Ethereum EIP-1559 is fast approaching; Why the hesitation?

Ethereum’s EIP-1559 upgrade is fast approaching, with the asset trading just under the $2100-level at press time. Now, Ethereum successfully made a comeback above the $2000-level after recovering from the drop towards the last week of June 2021. This changed the percentage of large wallet investors holding Ethereum, with the same hiking to the 42%-level, based on on-chain data from IntoTheBlock.

Over $85 billion worth of large transactions have taken place on the Ethereum network over the past week, and the on-chain sentiment is still bearish. What’s more?

Even though the upgrade is closer and on-chain activity has increased, traders on derivatives exchanges are cautious of their positions. What are they expecting from the upgrade? Is there a fear of a drop in price and long positions getting liquidated to fuel shorts on derivatives exchanges?

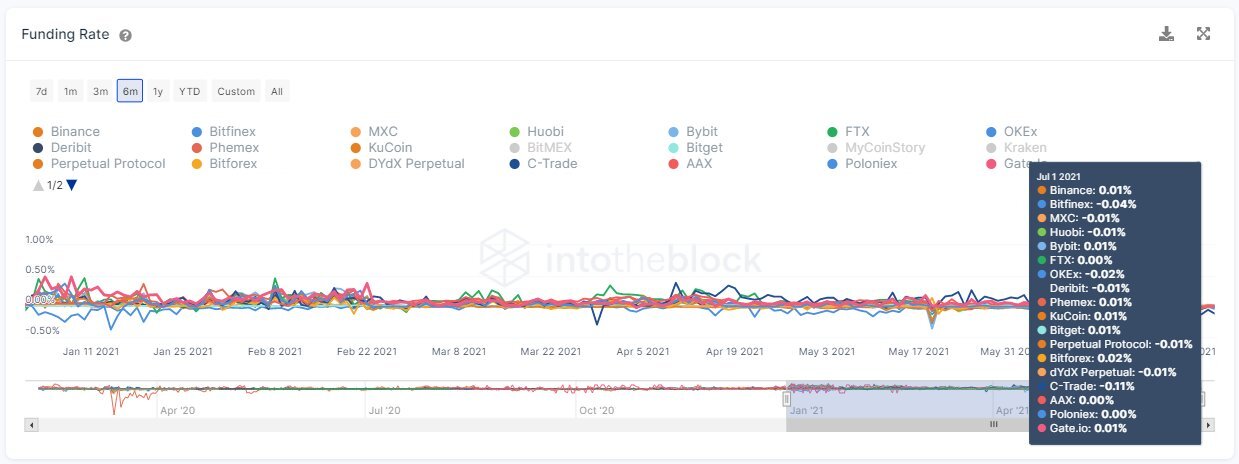

The funding rate across major exchanges is well below the high experienced between January and April of 2021, with the same still showing negative values on exchanges like Huobi or Bitfinex.

Source: IntoTheBlock

Why is this so?

The EIP-1559 upgrade is not expected to fix the problem of gas fees right from the start. It is expected to be a starting point for making the system further efficient, in the long term. The base fee is expected to adjust to market rates on a block-by-block basis. Users will have the option to complete transactions quickly by tipping the miner and the base fee is set to be burned. This may have an impact on Ethereum’s price since the fee is paid in Ethereum.

Additionally, Ethereum may face deflation in response to this update. Since ETH is planning to shift from the Proof of Work to Proof of Stake model, it is likely that ETH becomes deflationary eventually. However, all this may only happen when ETH 2.0 finally goes live.

What’s more, in terms of price and return on investment, ETH experienced an even bigger slump than Bitcoin in June 2021. The price of the altcoin dropped by over 40% from its highs on the charts. Traders are more cautious than ever, however, like previous upgrades on the Ethereum network, this may just add to the asset’s value and drive a price rally on the back of the roll-out, especially since Ethereum’s network effects are expected to become sharper.

Source: Coinstats