This Ethereum metric exceeds Bitcoin’s again! Here’s the impact

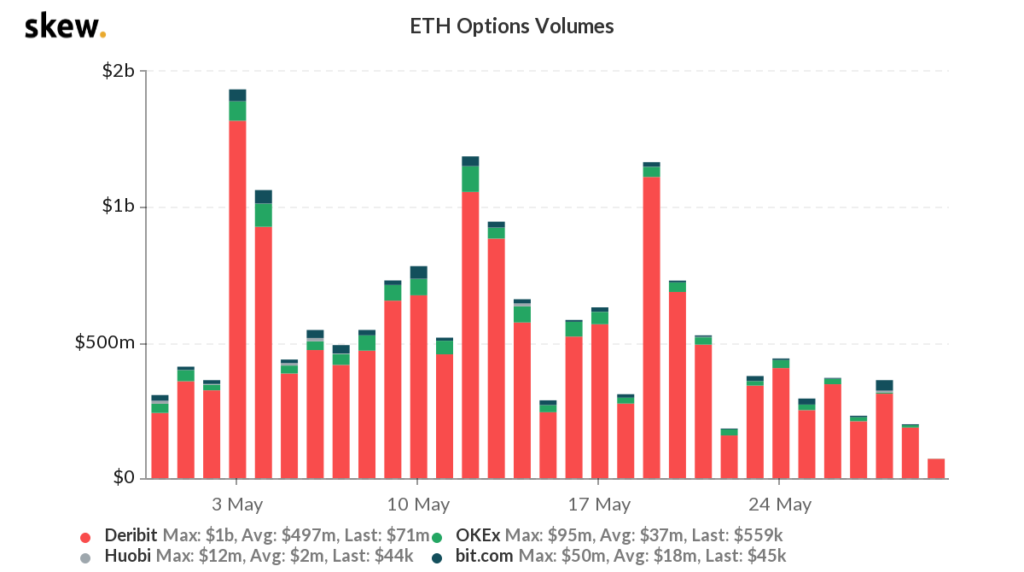

Trading below the $2500 level, Ethereum’s rally is faster, post the recovery. What’s interesting is that the Ethereum options volume has surpassed that of Bitcoin few times in a row. Based on data from Skew, options volume dropped consistently since May 24, and is consistently below $500 Million.

ETH Options Volume | Source: Skew

With several flippening metrics like transaction fees, value settled, etc. the narrative of Ethereum flipping Bitcoin is popular since the former’s market capitalization hit the $281 Million level. At the current price level, the market capitalization is a third of Bitcoin. Additionally, Ethereum’s price is currently below the $2500 level, however, it is nearly 12% higher than last week.

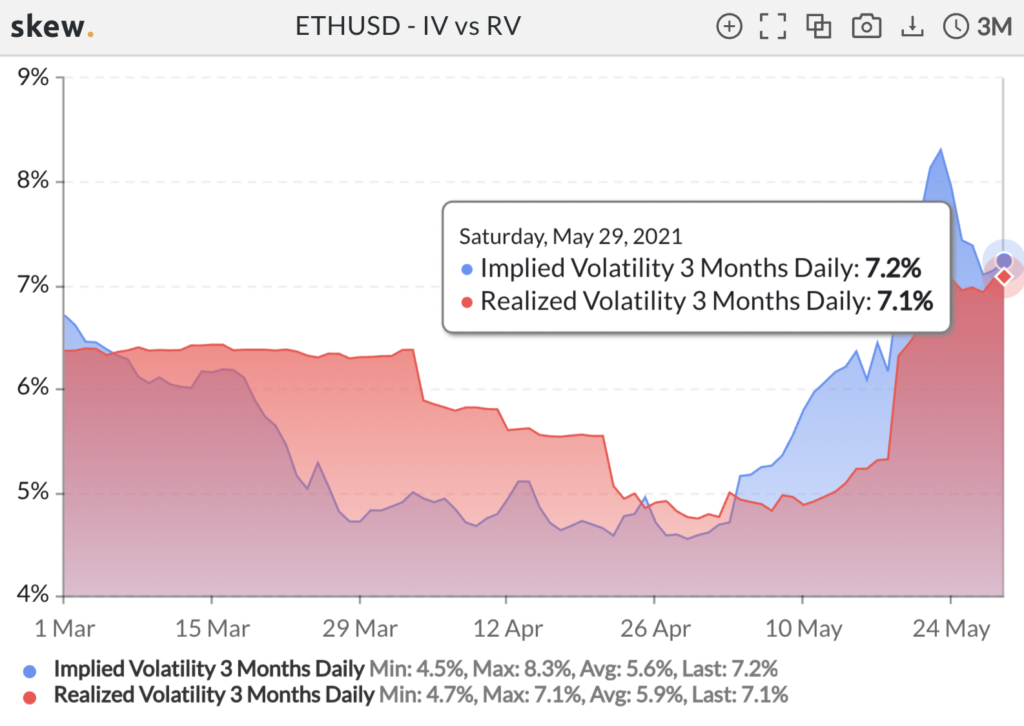

Since the 3-month implied and realized volatility is at 7%, based on the following chart, implied and realized volatility has remained above the average from March and April. This is a metric that supports Ethereum’s long-term bullish narrative.

ETH IV vs RV | Source: Skew

However, with ETH exchange volume exceeding Bitcoin on a regular basis it is exciting. Additionally, ETH’s shortage of supply narrative captured demand and audience with traders for a while; this flippening narrative is key to ETH’s growth as an economically important asset. While the latest developments in Ethereum and the new updates on the network, make the flippening narrative mainstream, these instances are more common. However, in the long-term, the focus may shift from this narrative to fundamental strength and increased network activity, despite the competition that Ethereum faces from the L2 scaling solutions.

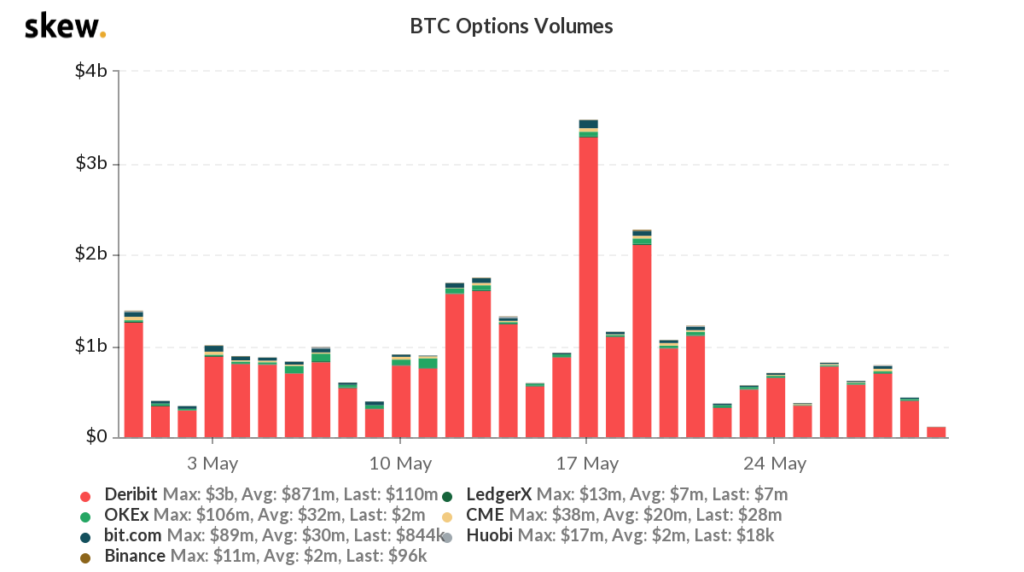

BTC option volumes | Source: Skew

Based on the above chart, Bitcoin’s options volume has dropped below Ethereum’s level several times in the past week. The drop in options volume is consistent with the dropping demand across exchanges, drop in investment inflow and the drop in trade volume across exchanges.

In the case of Bitcoin, with dominance below the 45% level, the rally is largely focused on altcoins like Ethereum, DeFi tokens and NFT marketplace projects. Whale wallets and large HODLers are resisting the selling pressure in Bitcoin. Addresses with 100 to 10000 Bitcoins have accumulated approximately 30000 more Bitcoin in the past week and this accumulation is largely the driver of the price above the $36000 level. Though ETH exchange volume exceeds that of BTC, it is likely that the flippening may not occur anytime soon, with Bitcoin’s bullish narrative.