Why a new ATH for Binance Coin won’t come without a price

With bullish market momentum shifting gears from one altcoin to the other, at press time, Binance Coin seemed to be taking full advantage of the scenario. In fact, BNB was valued at above $650, extremely close to its previous all-time high of $692 from May 2021.

However, there are certain fundamental differences between Q1 2021 and Q4 2021. And, while both periods exuded bullish behavior, it is important to understand the new developments at the moment.

With a market cap of $111 billion, Binance Coin is slowly extending its lead over a surging Solana.

Binance Coin rises while BSC supports – Sustainable?

The initial introduction of Binance Smart Chain as a competitive DeFi battleground against Ethereum allowed BNB to scale by over 10x during the beginning of 2021. At the moment, its rising functionality might be helping BNB re-test its highs.

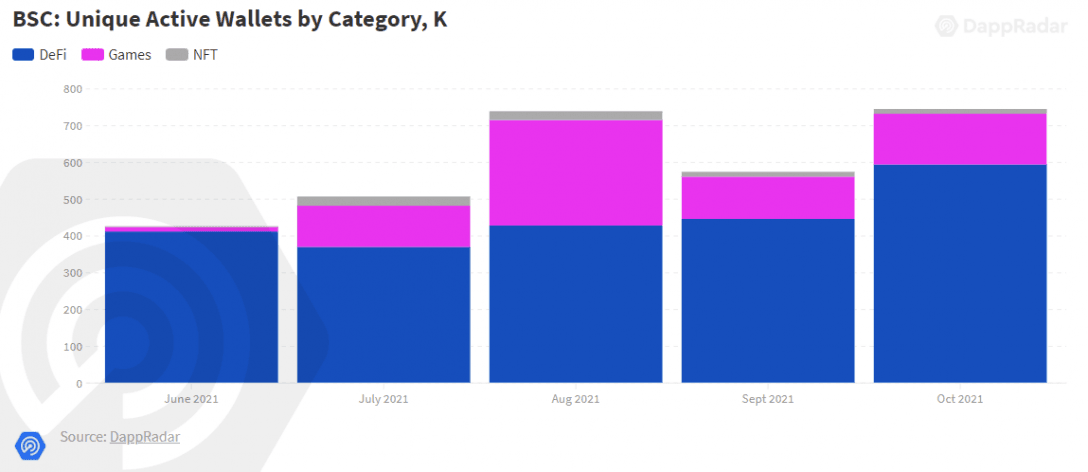

According to data, BSC has quickly established itself as a GameFi referral, and popular games such as Mobox and CryptoBlades are piling on activity for BSC. Ethereum’s Axie had taken a majority of the hype from a blockchain gaming world. But now, Mobox and CryptoBlades are bringing in more than 200,000 Unique Active Wallets.

The chart attached above illustrates the growing activity on BSC over the course of Q3 and the beginning of Q4 2021.

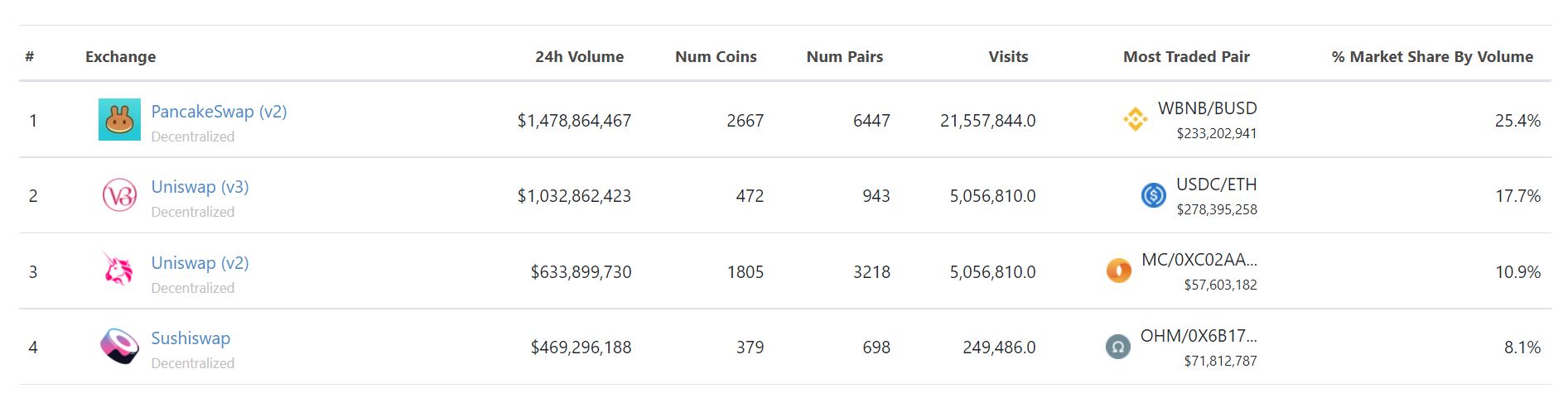

However, activity hasn’t been limited to only gaming tokens. At press time, BSC-built PancakeSwap is the most utilized decentralized application in the industry. In October alone, PancakeSwap, as a marketplace, attracted over 37,000 unique traders and amassed over $39M in trading volume.

Those numbers represent significant increases of 140.72% and 676.67%, respectively. Additionally, PancakeSwap is currently responsible for the highest trading volumes from all involved DEXs, amassing more than 25% of the market share.

Chink in the armor?

While BSC had extremely impressive statistics for its supported protocols, Solana is doing one better at the moment. Solana is picking up pace at a breakneck speed.

And, even though its market cap was half of Binance Coin, at press time, its total locked value was $25 billion when compared to Binance’s $21 billion.

Now, keeping these points in mind, from a structural point of view, BNB is just inches away from testing its $692 resistance. The only difference right now is there is a lack of development hype.

It is fair to suggest that considering BNB closes its weekly candle above $692, momentum might push its case forward. Alas, technically, its own trading volumes are much thinner at the moment, with respect to its early-year exploits.

Binance Coin can absolutely go on a tear after it breaches $692, but fundamentally, it might not be as strong as Q1 2021. Investors should keep that in mind before jumping onto the BNB bandwagon.