Grayscale Investments crosses $60 billion in AUM, keen on more ETFs in future

For many investors and traders, the digital currency asset management company Grayscale Investments offers a relatively more traditional – and supposedly safer – way to gain exposure to crypto assets. Grayscale has also been adding various coins to its Digital Large Cap Fund, thus boosting investors’ confidence in these assets as well.

Celebrating 60 billion

Though Grayscale Investments regularly publishes its assets under management [AUM] stats, one update garnered a lot of attention. The company reported that it had crossed $60 billion in AUM and was actually closer to $61 billion. The psychological number incited a range of reactions from across the crypto industry.

Grayscale’s assets under management has topped $60 billion https://t.co/HvMnrpAFgd

— Barry Silbert (@BarrySilbert) November 10, 2021

While the Grayscale Bitcoin Trust [$43,557.2 million] led in terms of AUM, other heavyweight players included the Grayscale Ethereum Trust [$14,852.9 million], the Grayscale Ethereum Classic Trust [$756.3 million], and the Grayscale Digital Large Cap Fund [$715 million].

Still on the waitlist?

While some alt coins and tokens are part of Grayscale’s “product family,” others are still on the waitlist. As of 2 November, some major assets under consideration included Polygon [MATIC], Polkadot [DOT], Terra [LUNA], Tezos [XTZ], and Avalanche [AVAX]. One asset which successfully moved to the final list was Solana [SOL].

However, an increasing number of investors are keen to learn the fate of Grayscale’s endeavors in the ETF sector.

Exploring a ‘gray’ area

After the SEC seemingly allowed the ProShares Bitcoin Futures ETF to begin trading, Grayscale applied to convert its own Grayscale Bitcoin Trust [GBTC] into a BTC Spot ETF.

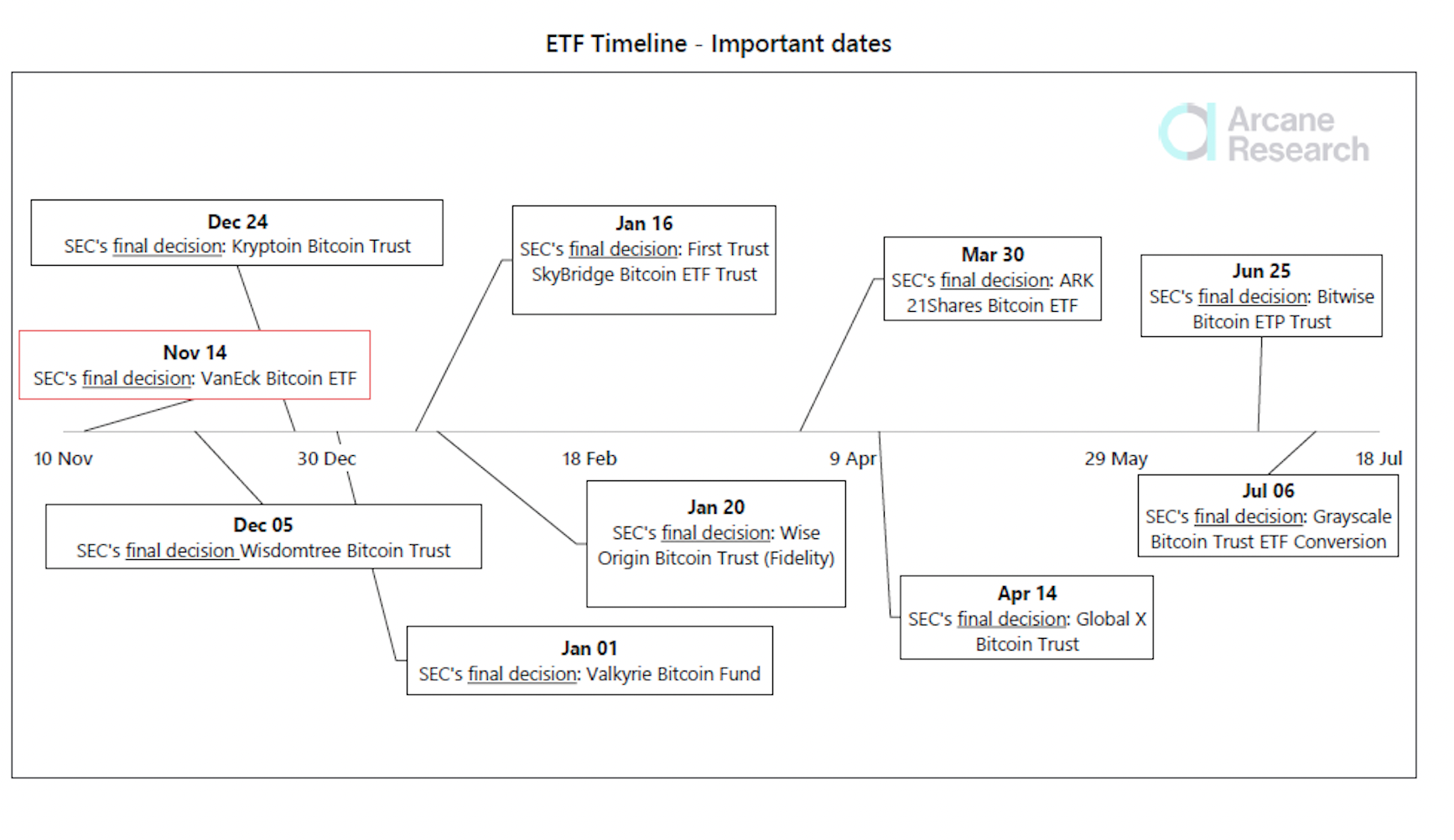

According to a report by Arcane Research, the SEC’s result on the same is expected before 6 July 2022. However, experts and industry insiders are hoping for the verdict to come sooner.

Source: Arcane Research

Furthermore, Bloomberg reported that Grayscale had applied for an ETF called “Future of Finance” [GFOF], apart from the GBTC conversion.

In its Bitcoin Spot ETF application announcement, Grayscale claimed,

“Today, the Trust is the largest Bitcoin investment vehicle in the world, holding approximately 3.5% of all Bitcoin in circulation.”

The company further added,

“We have long been committed to converting GBTC, as well as our other 14 investment products, into ETFs.”

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)