Here’s why Cardano’s 47% rally could be disappointing for ADA holders

Cardano made a major breakthrough this week after months of disappointing movement. But despite the unprecedented increase in price, the rally seems to be lacking strength.

Cardano rockets to $1.1

From a technical viewpoint, the increase in ADA’s value over the last 11 days has paved the way for Cardano to rest into the overbought zone. Needless to say, the recent rally has been a huge relief for ADA holders. However, investors are expecting positive momentum to continue. That way, a trend reversal can kick in on a macro frame.

Furthermore, there were a couple of times when ADA entered the overbought zone in 2021. For instance, in February when ADA rose by 217%, in May when ADA appreciated by 126%. And, then again in August when ADA shot up by 107% right before marking the ATH.

Cardano price action | Source: TradingView – AMBCrypto

It is important to note that despite reaching the overbought zone in February and August of 2021, ADA continued to rally. Perhaps, we could expect the same this time given the state of the market’s sentiment.

As per the Fear and Greed index, the persisting fear in the market has subsided remarkably in merely five days. It returned to neutral territory at the time of writing. Notably, at the moment, it seems like ADA’s rally could sustain. A little consolidation on the price chart can help ADA go up further.

However, since the aggregate supply on the network has still not recovered from losses, investors might preferably continue to HODL their ADA.

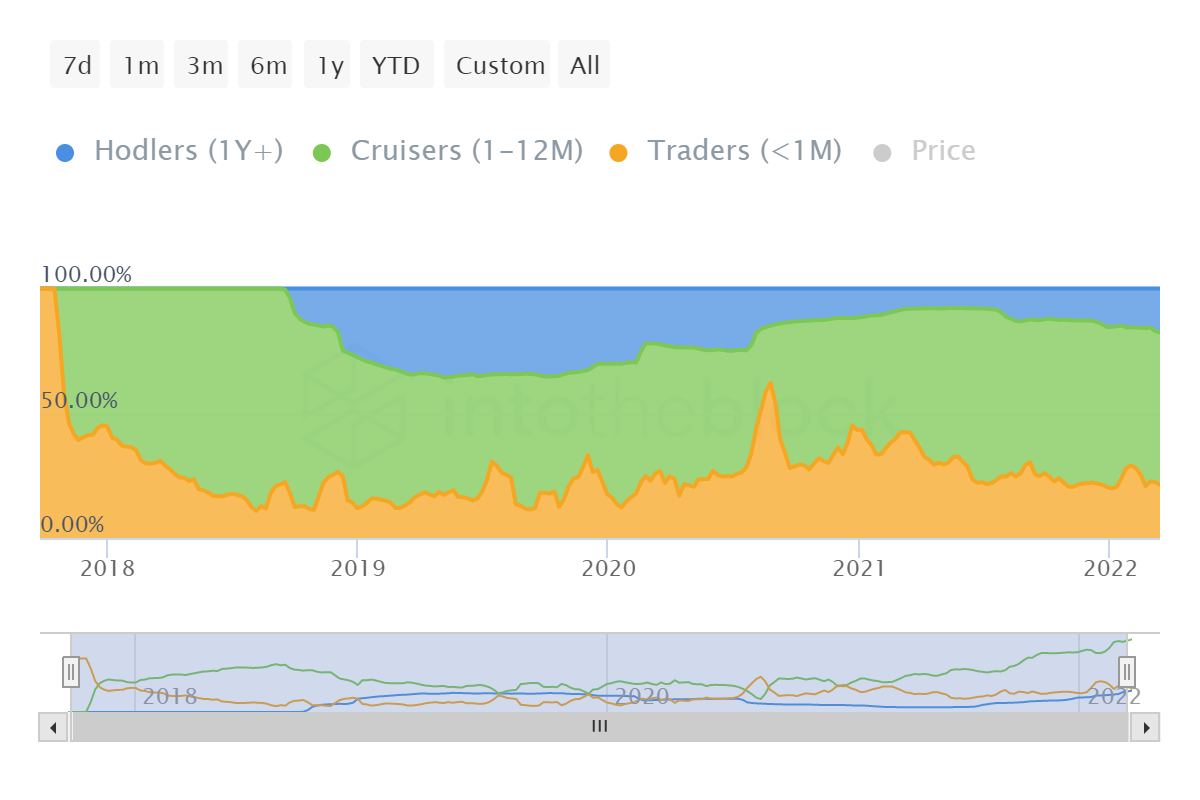

Cardano holders at the moment aren’t being hasty in cashing out for profits the way they did after the 12.49% rally on 2 February during which long-term holders’ (LTH) selling consumed over 152.37 billion days.

Cardano LTH selling | Source: Santiment – AMBCrypto

Over 61% of Cardano’s total supply is held by mid-term holders. However, these LTHs too have some influence over the price action since they have been holding about 12 billion ADA in their wallets. Thus, selling from their end could be harmful to a strong, steady rise.

Cardano supply distribution | Source: Intotheblock – AMBCrypto

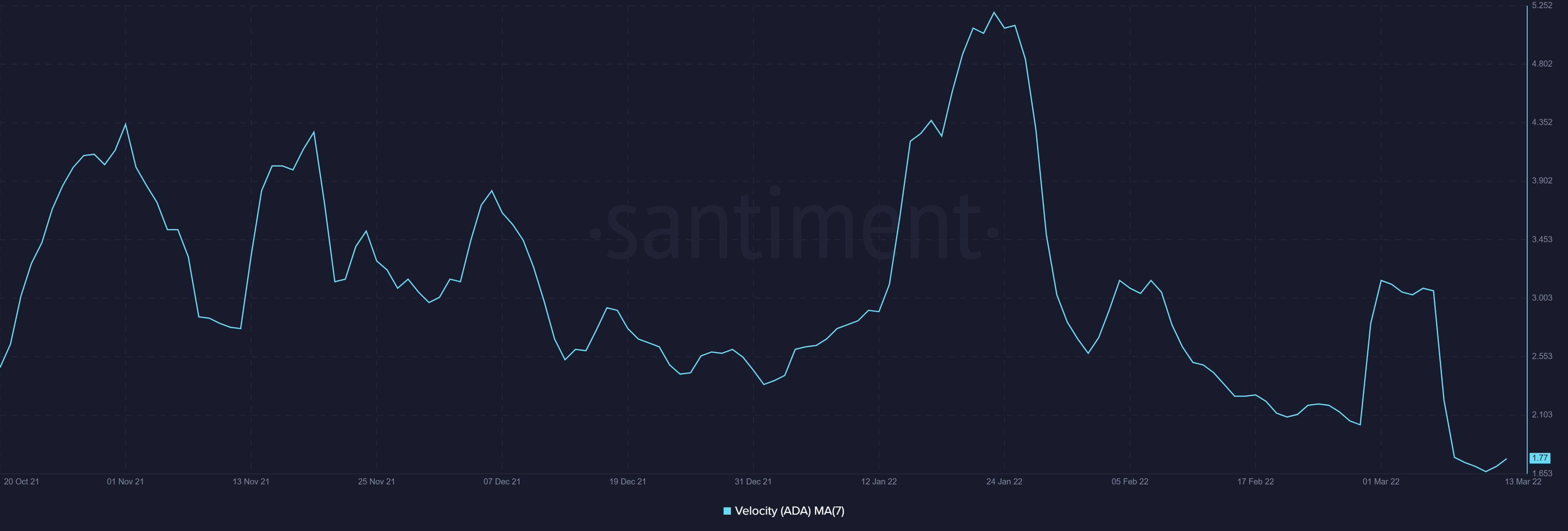

But now that the rate at which ADA changes hands has dropped considerably, the rally might sustain. Primarily because a strong hike requires strong support from investors, which Cardano seems to be enjoying of late.

Cardano velocity | Source: Santiment – AMBCrypto