Bitcoin’s volatility might be waiting for this particular trigger

Bitcoin was extremely volatile during the bullish-bearish market of 2017, with the same giving way to controlled chaos for a majority of the time since. Now, while that has been the case for a while in 2021 too, there is presently a debate on whether BTC’s current volatility is unusually low. A shift in volatility can trigger market reactions very quickly so, in this article, we will try to analyze its current market status with respect to its historical data.

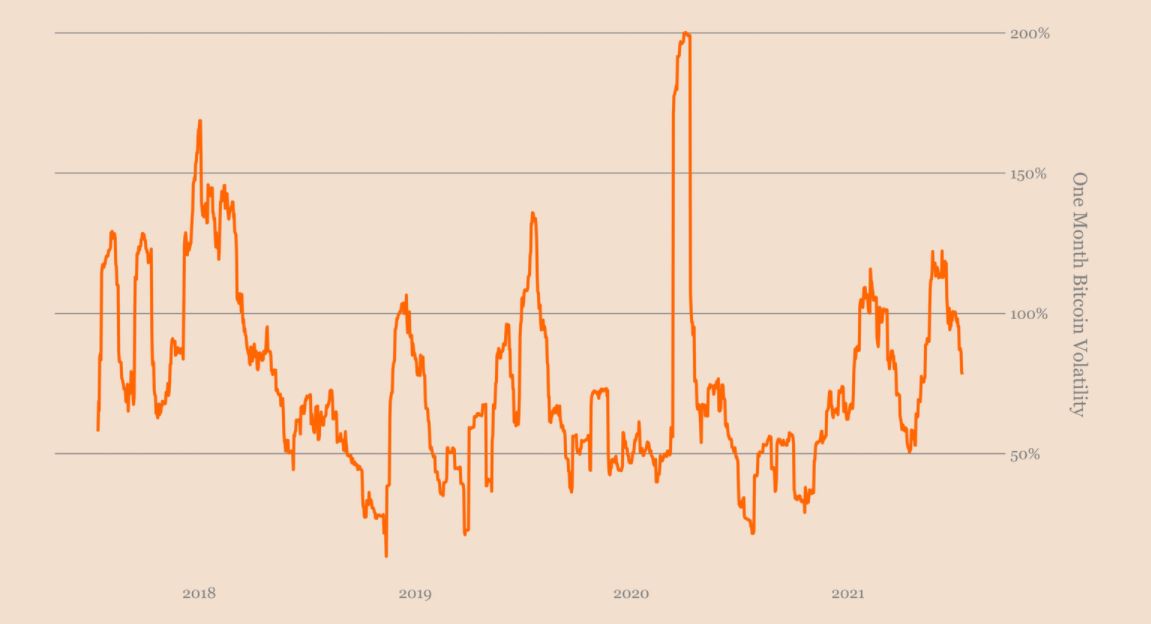

Observing Bitcoin’s One Month Realized Volatility

According to data, while volatility has been low, it is not extremely minimal. Observing the one-month realized volatility chart for BTC, it can be seen that while it has been trending down, it was still maintaining an average above the historically low levels of late 2020.

At the time of writing, the same was at 78%, just above the average volatility.

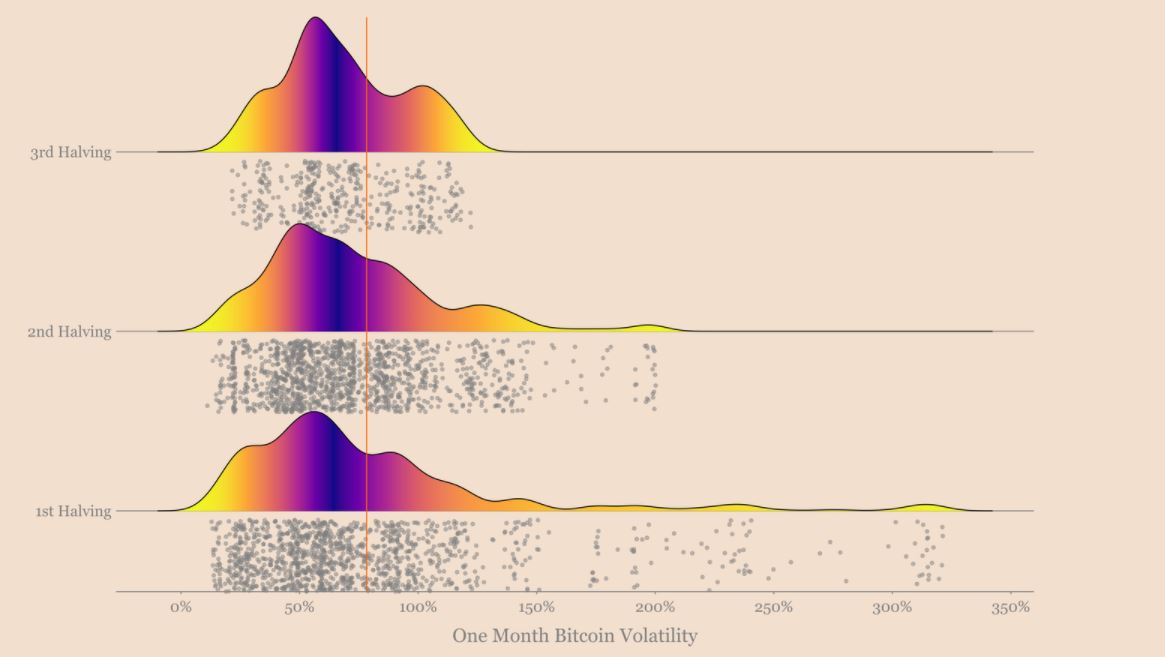

When it comes to distribution, the count is still high, and taking the long-term cycle into consideration, volatility has consistently gone down after every halving.

So, what about the Volatility Squeeze?

A Volatility Squeeze is basically a period where the price reacts strongly with respect to the prevailing turbulence. At press time, the squeeze period was down to 2 weeks but as explained previously, such a two-week range is not extremely low, but merely on the lower side.

Can anything else trigger the volatility?

A move remains evident on the institutional side and right now, Grayscale is carrying all the uncertainty. According to Mr.Whale, nearly 41,000 BTCs are getting unlocked in July, BTCs that have a notional value of $1.4 billion. The largest unlock is 3 days later on 18 July when 16,240 BTC will be available for release after the 6-month lock-in period.

Now, here is the catch. While the unlock will take place on paper, it is still up to the investors if they want to sell their GBTC shares on a net loss at the moment. With the premiums down, there is a likelihood that it could happen, but it isn’t a clear-cut certainty.

With respect to volatility, it can certainly stir up further bearish price action, something that might push the one-month realized volatility score north. As the incentive to re-invest with the unlocked shares is less likely, the consistently dropping premiums may only put more pressure on the investor’s mind.