Polygon needs this for positive momentum in the future

On the back of the rising market MATIC along with its network Polygon is making strides. However, it is well known that a successful market comes from its participants and that is exactly where it gets concerning for Polygon. The question is, from here on can investors fix the faults, or will things further spiral down?

Polygon making records

This week MATIC has performed phenomenally, registering a 20.06% rise. In lieu of network developments, MATIC also went up by 26% in a single day on October 15 when it was listed on Upbit.

MATIC price action | Source: TradingView – AMBCrypto

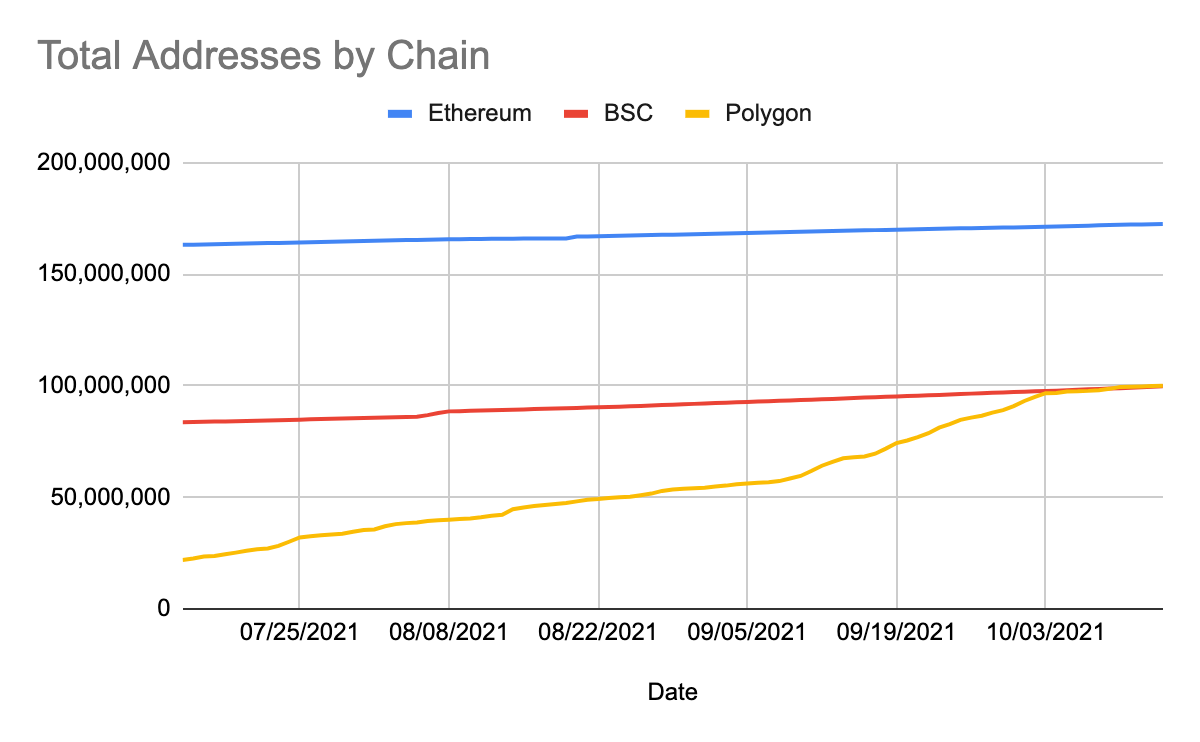

However, more than the token, the chain itself has been making records in the DeFi space. For the first time ever Polygon this week officially surpassed Binance Smart chain (BSC) in terms of total wallets. At the same time, it also crossed the 100 million wallet mark, creating a new all-time high.

Polygon total addresses | Source: Coin98

But this rise in participation is not going to slow down as Polygon continues to catalog over 330k wallets on a daily average.

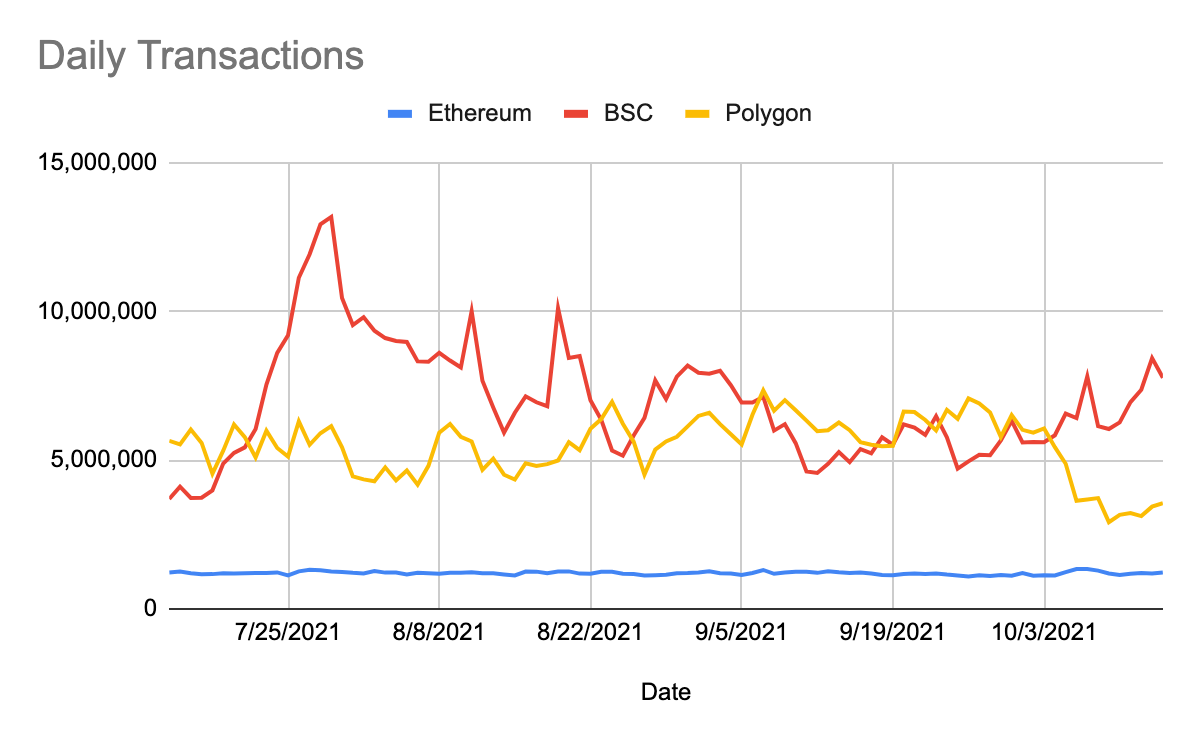

However, the problem is that this rise in participation is strictly born out of FOMO and/or hype of the bullish market. These participants are not exactly performing any transaction on-chain. If you observe the daily transactions on the network, you’ll see that they have been consistently dropping and presently stand at less than 3.4 million transactions a day.

Polygon daily transactions | Source: Coin98

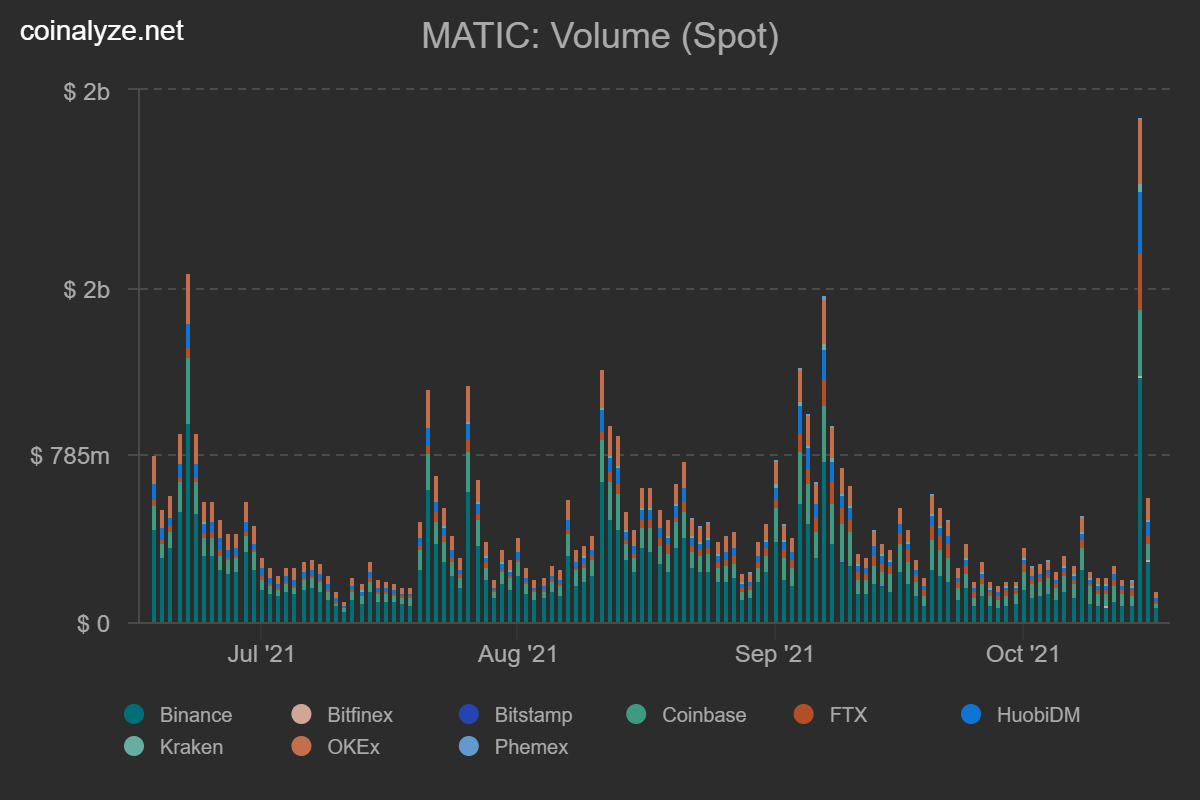

What about the spot market?

Even in the spot market, the sudden spike in volumes was registered only due to the aforementioned reason. Volumes touched $2.38 billion in a single day and over $8.5 million worth of shorts were liquidated.

MATIC spot volumes | Source: Coinalyze – AMBCrypto

Another issue is that MATIC investors had been sitting quietly for weeks and only woke up when something major occurred, like yesterday.

This was also the case on 31 August, 2021 when active addresses spiked only because MATIC went up by almost 20%. It suffers the same problem Bitcoin does – too many participants but very few serious ones.

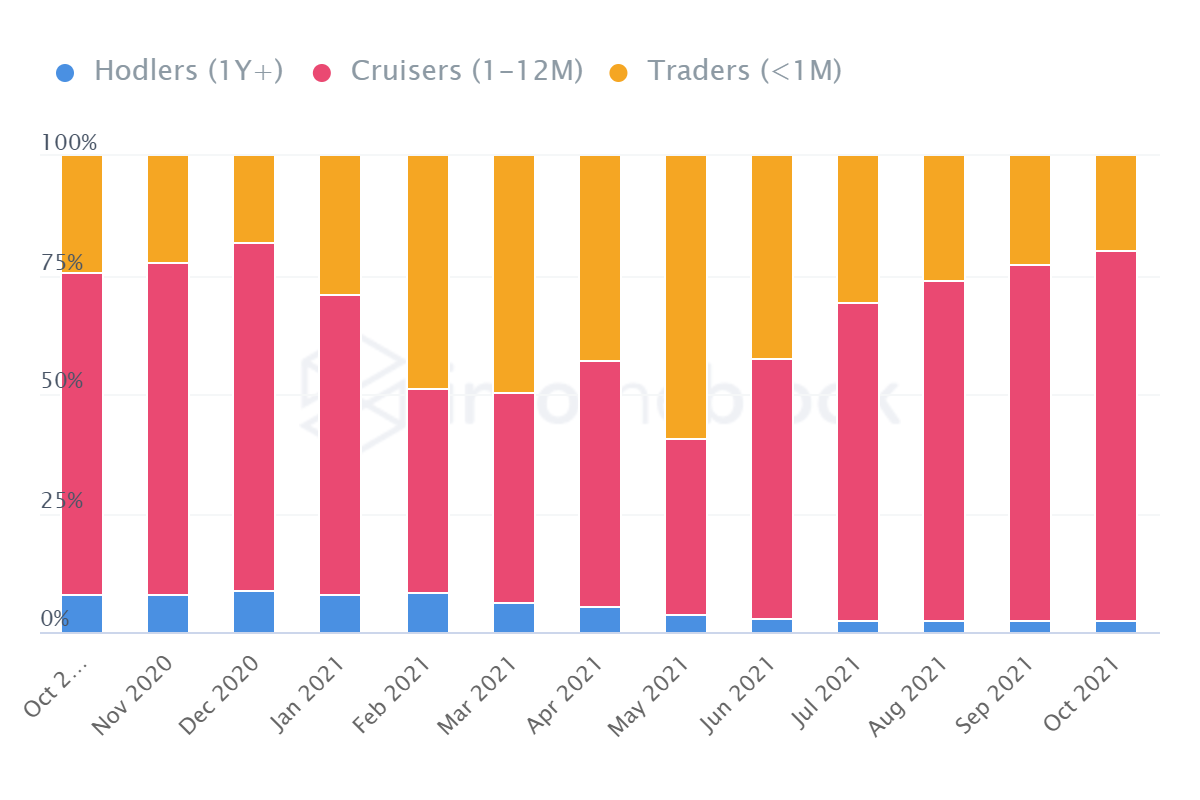

To top it all off the network has a deficiency of long-term HODLers, another sign of the lack of seriousness. HODLers holding the asset for 1-12 months are dominating the market occupying 77.8% of all addresses.

MATIC addresses’ distribution | Source: Intotheblock – AMBCrypto

But the good thing is that at least the network isn’t riddled by short-term holders/traders who buy and sell in the span of days. So some hope still remains for MATIC to form a strong foundation of investors.