This fact offers insights into how much Ethereum’s price can grow

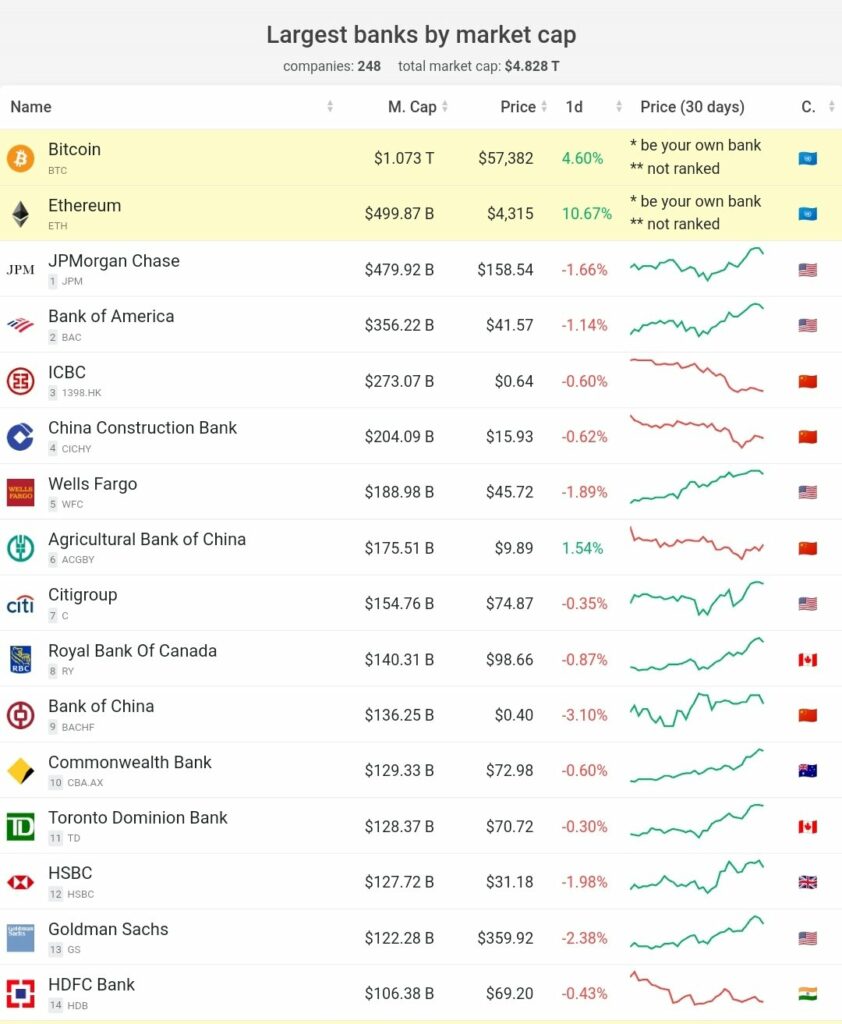

Ethereum’s market capitalization is now greater than all the largest banks in the world. Based on market cap, it now ranks above JP Morgan Chase, Bank of America, and Wells Fargo among others.

ETH Market Capitalization || Source: Twitter

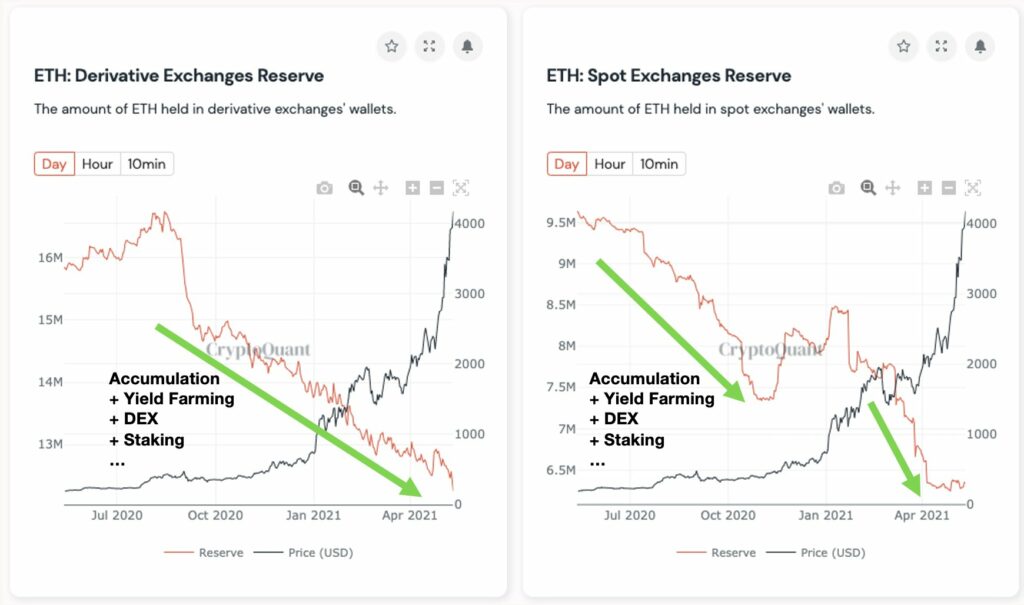

Additionally, unlike Bitcoin, Ethereum holdings have been decreasing across spot and derivatives exchanges. This is likely to have intensified the sell-side liquidity crunch. This reduces the liquidity of the Ethereum ecosystem, however, its increased usability is likely to further drive demand.

Another metric to consider for the bullish sentiment among traders is the historically high activity from ETH’s top stakeholders over the past week. This includes the 4-hour window on May 5 that saw over 6300 ETH transactions (worth $100000). This explosive activity started on May 3, and this contributed to the rally to $4200 level.

ETH exchange reserve || Source: Twitter

Other factors driving ETH’s price rally are the US institutional spot bid in the short-term. In the long-term, the rally crossing the $4000 level for the first time in the past two days, is a driving factor. The YTD ROI now stands at 450%. This activity has led to ETH eating into BTC’s market share, as the narrative around DeFi projects has shadowed the digital gold narrative. Additionally, the digital gold narrative seems to have taken a back seat when DeFi projects offer double-digit returns within weeks of ETH’s rally.

Unlike DeFi, the ETH rally is primarily spot-driven, with funding rates, spreads across markets and open interest in projects all at levels conducive to pushing demand higher. This has indicated muted retail leverage-driven flows thus adding to the evidence of a bullish sentiment at the current price level.

Traders are also anticipating ETH flipping BTC with the bullish price action, since in terms of market capitalization it is currently half of BTC based on data from coinmarketcap.com. The fact that the current rally is not a meme-fuelled one, offers insights into the maturity and fundamental growth of the ETH network. The investment inflow in ETH may soon trickle down to altcoins in the top 10, thus supporting another altcoin rally before the focus shifts to Bitcoin’s S2F targets for 2021.