With prices around $2, and high returns, all Algorand, MATIC need is…

After a month packed with high gains, higher dips, and a lot of market euphoria, a number of coins witnessed perplexing trajectories leaving participants dazed and confused. However, one thing was certain- the crypto market’s maturation and the strength of mid-cap alts to surprised everybody.

While coins like Cardano, Solana, Terra, and AVAX made new ATHs, others like Algorand noted high gains. On the other hand, coins like MATIC that held a higher rank a month ago slipped down while struggling against new entrants in the top 20 club like Algorand.

Nonetheless, one thing that both Algorand and MATIC offered was an easy entry and steady return to newer participants as both the alts were priced near $2. At the time of writing, Algorand’s close to 30% gains over the last three days heightened market anticipation from the coin.

On the other hand, MATIC saw slower gains and struggled ahead of the $1.35 mark. However, in terms of return on investments and network growth, which way was the market drifting?

Growing user base

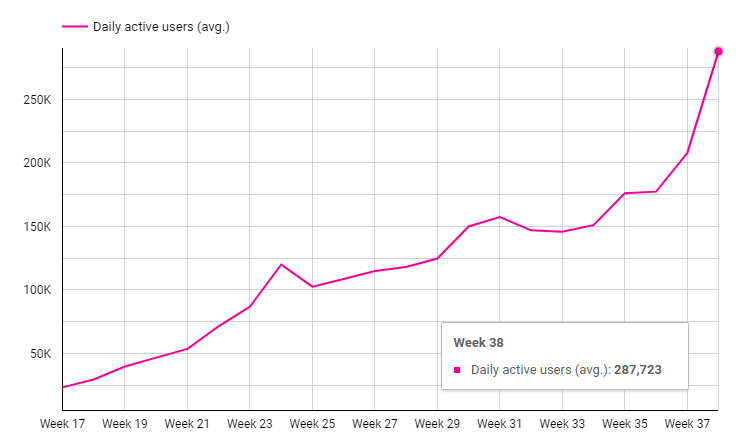

While MATIC seemed to struggle on the price front, Polygon’s user base grew 38.52% week over week as the network averaged over 287K unique daily active users. On September 27, Polygon flipped Ethereum’s users for the first time, spiking to over 350K.

There were many catalysts of this growth including the NFT adoption and the gaming tick-off. Notably, since July, traders on Polygon OpenSea have multiplied 45.5x, and NFTs sold by 17.5x.

Daily active users average | Source: Our Network

Algorand’s active addresses have also had steady growth, in fact, recently the network achieved the milestone of registering 13.5 million addresses. One reason for this rise was the news of El Salvador’s government’s infrastructure being built on Algorand, while most of ALGO’s price rally was attributed to its $300 million Defi innovation fund launched on 10 September, 2021.

Algorand address growth | Source: Algorand

More recently on 29 September, Algorand announced the launch of the Algorand Virtual Machine, or AVM, a layer-1 protocol upgrade. The upgrade which is designed to enhance decentralized app scalability for developers and organizations, enable instant transaction finality, and sustain a negative carbon output, also played a role in its recent over 30% pump.

Path to ATHs looks tough

While both the alts’ growing networks contributed towards the market confidence, there was considerable skepticism when it came to investing or trading the alts. Algorand for instance had high long-term and short-term ROIs but it was still 73.14% down from its ATH back in June 2019.

On the other hand, MATIC’s one-month ROI had fallen and noted -26.74% as the alt oscillated 25% away from its local top at $1.7 in September. For MATIC, the spot market looked comparatively dull as trade volumes neither saw any massive spike nor got close to the May volumes. Likewise, ALGO’s trade volumes at the time of writing didn’t see any uptick either.

Ergo, even though recovery and gains (so to say) are in play, the two alts needed higher inflows and a strong push from bulls to flip key resistance levels into support and sustain a position above the same for decent gains.