Solana’s last 72 hours and what to expect going forward

Of all the existing altcoins in the market, Solana has been the hottest asset for over 3 months now. Rising by more than 764.12%, SOL had been pushing higher, before consolidating for most of this month.

However, the last 72 hours came as a blessing and pulled the altcoin out of its misery. It recovered all the losses it endured over the last 2 months, all in 3 days.

Solana does wonders

On 20 October, Solana began its upward movement, and in the days that followed, it went up by 29.78%.

This W-shaped recovery led the coin to breach its long-standing critical resistance of $200. In the process, it also hit a new all-time high. Consequently, the altcoin’s market cap shot up from $46 billion to $62 billion.

Solana price recovery | Source: TradingView – AMBCrypto

However, this wasn’t some random hike. The push came from the multiple events that transpired between 19 and 20 October –

- Deposit and withdrawal for USDT and USDC via Solana were enabled on the cryptocurrency exchange platform OKEx

- Inter-operability protocol Wormhole added support for Terra, enabling the transfer of UST and LUNA across the chains including Ethereum and Binance Smart Chain

- Solana’s recently launched Staking protocol Marinade Finance crossed the $1B mark in less than 2 months

Naturally, investors, without making heads or tails of the situation, jumped into Solana based on the bullishness alone. And that brought about this rally.

Investors on a high

Trading volumes on 21 October were at a monthly high, hitting $3.4 billion in a single day. On top of that, about 100k SOL was bought in just 5 mins, at the time of writing. What’s more, over 6 million SOLs ($1.2 billion) were bought and sold on 21 October.

Solana buy/sell volumes | Source: Coinalyze – AMBCrypto

However, surprisingly, there seemed to be more bullishness in the leveraged trading market than spot. Volumes crossed $10 billion, and more than $16 million worth of long and short contracts were liquidated in a single day.

The bullishness is carrying over to today too since shorts contracts worth $4 million are taking precedence over longs.

Solana derivatives volumes | Source: Coinalyze – AMBCrypto

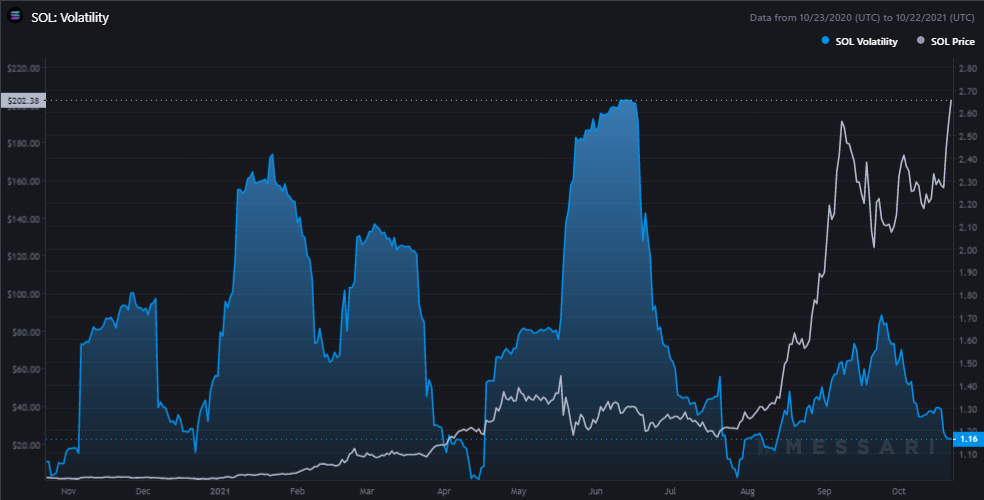

And, for those who were waiting for a but, there doesn’t seem to be a warning sign here. At press time, there were no indications of a price fall yet since volatility has been very low. Finally, the average user sentiment is also strongly positive right now.

Solana Volatility | Source: Messari – AMBCrypto

So, for those of you who want to invest in SOL, this is your time. However, watch the price for a correction towards $200. If the candle closes above it, confidently enter the market. If it doesn’t, remain cautious.