Why Bitcoin has USD to thank for emergence as ‘next gold’

The likelihood of cryptocurrency becoming the future of finance brought Bitcoin to the mainstream a few years ago. The dialogue then changed to its validity as an asset and if it can stand the test of time, given its volatility.

Right now, the discussion is about whether Bitcoin could potentially become the next best inflationary hedge asset, akin to gold. Given the state of the U.S. Dollar in the existing economy, it looks like that day might not be far away.

Bitcoin is the next Gold

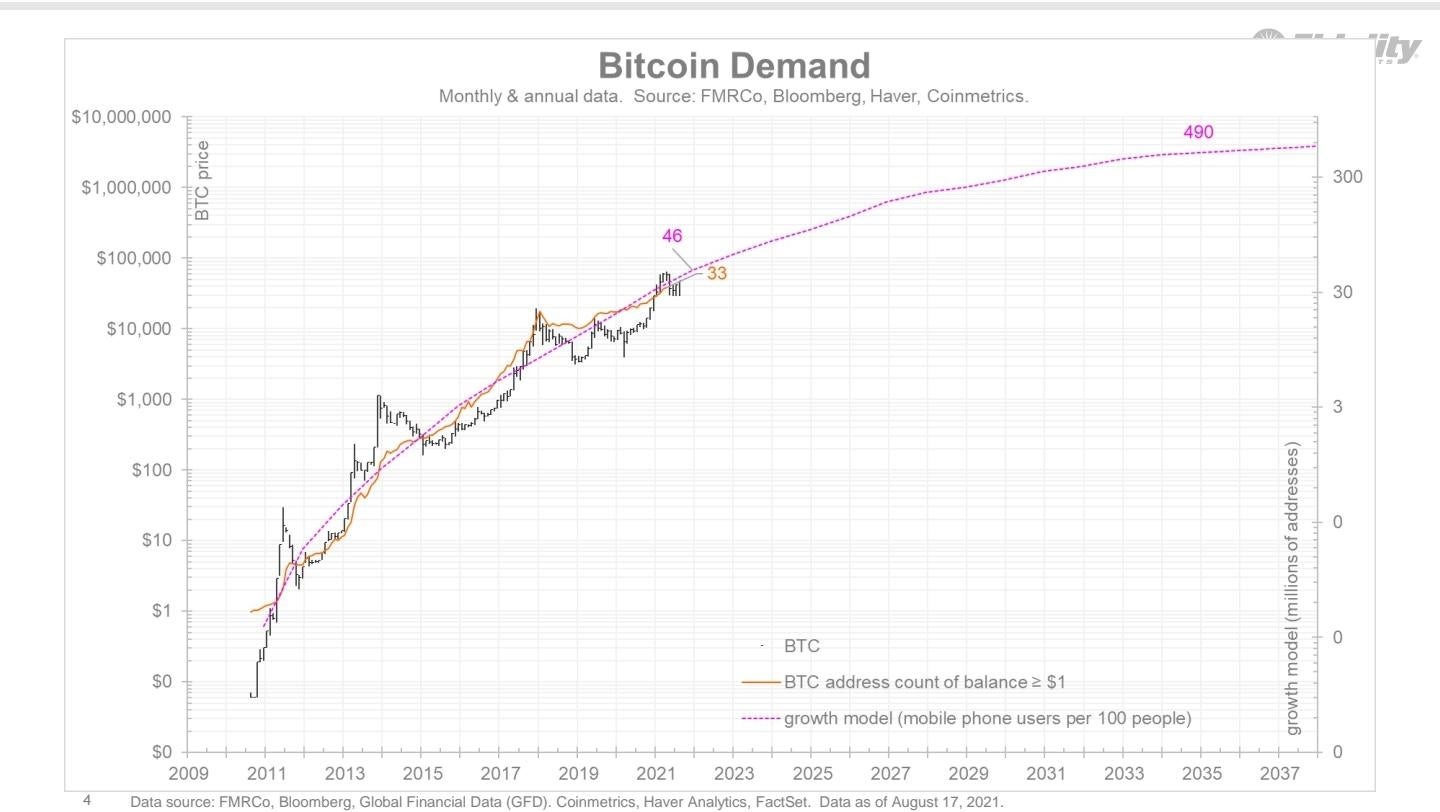

According to recent research by Fidelity, one of the world’s biggest financial services company, Bitcoin’s demand has been growing. And at no small rate either, since the demand for Bitcoin has been as high as it was for mobile phones.

How so? Well, there’s an urgent need for an alternative asset since global debt is exploding to new levels. An asset other than the U.S dollar is needed to beat the growing inflation.

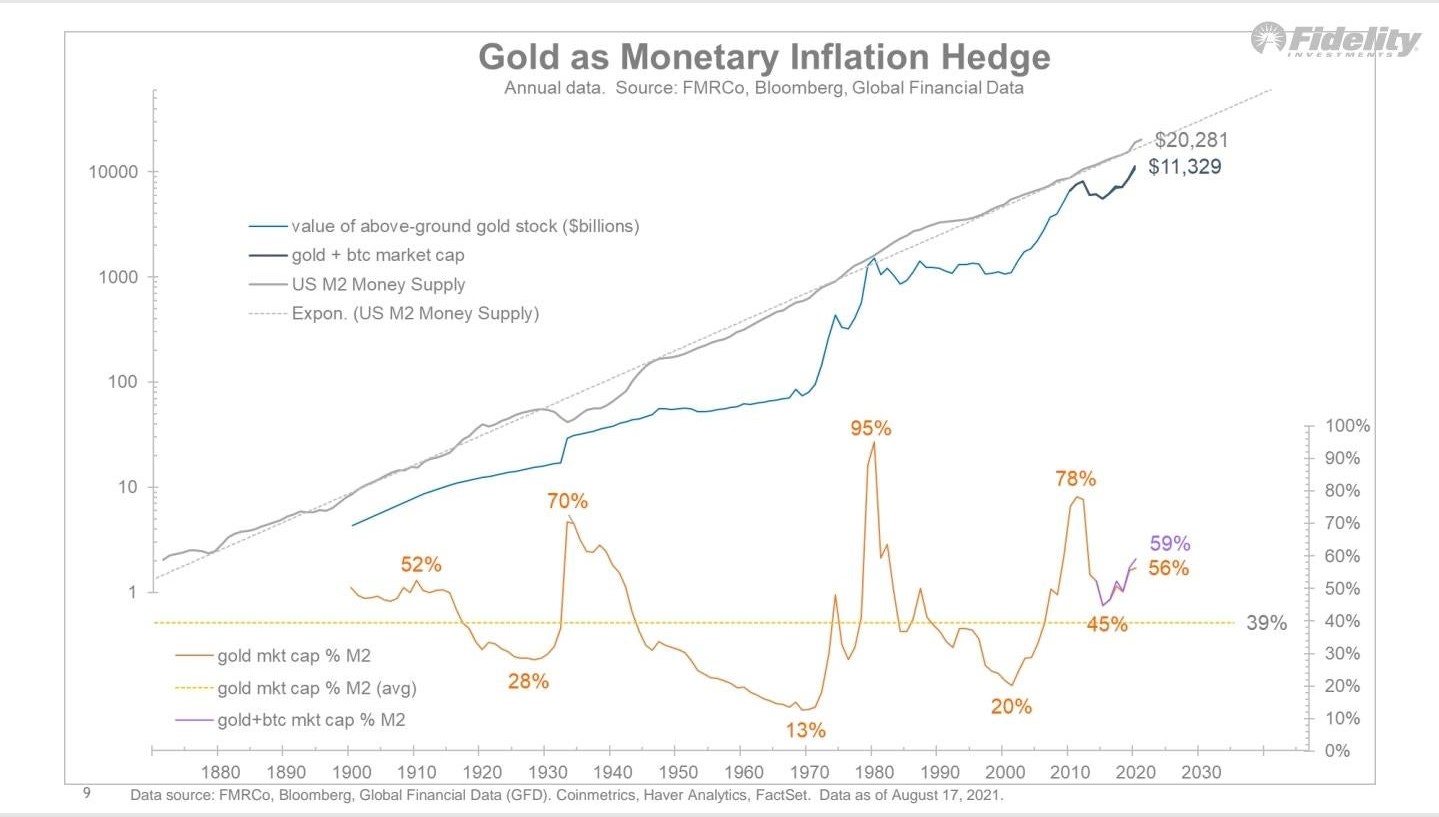

In the past, Gold has been that asset. Even after the gold standard was dropped, Gold being a good inflation hedge, kept up with the market.

And now, it looks like Bitcoin could be joining that brigade too. Bitcoin’s market cap, combined with Gold’s, represents about 59% of the money supply today.

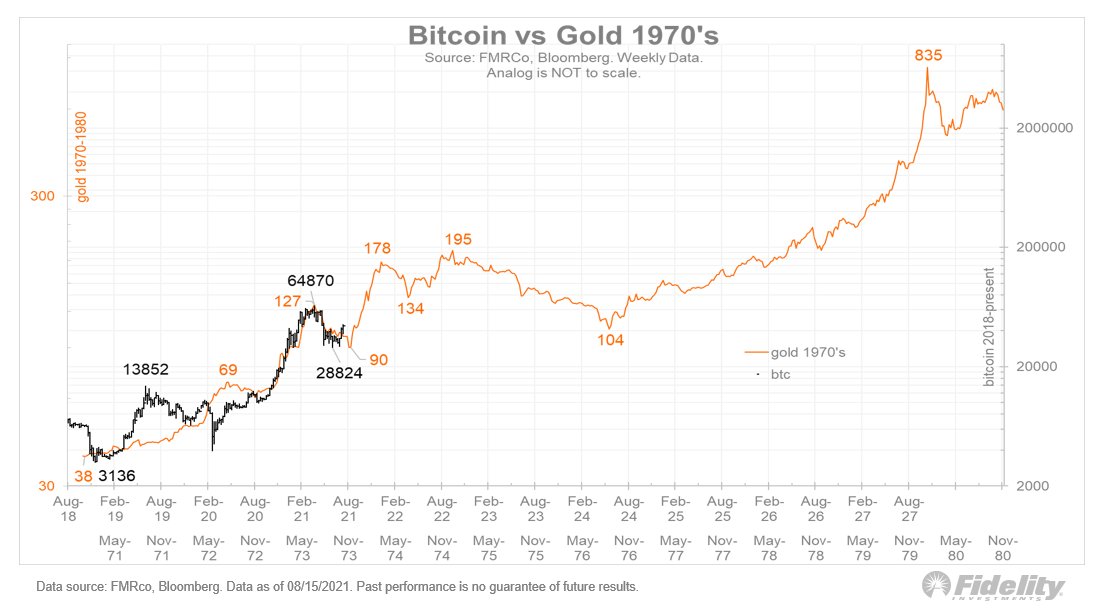

Additionally, when Bitcoin’s price is compared to Gold’s path since the gold standard was dropped, it looks like BTC has been moving in quite a similar manner. This, in a way, shows us where Bitcoin’s price could be heading in the future.

What about investors’ behavior?

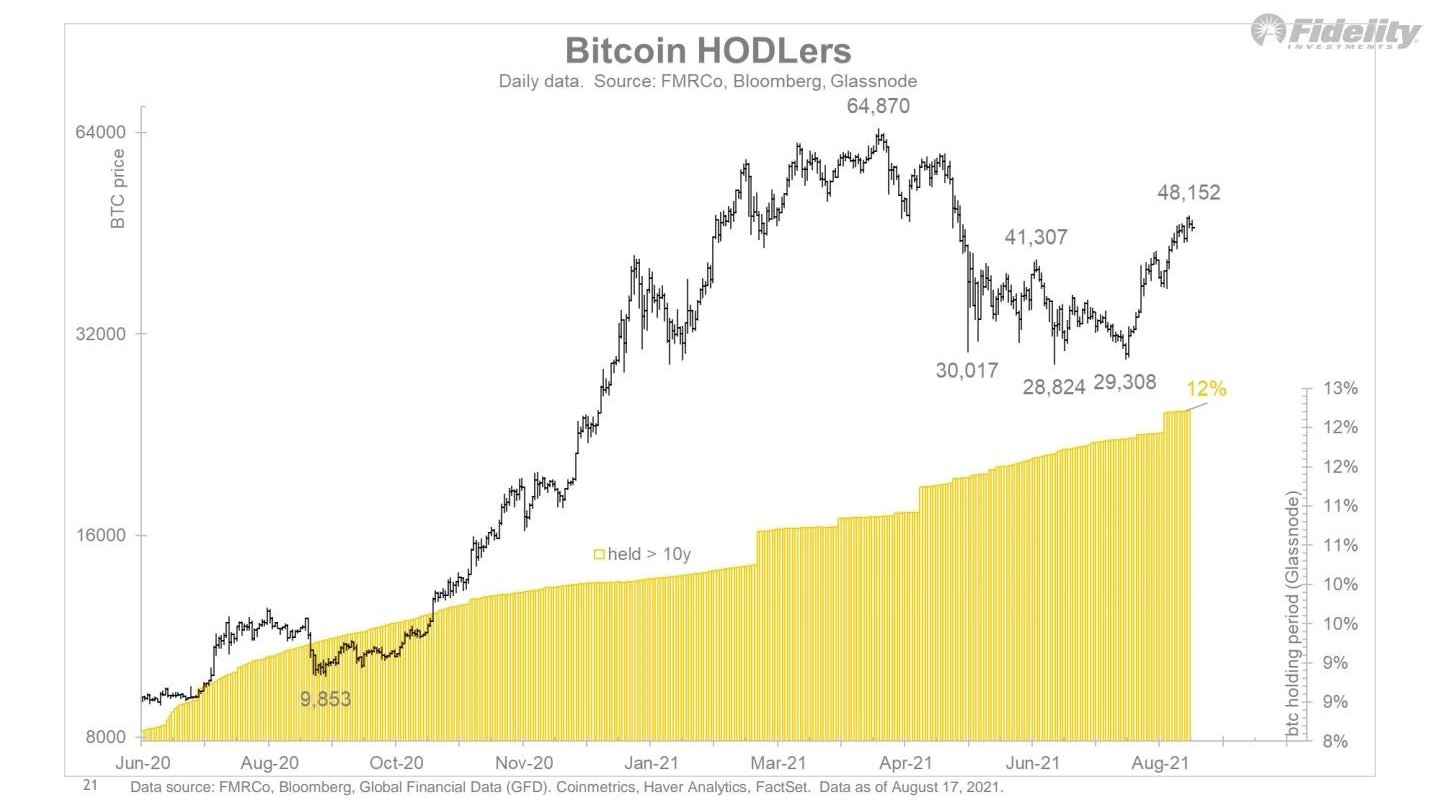

Now, by and large, Bitcoin’s markets have seen investors’ participation increase with time. However, there have been instances that have impacted negatively as well. Due to sellers buying in at tops and selling at dips, holding time has come down for Bitcoin as young coins are sold off quickly.

However, most HODLers remain undeterred since their numbers have been growing despite all the volatility in price action.

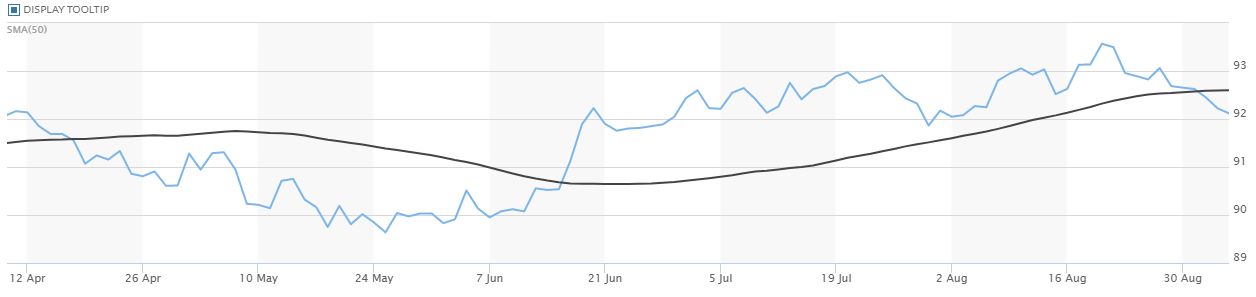

Plus, another reason for BTC’s demand increasing is the movement of the Dollar index. It is falling at a time when the likes of Gold and Bitcoin are rising. Thus, it is increasingly becoming apparent what people would want to choose.

Ergo, in light of the aforementioned demand and supply dynamic, $1 million by 2026 is well within the realm of possibility.

U.S. Dollar Index | Source: MarketWatch

Popular analyst Mark Moss was one to give his opinion on the Bitcoin and Gold v. U.S Dollar discussion too. According to him,

“This would mean USD is as worthless as the Zimbabwe note”

On the contrary, other big names like Ray Dalio, Former co-CEO of Bridgewater Associates, still stands with Gold.

“If you put a gun to my head, and you said, ‘I can only have one, I would choose gold.”

Needless to say, what you invest in is subjective to your opinion.