Ethereum: What you should know about Long-term holders’ ‘historic’ sell-off

October and November have been kind of historic for not just Ethereum, but all altcoins. However, “historic” doesn’t necessarily automatically imply a positive development. In Ethereum’s case, this particular development is the perfect example.

Ethereum marks a new ATH…

Not in terms of price action though. Instead, it has to do with an ATH, one set thanks to its investors.

Since its $4878 all-time high 10 days ago, ETH has been dropping on the charts. The depreciation of 7.7% on 16 November 16 triggered many market investors significantly. And, since this was the first significant price fall in almost 2 months, it was not surprising to see investors panic.

Ethereum price action | Source: TradingView – AMBCrypto

The scale of the aforementioned depreciation doesn’t tell us the whole story. In fact, in just 24 hours, 4 billion coin days were destroyed as many long-term holders sold their assets. This was the biggest sell-off seen by LTHs ever due to the fear of significant losses.

As a result, this marked the ATH peak of coin days destroyed.

Ethereum CDD | Source: Glassnode – AMBCrypto

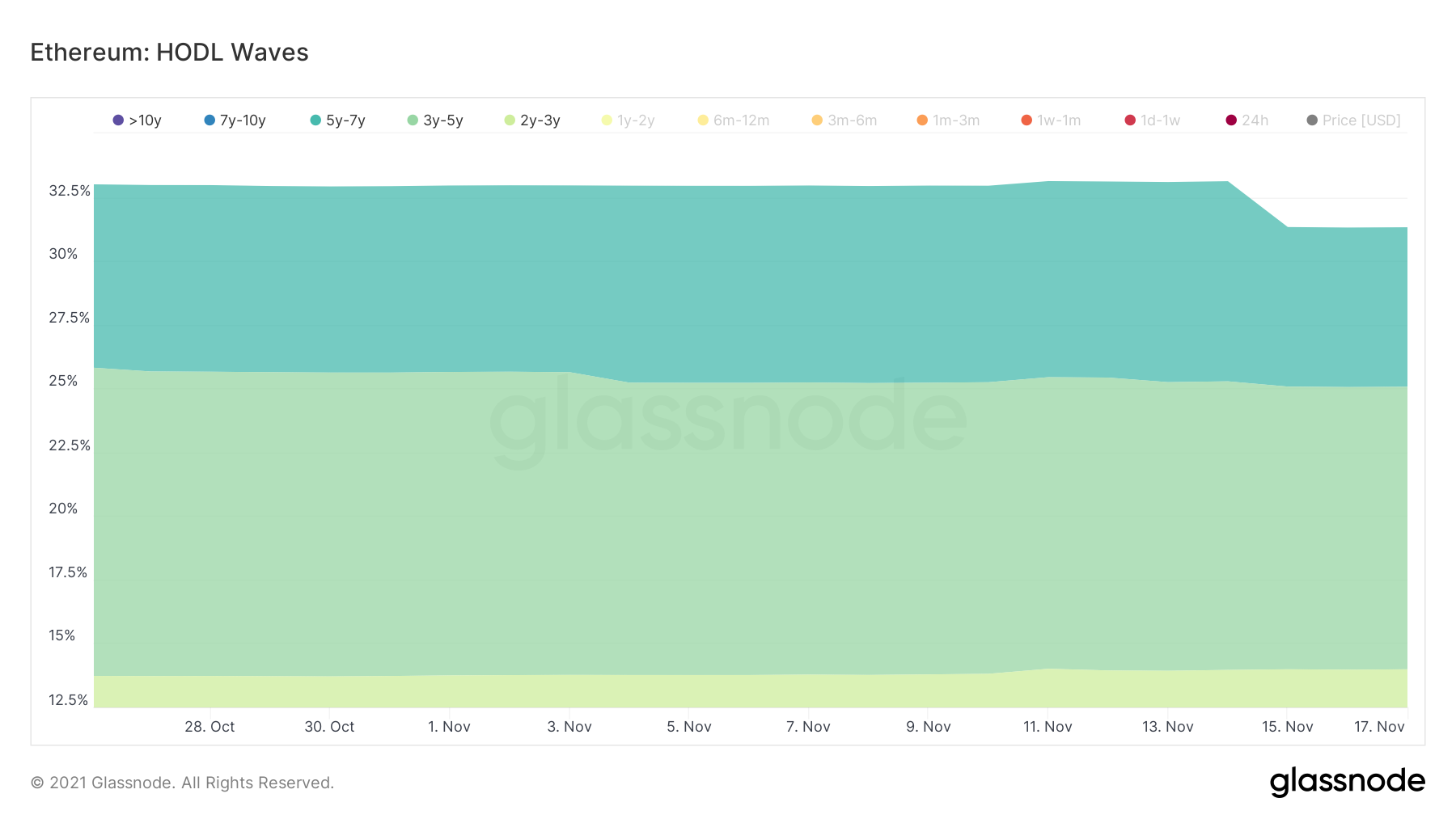

And, these were some pretty old coins too. More than 1.6% supply of 5 years to 7 years old coins were sold off. The coin days destroyed also included coins between the age of 3 years to 5 years.

As expected, for the first time in 3 years, Liveliness shot up so significantly that it was at an all-time high. This pointed to several long-term holders liquidating their positions.

Ethereum LTHs | Source: Glassnode – AMBCrypto

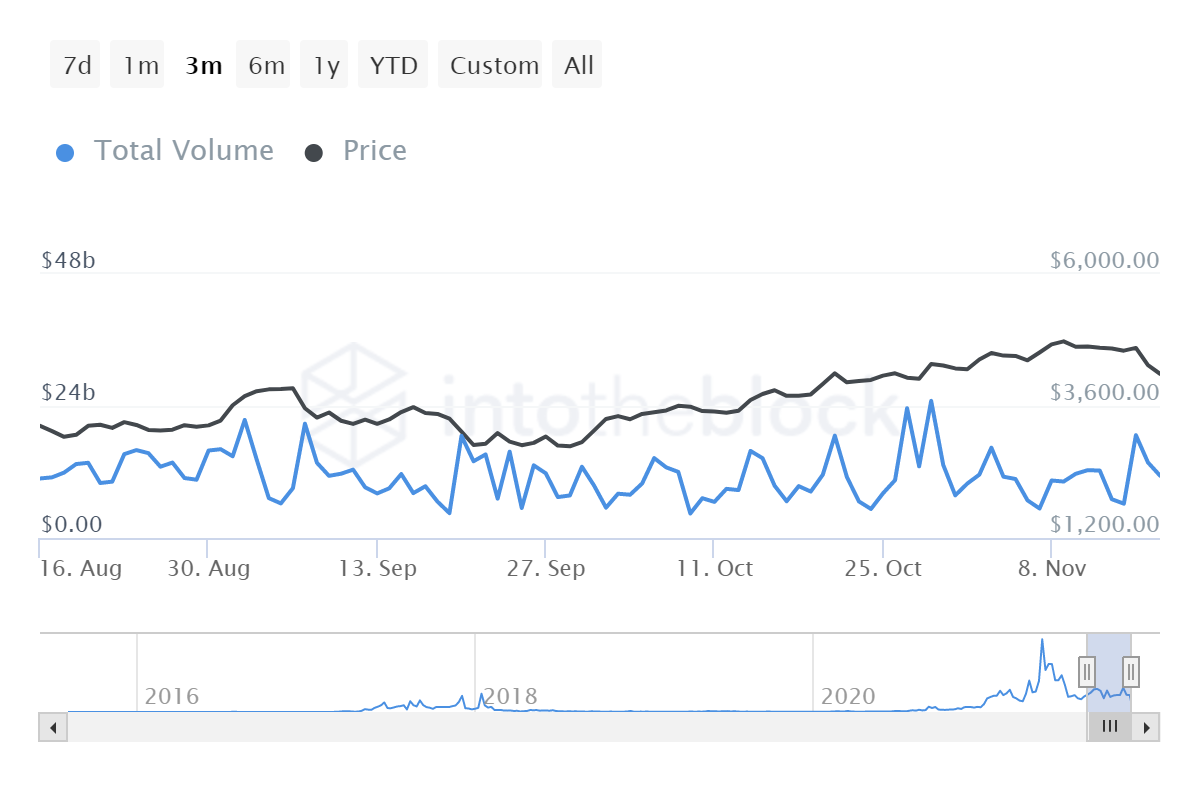

Here, it’s worth noting that these were only LTHs and not whales, with large transactions (transactions worth more than $100k) oscillating within their average figures and ranges.

Ethereum large transactions | Source: Intotheblock – AMBCrypto

Even so, the price fall did more damage than just triggering long-term holders to sell. There have been many investors who suffered losses in these 10 days.

All-time highers and lowers dictate that right now over 3.37 million addresses who bought their ETH around ATH prices are suffering major losses. The only people who are truly in profit are the 394k addresses who bought ETH around its all-time low prices a long time ago.

Ethereum all-time highers and lowers | Source: Intotheblock – AMBCrypto

Incredibly, one good thing did come out of the aforementioned price depreciation.

Ethereum is now back in the opportunity zone after 2 months. This low-risk buy area might serve as redemption for Long-term holders. Especially when new investors buy back their sold ETH.