Here’s why Bitcoin’s process towards the next rally is changing

Bitcoin closed a position above $42,000 on 6th August and since then, the asset has consolidated above the range. With the asset valued at ~$45,000 at press time, the general sentiment around the crypto market is starting to improve. Altcoins are performing admirably as well, as the industry remains at the cusp of another bullish charge.

Although, there are a few similarities surfacing between the Q1 rally and now, not all sentiments are collectively hinting towards a positive outcome. Yet.

CME Bitcoin futures; far from home?

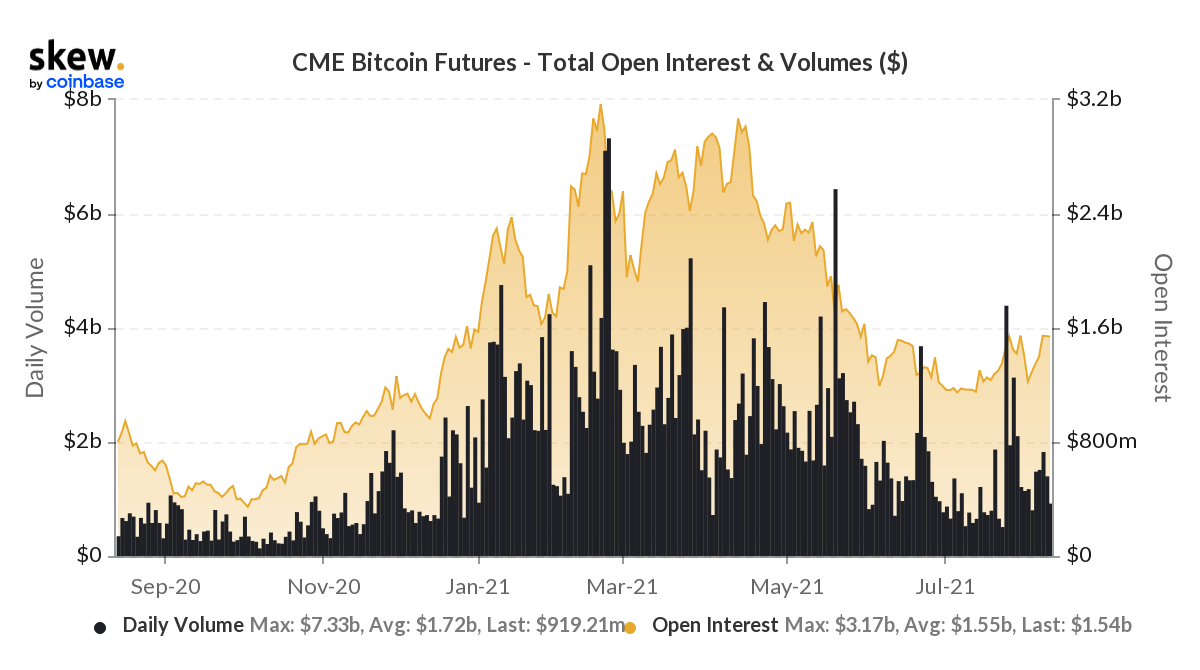

Since the bearish onslaught in May, CME derivatives market has been pretty quiet throughout the summer. While BTC prices have significantly recovered over the past 2-3 weeks, there is still a lack of activity from the CME end.

For context, the last time Bitcoin was consolidating above $45,000, CME Bitcoin futures averaged an Open-Interest value of above $2.2 billion and daily volumes were also average around $1.4 billion.

At press time, OI was around $1.5 billion and daily volumes were $919 million. Now, these numbers weren’t differing by a huge margin but it was indicative of the institutional trader’s cautiousness.

What is the current wait about?

Source: Ecoinometrics

According to the CME COT report, the retail crowd hasn’t changed their position by much even after BTC’s price rise. However, there were a few changes that suggest a gradual change could take place. At the moment, smart money is beginning to resume basic trade, which means that some of the positions are preparing to enter futures going forward.

There is definite momentum building in the ecosystem since if BTC starts trending up, the premium on futures would be higher than spot trading. Additionally, CME Bitcoin options also appeared more balanced at press time with 4 puts set up every 3 calls.

Are we looking for trigger from CME?

Right now, it is difficult not to point towards one effect without incorporating the other. Yes, CME’s interest would indicate that a bullish rally has picked up definite momentum however, over the past couple of years, the impact hasn’t been exactly ground-breaking.

For Bitcoin, the positive momentum has arrived from various factors as well, so CME derivatives do not hold a strong hand anymore. With every bullish rally, the process towards the next one is undergoing a change, and something similar might unfold for the present resurgence as well.