New Cardano sidechain project might spur entry into the DeFi space

Cardano is trying to revolutionize its blockchain into an interoperable one and compete with Ethereum’s decentralized finance [DeFi] ecosystem. Tracing the steps of ADA, its native altcoin, Cardano is now inching closer to its DeFi objectives with dcSpark, a product-based DLT company.

On Wednesday, dcSpark announced plans to develop a novel sidechain project dubbed Milkomeda to aid non-EVM [Ethereum Virtual Machine] cryptocurrencies in achieving and maintaining mass adoption. As per the press release, the protocol will be launched on Cardano, along with other non-EVM chains like Solana and Polkadot. This will allow the use of wrapped assets to pay for transaction fees.

The release added,

“In other words, as an example for Cardano, Milkomeda will allow sidechains to be deployed that connect directly to the mainchain and use wADA (wrapped ADA) as the asset to pay for transaction fees.”

This will allow developers and users to interact and develop on the Cardano blockchain, something that the team has been aiming at. The blockchain is itself in process of deploying smart contract abilities on the mainnet in September, which has also aided the value of its ADA token in the market. Adding to these points, Milkomeda will bring EVM compatibility into the ecosystem, also a part of the Cardano roadmap.

The released added,

“The EVM-based sidechain which will connect directly to Cardano will be named M1, and will be both the very first Milkomeda sidechain as well as the very first Cardano sidechain. It will use wADA as its base assets, and the Milkomeda validators who run the sidechain will be selected from existing stake pool operators and other trusted entities within the ecosystem.”

Cardano tracing Ethereum’s footprints?

Ethereum has established itself as THE blockchain for DeFi protocols. However, its high gas fees and congestion have often deterred many users, following which some jumped ships.

If Cardano can provide low fees and secure alternatives to users, it can fill in the void left by Ethereum during times of high activity. This could lead to a visible shift in DeFi momentum.

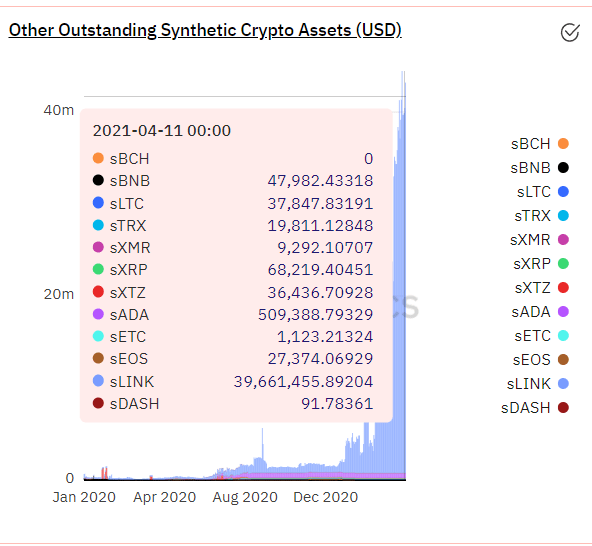

Source: Dune analytics

The late-2020 Ethereum rally happened on the back of the DeFi boom. However, it was a slow process to get there. Even if Cardano manages to deploy smart contracts on its network, it may take some time to function smoothly.

What’s more, it’s worth considering the attached chart, with the same underlining the growing demand for Synthetix’s synthetic assets. What it also implies, however, is that early participants can still get a share from the DeFi pie.