It makes sense to add this Altcoin, if you have Ethereum in your portfolio

Over the past few days, major altcoins have registered recoveries in the market, as selling pressure seemed to have declined. Ethereum was leading the charge, but more often than not, it is difficult to gauge which altcoins to add alongside the largest altcoin. Not all assets rise in unison, and even if a collective increase is observed, they largely vary in terms of growth.

However, it might be worth considering that Ethereum Classic has performed well with Ethereum when both assets have been kept under the same portfolio. The month of July could be even more important for both these assets from a point of correlated increase.

July: a month of upgrades?

The much-anticipated London upgrade went live on the Goerli testnet today. During the same period, Stevan Lohja, developer manager for Mantis, stated that Magneto would be inclusive of the Ethereum Berlin upgrade features. The announcement also positively affected Ethereum Classic as its valuation rose 30% in less than 24 hours.

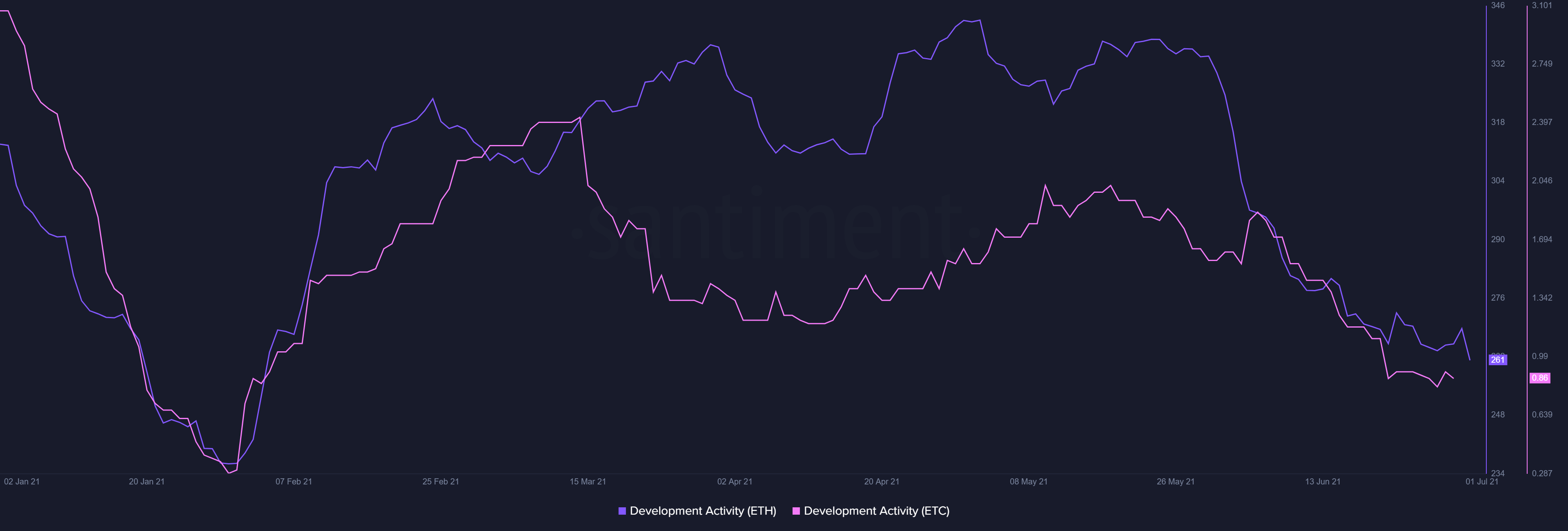

Development activity has been crucial to altcoins’ growth in the 2020-2021 period.

If the above chart is observed, it can be identified that both assets enjoyed a strong bullish spike during the same period at the end of April. While it can be said that other assets rallied in a similar time frame, the reactionary position and price action of Ether and Ethereum Classic were extremely similar. While Ethereum Classic peaked on 6th May, Ether registered its own ATH on 12th May in a similar fashion.

Fast-forward to the current market structure, while Bitcoin and other assets faced stronger short-term corrections, ETH, ETC were mirroring each others’ movement, peaking on a similar time frame, on a 1-hour, 4-hour, and daily chart.

Does development activity indicate the same for Ethereum, Ethereum Classic?

Surprisingly, irrespective of the upcoming essential upgrades for both the assets, development activity seemed to have dropped for both assets, according to data from Santiment. Ironically, Ether and ETH Classic were similar in this aspect as well, but it wasn’t exactly a bullish indication.

Yet, most datasets indicate that the correlation between Ether and Ethereum Classic is legitimate in terms of valuation. Hence, keeping a basket portfolio of both Ethereum and Ethereum Classic could be beneficial for the retail investors, who are trying to diversify during this period of volatile recovery.