This is a ‘really positive move’ for the crypto-industry

In a recent interview, BlockFi co-founder Flori Marquez commented on institutional investment in cryptocurrencies. She said that a lot of companies were offering crypto-focused financial products and further opined,

“I think that the main question right now is should financial products that operate in crypto be treated differently than other financial products.”

In this context, it essentially meant bridging the “worlds of traditional finance and crypto.” Additionally, she said that the engagement from “state and national regulators is a really positive move for the industry.” Further, she said that she is glad that the market has evolved over the last four years, adding,

“I think the landscape has definitely shifted.”

However, among the many voices who consider lacking regulatory clarity a hurdle, Marquez also added,

“There are a lot of people who are sitting on the sidelines today, who are waiting for regulatory clarity in order to engage…”

Among investors, there is also a section of institutional investors. The BlockFi co-founder commented that it has become easier to get funding for crypto businesses now as opposed to a few years back. She explained that there was a huge gap in raising seed funding back in the day as,

“Then there were the crypto VCs who generally were more blockchain-focused and didn’t really understand financial products…”

In contrast, she said that a large financial institution without a crypto research desk today is likely lagging. However, in contrast, SkyBridge Capital founder Anthony Scaramucci had stated in a recent that a large number of money managers continue to refrain from cryptocurrency investments.

But, despite the volatility and risk associated with crypto, the asset offers diversification benefits according to a recent research paper. A Fidelity report had also previously found that seven in ten institutional investors look to invest in cryptocurrencies in the future. But, as Marquez pointed out, regulatory concerns are keeping some investors in a wait and watch mode.

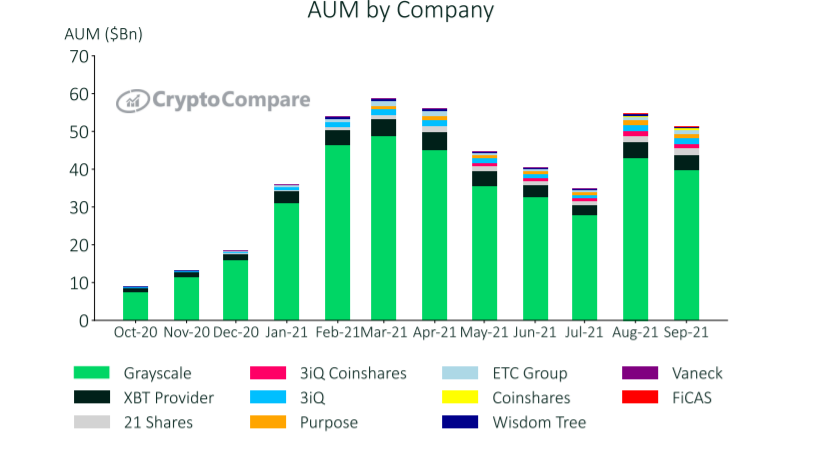

CoinShares’ weekly report suggested that investors took the recent China ban as a buying opportunity. The report estimated about $95million worth of inflows in the week ending 27 September. The total asset under management (AUM) with the institutions stands at $52,646 million.

According to the latest CryptoCompare Report, Grayscale is lead the AUM race in the past months. Grayscale Bitcoin Trust (BTC) includes interest from companies like

ARK Investment and Horizon Kinetics.