Ethereum ‘flippening’ Bitcoin – Assessing if it is any closer

The question, hope, argument, or possibility of Ethereum “flippening” Bitcoin has popped up time and time again, especially over the previous month. However, the question is more relevant now, primarily because of two reasons.

Source: Coinstats

The first one being Ethereum’s London hard fork scheduled for this week. The second reason is Ethereum’s performance over several metrics of late. This article will examine both these reasons in detail.

What changes after Ethereum’s hard fork?

Bitcoin‘s limited maximum supply of 21 million has placed it above Ethereum as an asset. While EIP-1559 won’t necessarily make ETH deflationary, it does start to reduce its net issuance as Ethereum would be burned through the introduction of the base fee. Ether’s monetary policy and its restructuring also put into the spotlight Bitcoin’s premium over Ethereum.

Since OG Bitcoin has been around for longer, it has a greater Lindy effect. Market players and investors are more confident about the top coin due to its deflationary nature. This further creates a monetary premium for Bitcoin.

However, the possibility of ETH flipping BTC cannot be discarded and a look at on-chain data will help understand the likelihood of the same.

What do the metrics say?

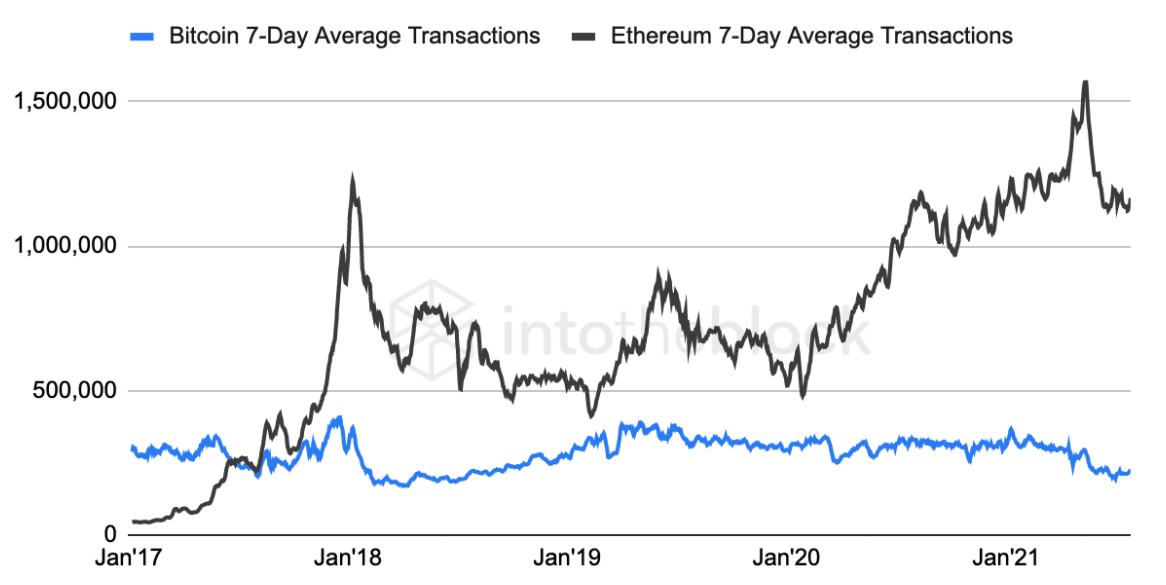

A recent report compared certain on-chain metrics for BTC and ETH to look at their utility, network effects, and monetary premia. It highlighted that Ethereum transactions have outnumbered Bitcoin’s since the summer of 2017. By implication, in terms of utility, Ethereum is way ahead of BTC.

Interestingly, the creation of DApps has led to a constant increase in ETH transactions since 2020. The 7-day average number of transactions grew by 120% over that time, and the same for Bitcoin dropped by 20%. Additionally, Ethereum is a smart contract platform. That makes it more valued, in relation to its transaction activity, when compared to Bitcoin.

Furthermore, Ethereum’s 7-day average fees surpassed Bitcoin’s for most of 2021. Ergo, in terms of demand too, Ethereum might just be a step ahead of Bitcoin. The first time Ethereum’s fees were greater than Bitcoin’s for a long time was during the DeFi summer.

While EIP-1559 is not expected to decrease fees, the hike in usage of the network after it takes place would result in a higher amount of ETH being burned. This would directly benefit holders from network activity.

Finally, the report also observed that despite its first-mover advantage, Bitcoin has “lagged behind Ethereum” in terms of its growth in the number of addresses with a balance. Currently, there are approximately 20 million more Ether holders than Bitcoin holders.

Does this mean Ethereum is all set to flip Bitcoin?

A plain answer to this question would be No. Despite most key indicators pointing to greater utility and network effects, Bitcoin continues to be the king in terms of valuation, dominance. Ethereum’s market cap has grown by 1,600% since 2020. While Bitcoin’s has increased only by 400%, Ethereum’s market cap is about a third of Bitcoin’s size in relative terms.

Thus, in light of EIP-1559, it will be worth asking whether Ethereum will develop a similar monetary premium as BTC once its supply starts getting burned. And, would that be a threat to Bitcoin’s monetary premium in the future? Whatever happens, Ethereum flippening Bitcoin in the near future seems a little too optimistic for now.