo AI Bot for seamless Future Trading

Cryptocurrency trading is one of the fastest-growing areas in the financial service industry, with an estimated 30% growth rate between 2019 and 2026. More coins are introduced to the cryptocurrency trading market, which means more trading opportunities. The numbers of investors and traders joining this trading market are also constantly increasing, implying increasing competition.

The cryptocurrency trading market is becoming complex daily. To rip the benefits that come with such market development, you must pay considerable attention to details, when analyzing market trends.

Automated trading solutions bot technology has become a cutting edge in the cryptocurrency trading market. It enables traders to perform their trading activities in the comfort of their homes. However, it is important for traders to ensure that they are using trading bot solutions that give them a competitive advantage in terms of trading tools, insights, and fees.

Bitsgap has always been at the forefront of developing next-gen tools for trading, automation, and portfolio management to respond to the growing market. Bitsgap has been pushing the boundaries of trading automation by releasing advanced and profitable bots.

Bitsgap has yet again launched another trade automation bot solution to give to enable seamless trading.

New Bot for Futures Trading

Bitsgap has released new futures trading bot to stretch the boundaries in the crypto trading market. The automated trading system, Combo Bot, is a unique solution that makes use of both the GRID and DCA trading algorithms when seizing trading opportunities.

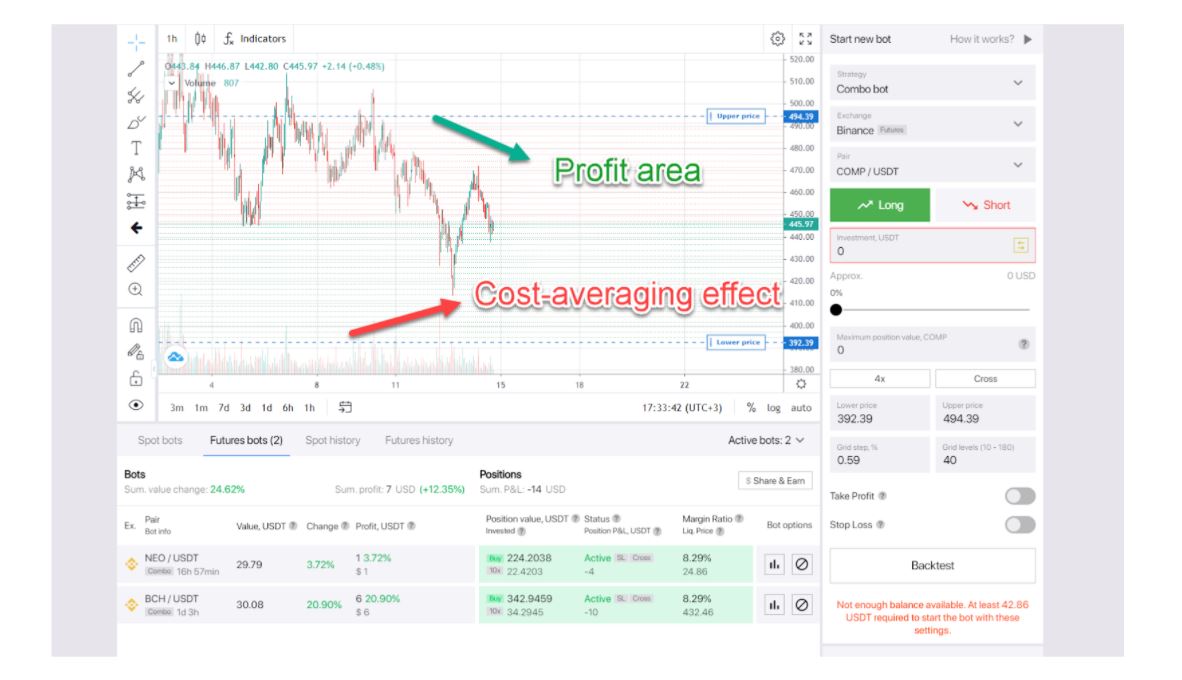

Technically, the Combo Bot has two features – longing and shorting. If you are monitoring the price of a commodity and you are predicting a price rise, then you can long trade using the bot. As the price rise, the algorithm will initiate sell for the GRID orders and proceed to lock in all returns. If the price starts to fall, dollar-cost averaging will be turned on, thus executing buys. When longing with the Combo Bot, an entry is a buy whereas a close is a sell

Source: Bitsgap

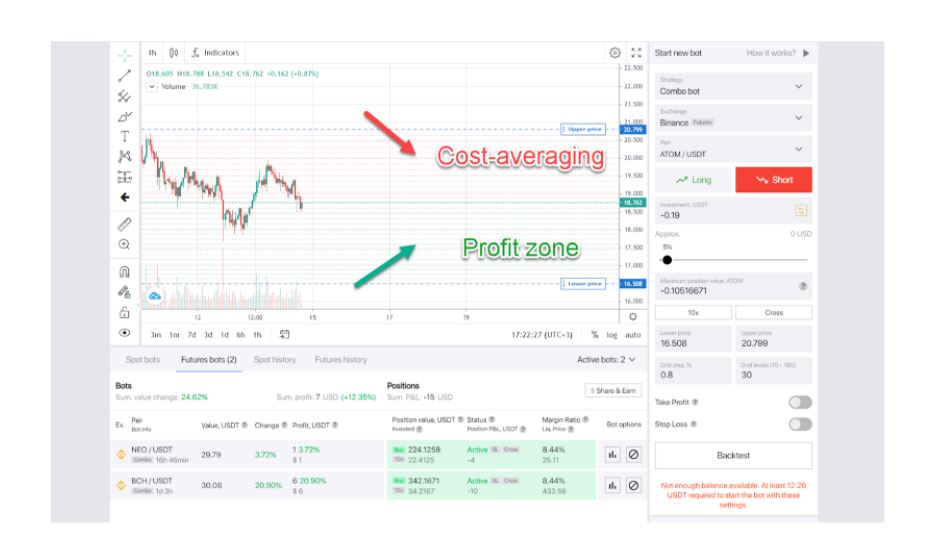

If the market analysis is indicating a price fall, a trader can short using the Combo Bot. The algorithm will execute buy GRID orders when the price falls. The bot will also exploit the short-lived price increases by executing short-sell DCA. Short entries lead to a sell-entry and a buy close.

Source: Bitsgap

Generally, the technique employed by the new Combo Bot seeks to capitalize on normal price volatility by placing buy and sell orders at regular intervals above and below the base price. This technique takes advantage of both trends and ranging conditions.

Combo bot also comes with a leverage margin feature. Traders can now generate higher profits beyond what their funds can generate by activating leverage. Traders can now borrow capital to increase their leverage thus increasing their exposure to specific trades. A trader will have to deposit collateral to use the margin feature. However, Bitsgap supports competitive margin ratios thus allowing traders to make higher profits from their leveraged trades.

Traders can still take advantage of both isolated margin and cross-margin. Cross-margin mode has a better capability to resist liquidation hence suitable when dealing with a long-term strategy that may require a position to survive extreme market situations. Isolated margin mode can be more applicable for traders shooting for short-term high-profile profit since it is more flexible and restrict the loss only to part of the funds. More attention is required to adjust the margin promptly when using an isolated margin.

The new Bot has an intuitive user interface, suitable even for new traders. User’s profit and loss are transparently displayed on the chart to highlight the efficiency of the bot in terms of profit-making.

The bot is designed to ensure a high success rate. Despite the unpredictable price swings, a skillful combination of GRID and DCA strategies will high likely result in a profit.

Disclaimer: This is a paid post and should not be treated as news/advice.