Trade easy and make a passive income with TradeSanta

If you’re a man of today and live a busy life, you’re probably pragmatic in all that has to do with money matters and time management. So, good news: there’s one more field in your life you can easily optimize – crypto trading.

Experienced crypto traders use a whole kit of tools on a daily basis to improve their results: automated trading platforms aka crypto bots, TradingView, crypto trading signals, closed communities on Telegram, and niche media outlets.

Today we’re talking about the first tool in our list, crypto trading bots, your never-sleeping soldiers on the constantly changing crypto front. But first things first.

What is Automated Trading in Traditional Markets?

Automated crypto trading is not something completely new to you once you’ve heard about automated trading in the traditional markets. When talking about buying and selling stocks, automated trading is a process allowing algorithms exit and enter the market based on a system of pre-composed rules.

That said, deals can be closed automatically without you being involved. In fact, algorithmic trading, which can be seen as part of automated trading, accounts for 60-73% of the overall US equity trading. But that makes sense. The volumes on traditional stock exchanges are too significant to be traded only manually.

What is Automated Trading in Crypto Markets?

Even though not as popular as in the traditional markets, the pattern only naturally migrates to the crypto niche. Automated crypto trading is carried out by software that uses filters, signals and technical analysis. You can choose a strategy, say DCA or Grid, just like with a TradeSanta bot, and the software will chase after entry and exit points based on your preferences.

Because the bot “makes decisions” using market analytics and mathematical formulas, it’s not affected by human emotions and works 24/7, having no need for the rest and spotting right opportunities day in and day out. So, does it sound tempting?

For those still in doubt, here is the list of…

Pros and Cons of Automated Trading

Again, the most obvious reason to use a crypto bot is to make your life easier, save some time and automate profits, especially when talking about making passive income through crypto. But there are some additional benefits you might want to take a look at.

1. Kill the routine with automation

Market volatility is one hectic phenomenon in crypto, yet, it requires the same set of actions again and again: spotting the right opportunity, placing the order manually, closing the deal at the best rate, and keeping the order at the top of the book. Honestly, this is where our human patience can grow thin. Luckily, you don’t need to repeat yourself all the time, just allocate the process to the bot that can do it all so much faster!

2. Think of a trading bot as your exoskeleton

What are automation systems in the realm of traditional stock exchanges? Initially, high-frequency bots were designed to place and close multiple orders in a fraction of a second, and the idea behind trading automation in crypto is basically the same. Think of a trading bot as your exoskeleton. Why? Because with them, you can level up a lot of things, for example, your speed when closing deals. How about that, does it feel good to be a part of the future?

3. Save your tears for another day

Remember a famous song by The Weekend? Crypto bots give you a nice promise: no more emotional swings, sweating in front of your monitor day and night and, of course, wrong moves. Think of the worst decisions you’ve made in your life. All of those times you were emotional, right? Honestly speaking, emotional trading is the worst trading strategy ever. Compared to DCA, emotional trading helps you consolidate negative balance. Maybe you should better go and try Grid instead? Bots do not sweat, or scream, or feel joy. They just keep following the algorithm that was embedded earlier into them no matter what.

How does a crypto bot work?

Say you’ve liked what you’ve read and now want to give automated crypto trading a try. Let’s show you how a crypto trading bot works.

First and foremost, think of a crypto trading exchange you have an account with. For the sake of a good example, let’s say you use TradeSanta bots and have some money on HitBTC, one of the exchanges this automated trading platform supports.

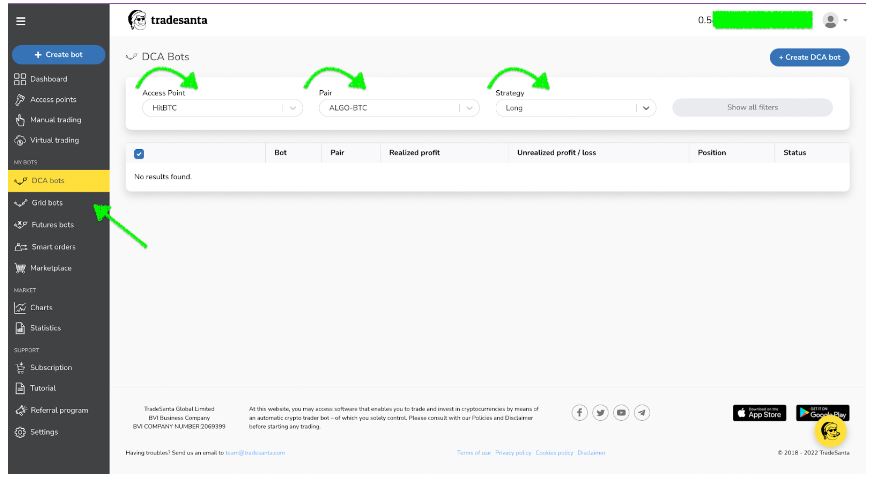

Make sure to add your API key from HitBTC to TradeSanta. It’s not as scary as it sounds. Just go to the HitBTC crypto exchange and choose the API Key tab and generate public and private keys. While logged into your account on TradeSanta, go to the Access Points tab. It’s almost in the top left corner on the dashboard – copy and paste the keys, and you’re done.

Now, choose your trading strategy, Grid or DCA, a trading pair, in our case, ALGO-BTC, and a position: long or short.

Setting up a TradeSanta bot in 2022

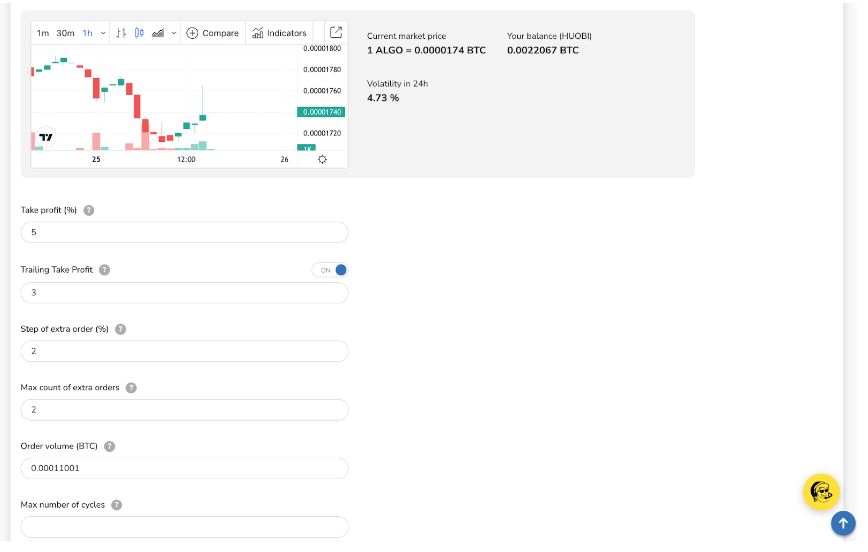

After the initial settings are all up, the platform will link you to the next page with more detailed settings.

Tools you can use with TradeSanta in 2022

Here, you can choose your take-profit target, as well as your trailing take-profit target. In addition to that, you can set up a number of extra orders and order volume.

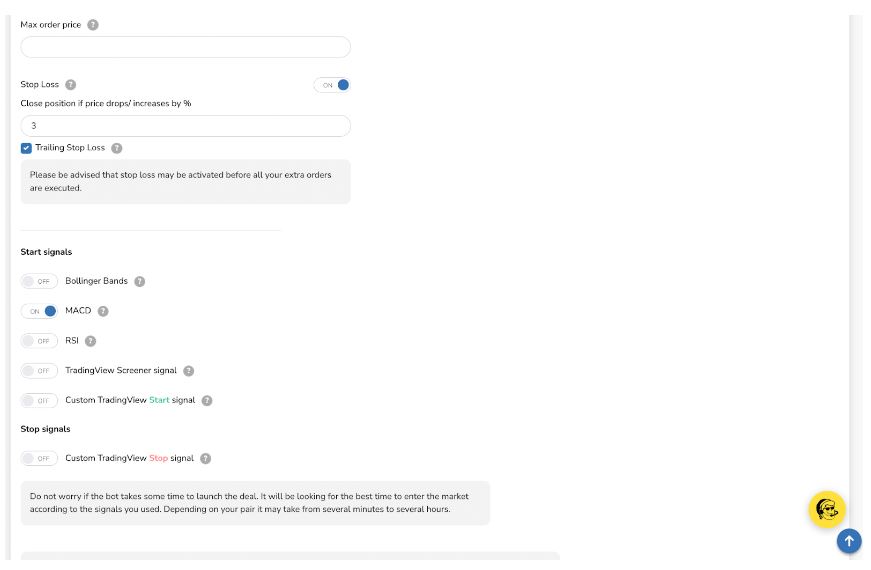

Do you prefer to use risk-management tools while trading? Just set up a stop loss. For those of traders, who want their bot to use technical analysis, choose which indicators suit you the best.

And that’s basically how a crypto trading bot works. After setting it up once, you will no longer have any problems setting up bots in the future, either from a desktop or your mobile phone!

Summing up

That said, if you’re thinking of saving yourself some more time and still want to keep your crypto wheel profits rolling, maybe check out crypto trading bots because they can significantly improve your life!

Coming from the Wall Street culture, automated trading slowly transfers to the crypto niche, giving you a competitive advantage over other human traders. No need to monitor the market all the time, an increasing number of the deals closed, good health, and sleep – these are not even all the advantages of crypto robots.

They are easy, they are smart, and fun – if you use TradeSanta, they very good place to start for a newbie and go on for a professional. Do you want to know more? Shoot all the questions on our socials!

Facebook, Telegram, or Twitter!

Disclaimer: This is a paid post and should not be treated as news/advice.