Here’s how Polygon boosting utility can impact MATIC’s rally

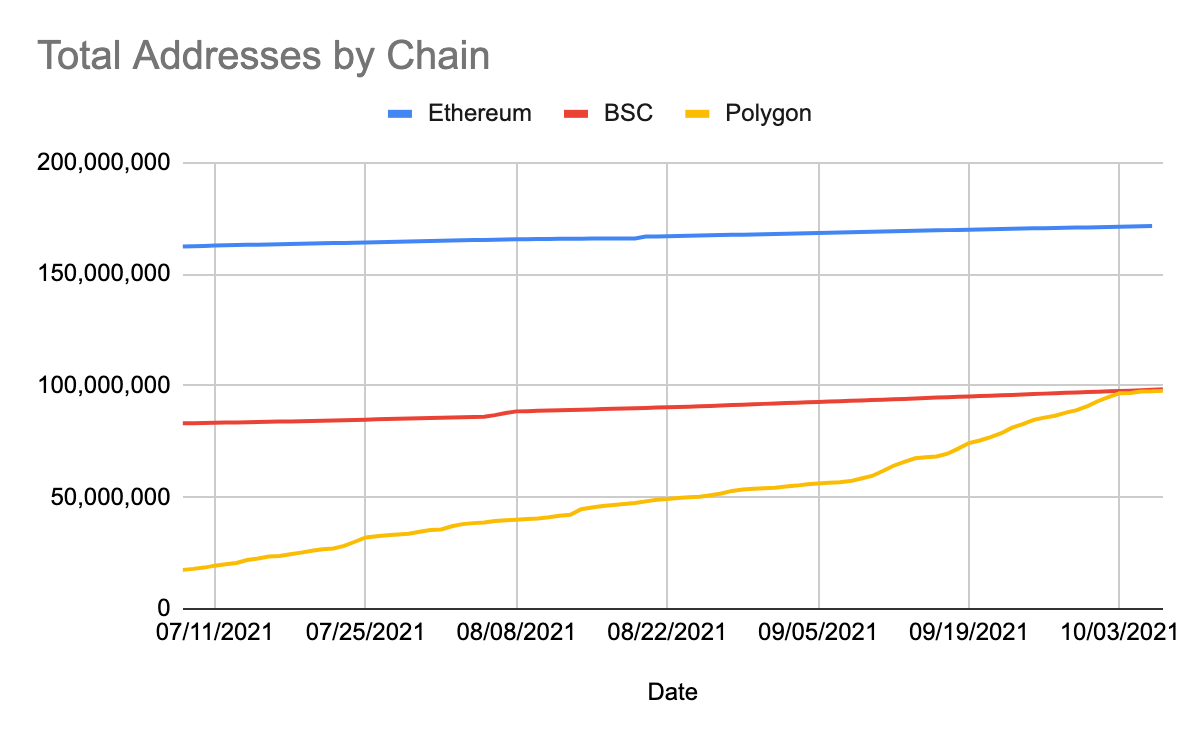

The market has had high hopes from the Polygon network, more so, after it overshadowed the Ethereum network as the former’s active addresses briefly flipped ETH’s.

While the network’s growth has been commendable, the layer-2 solution that connects Ethereum to other blockchains, saw considerable roadblocks after the network’s validators recommended raising transaction fees to tackle the spike in spam transactions.

What changes?

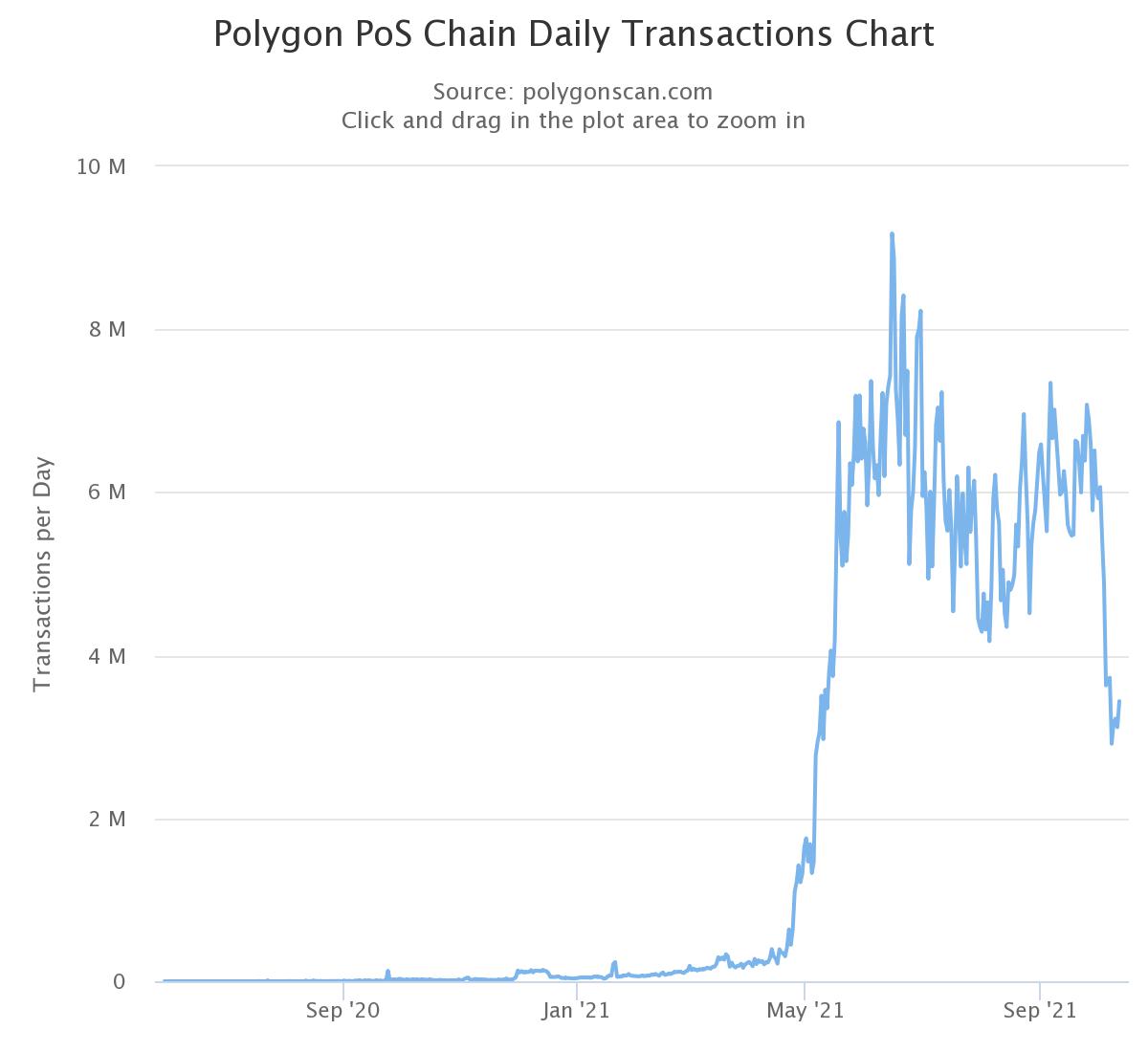

After Polygon’s co-founder Sandeep Nailwal, made the recommendation, the network saw a drastic decline in its on-chain activity. Daily average transaction volume on Polygon dropped from over 6 million to under 3 million, an over 50% fall.

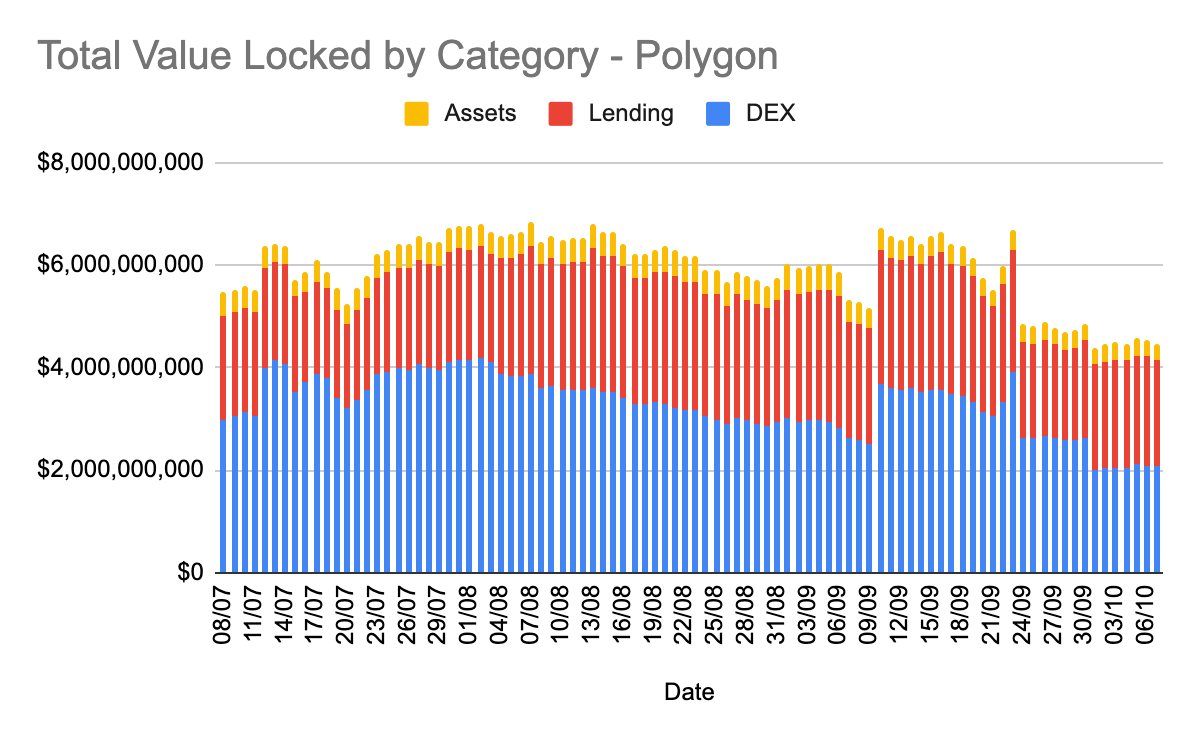

Nonetheless, Polygon still captured the highest share of total value locked on Ethereum bridges. In the last week, the number of wallets on Polygon increased sharply and reached about 97.7 million wallets, which caused the gap with Binance Smart Chain to plummet to about 695,000 wallets.

In fact, Polygon has maintained its dominance over Arbitrum and Optimism in terms of TVL in Ethereum bridges despite the decline. However, Polygon’s Total Value Locked had fallen by 8.3% to $4.46 billion over the last week. The main reason came from DEXs when TVL decreased significantly from the beginning of September.

However, all in all, since the network maintained its dominance as daily transactions fell, traders still expected a bullish impact on MATIC’s price.

Price still on crossroads

After three recent fakeouts for a breakout since September, MATIC seemed to be underperforming price-wise. After reaching a multi-month high of $1.79 on September 5, the alt made lower lows while teasing the market with a potential breakout.

Nonetheless, the asset has maintained above the crucial $1.2 level all through October. In fact, MATIC had 5.76% daily gains at the time of writing but was down 1.54% weekly. While on the price front, MATIC didn’t seem to be making any big moves, the network strengthening utility could boost price action.

Network strengthening utility

Recently, Polygon Studios, the gaming, and development arm of Polygon, partnered with Unicly (UNIC), a protocol that combines, fractionalizes, and facilitates NFT trading. This partnership is expected to enable NFT projects built on Polygon to be eligible for whitelisting and receive incentives through UNIC rewards.

Amid the NFT boom, one striking trend was the high social anticipation around protocols that added a utility layer to NFTs. With this partnership, Polygon also looks set to boost the network’s utility. In fact, Unicly could further provide solutions to Ethereum’s gas fee problem which again pumps the network.

Based on these developments it could be anticipated that MATIC might break out especially, after consolidating for over a week. However, MATIC’s low trade volumes and low social anticipation amid growing network developments still acted as a roadblock.