Bitcoin: ‘buy the dip’ is clearly not the strategy for these players

Bitcoin, on its way down, flipped many bullish traders: they were forced to realize profits while they still could. The fall incurred last week pushed the market capitalization down by 11%. Even though BTC bounced back from its monthly lows of $29,000, traders, miners, and holders were all in the unchartered territory.

The Chinese restrictions over mining have led to the hash rate dropping, meanwhile increasing the time for block productions. This clearly highlighted that the blockchain was witnessing a difficult time. However, one factor separated this correction from the others- Derivatives.

According to data provided by IntoTheBlock, unlike previous corrections, markets were not overleveraged. This can be evidenced by the total liquidations that took place on 22nd June, in contrast to the liquidation seen in the market on 18th May.

On 22nd June, the price dropped by 20% leading to total long liquidations of less than $600 million. Interestingly, the fall on 18th May resulted in total long liquidation of $7.09 billion. This stark difference between the values suggested that derivatives traders remained cautious and speculations in the markets have decreased.

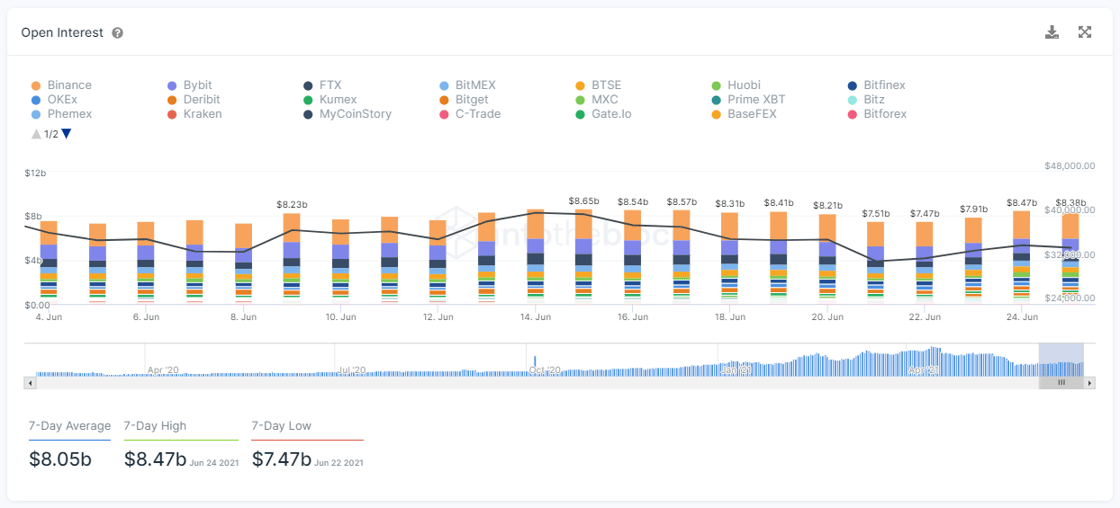

Moreover, the open interest did not report a large change. As the market moved on 21st June, OI dropped by a meager 0.5%. Meanwhile, on exchanges like FTX, OI increased pointing to long traders consolidating positions on the local bottoms.

Source: IntoTheBlock

As retail traders were trying to understand the shortcomings of the current volatile market, the institutions were choosing to keep out.

The on-chain transfers of over $100,000 were considered as large transactions and can act as a proxy to institutional investors and high net worth individuals. As per data, the total value transacted in these large transactions declined by 61.7% compared to the highs set in February 2021.

Although we saw Microstrategy invest roughly $489 million in BTC on 21st June, no other institution followed its “buy the dip” strategy. It was clear, that the low value of BTC and the corrections have discouraged man large buyers from making new investments. The market has remained in the state of “Extreme Fear” and may continue on this path until we see a bullish return.