What’s the effect of Bitcoin realizing gains after 4 months

Bitcoin hit a new all-time high of $67,276 two days ago and since then, something has changed. There has been a marked difference in investors’ behavior from hours before the ATH and hours after it.

In any case, it is playing in their favor as the profits gained from this will not only benefit long-term holders, but also the market in return.

Bitcoin holders in profit

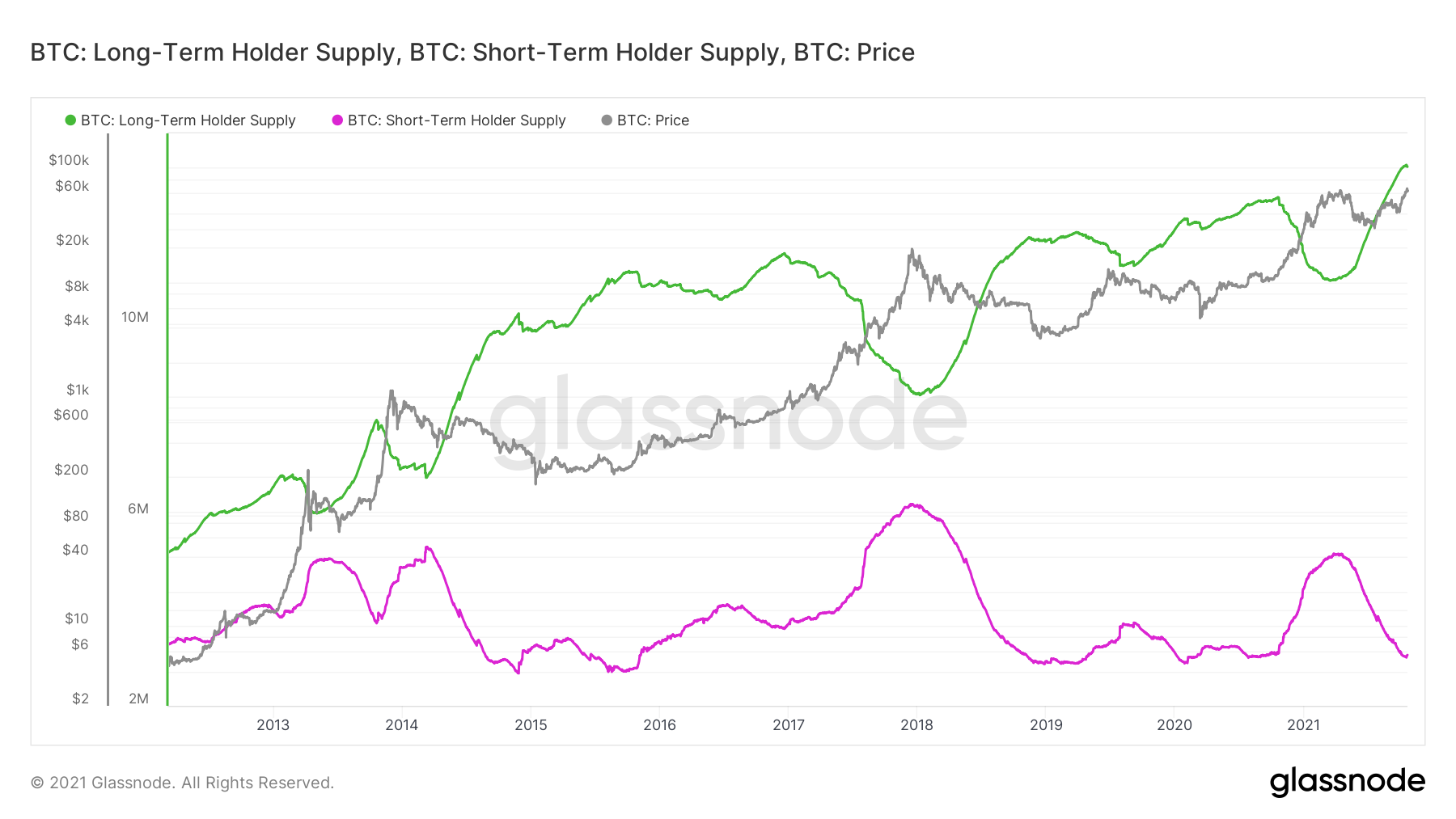

Following the much-awaited ATH breach, long-term holders’ supply has begun declining to indicate that these holders are distributing.

Down by 37k in just 3 days, these investors have sold Bitcoin worth over $2.2 billion.

Bitcoin LTH supply | Source: Glassnode

However, this is not surprising because the market is expecting to sell anyway. This is because for a long time LTHs have been buying into weakness and selling into strength. The distribution we’re seeing right now will mark the return of short-term holders.

Since the May rally, their holdings had been falling. Until now. In the past too, STHs’ holdings only gained strength when LTHs supply went down. And, that is what will happen this time as well.

Bitcoin LTH-STH supply | Source: Glassnode

So, have LTHs pulled out completely?

Not really. Since the $67.2k all-time high, BTC has fallen by over 8% to trade at around $61k, at press time. Despite that, however, the strength selling continued. This resulted in a bit of the supply being overhead by about 1.59%.

What’s more, as is visible on the illiquid supply shock ratio chart, supply is still continuing to move to on-chain entities. These have projected minimal selling in the past (less than 0.25% of the supply they buy).

What this means is that the market is only experiencing a short-term correction at the moment, while the long-term picture remains intact.

Bitcoin illiquid supply shock ratio | Source: Glassnode

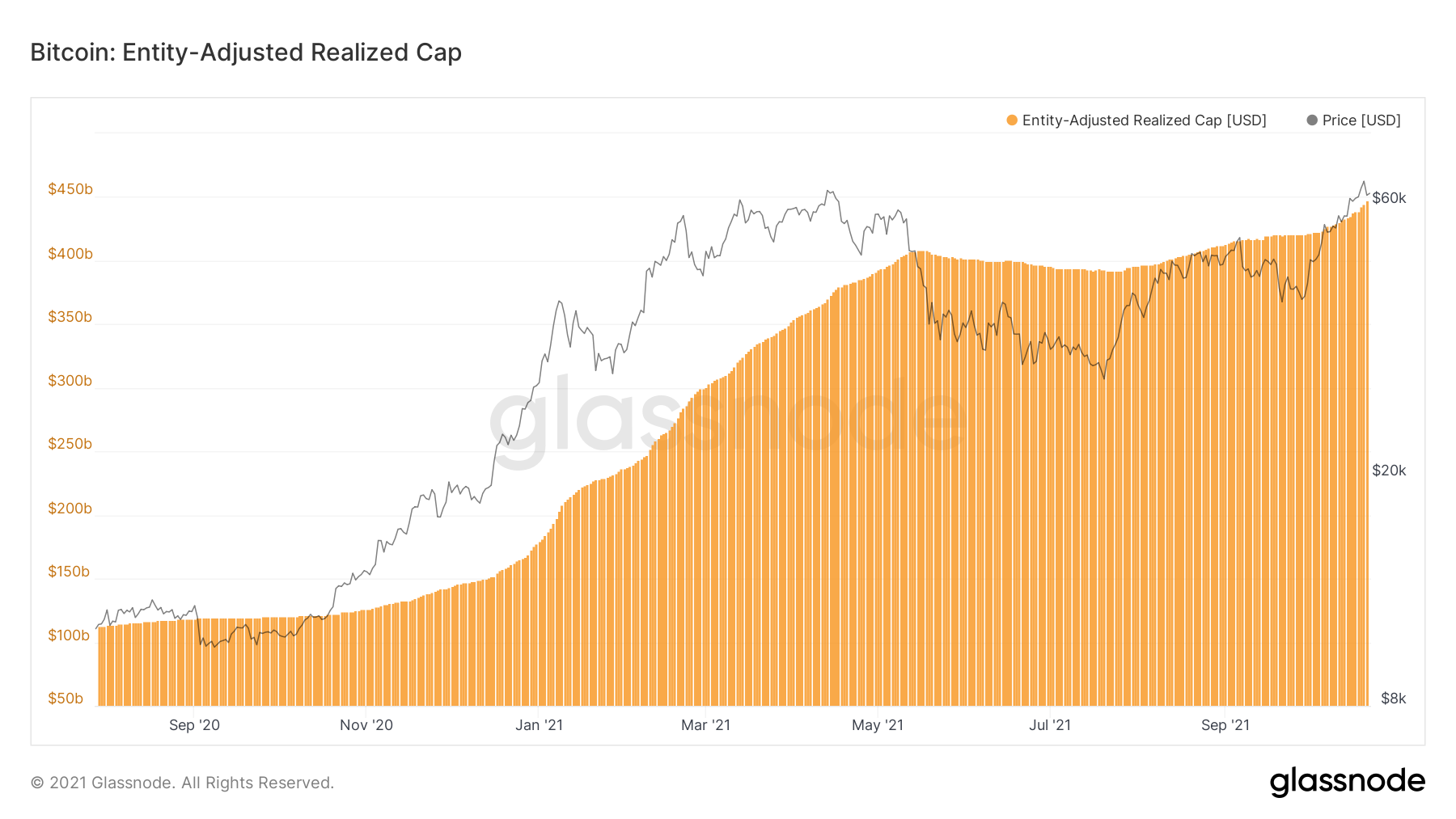

Plus, the incline of the realized cap is proof that Bitcoin is realizing profits and new inflows are absorbing these gains after declining for almost the entire summer.

Bitcoin entity adjusted realized cap | Source: Glassnode

Ergo, this move by investors is for the benefit of the market since the hype surrounding the king coin has and will continue to bring in new investors.

And, the more supply LTHs distribute, the more they will realize profits and the chances of long-term holders increasing will improve. This will result in the market strengthening further.