Beyond the White Paper: 13 years on, did Satoshi imagine this for Bitcoin

13 years ago on 31 October 2008, Satoshi Nakamoto published the Bitcoin White Paper titled, “Bitcoin: A Peer-to-Peer Electronic Cash System.”

"I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party."#thankyousatoshihttps://t.co/cz3yYo4UEw

— jack⚡️ (@jack) October 31, 2021

However, it might be an understatement for some to just call it a digital currency now. Investor and commentator Balaji Srinivasan recently reasoned that,

“Bitcoin really is the safest long-term asset not just because of its technical qualities, but because of its simplicity, global availability, community, and the social defense arrayed behind it.”

Currently, Bitcoin is not only dominating the sector’s market cap with its share of over $1.13 trillion, but it also commanded 99% of the inflows last week. CoinShares noted that a total of US$1.45bn went into the asset as of 25 October.

As we speak about last week, a lot of the activity is associated with the approval of Bitcoin-focused ETF. Considered a piece of major news for the industry, the investment product launch is also associated with wider adoption of the asset by many.

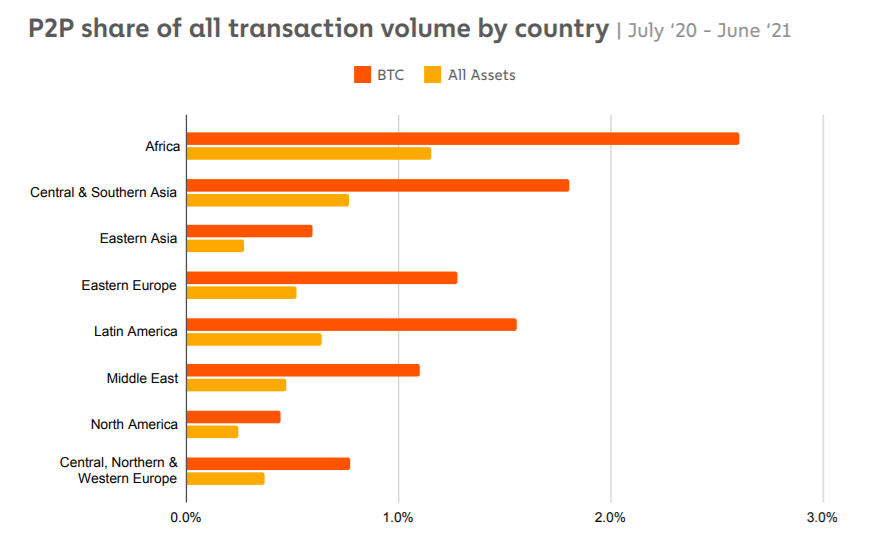

The global adoption and transaction figures also present a strong case for Bitcoin. It has a lion’s share in P2P transactions as per a 2021 Chainalysis report.

Srinivasan also noted that people now recognize the dollar and Bitcoin globally, making them the top two worldwide. He also stated,

“It’s not really an ‘investment’ anymore, it’s a lifeboat.”

For people who do not consider Bitcoin enough, Srinivasan reasoned that “Bitcoin means we have a base to rebuild from.”

His argument makes sense as even market spectators know that Bitcoin has covered a long road quite quickly. You could even call it a volatile road that turned $0 in 2008 to an ATH of $67,000 in 2021. Take the example of investor Greg Schoen. He could be one of the many investors who would regret prematurely selling their BTC holdings.

https://t.co/aVCVvvmbg2 I was wondering why I was seeing a spike in notifications, that explains it.

— Greg Schoen (@GregSchoen) November 25, 2020

At a price of around $60,000, at press time, his current Bitcoin portfolio would have been worth over $102 million. This could be the reason that MicroStrategy’s Michael Saylor keeps pushing investors to hodl Bitcoin and never sell.

You do not sell your #bitcoin. https://t.co/zMGyYU1iRp

— Michael Saylor⚡️ (@saylor) October 28, 2021

That’s not it. Some see an even bigger potential with Bitcoin. Kraken’s Dan Held sees Bitcoin’s price “going to the moon.” He said,

“If everyone in the world understood Bitcoin, and the current macro environment, then the price would be $1M-$10M per Bitcoin.”

But, before that leap, some issues need to be solved. There are unclear regulatory policies and agency crackdowns in the space in many parts of the world. Recently, China even banned Bitcoin and other crypto assets. Investor Raoul Pal, in a recent Twitter thread, told the “older cynics” that young investors are not “interested in your love of oil or commodities.”

He argued for “embracing change” and called crypto adoption the “4th Turning,” stating,

“We will all feel left behind, but we have to trust in this younger generation of people under 40 to lead the way and show us new ways. We need to be led.”