Chainlink: Despite falling below $10, this cohort continues to accumulate LINK

According to a tweet by Santiment, the Chainlink token dipped below the $10 mark for the first time in the last 18 months. At press time, the token stood at rank 28 at a price of $10.16. However, on 8 May, the price of the token did fall to $9.89 as per the UTC +5:30 time zone.

As per data from CoinGecko, the was functioning at -5.8% in the last 24 hours and the token was -7.9% down in movement given the last seven days.

Although running in green at the moment, the Awesome Oscillator (AO) stayed below the zero line, whereas the Relative Strength Index (RSI) stood at a score of 30.32 with no sign of moving toward or beyond the 50 mark.

With this, let’s also take a look at what the other metrics have to show about the performance of the LINK.

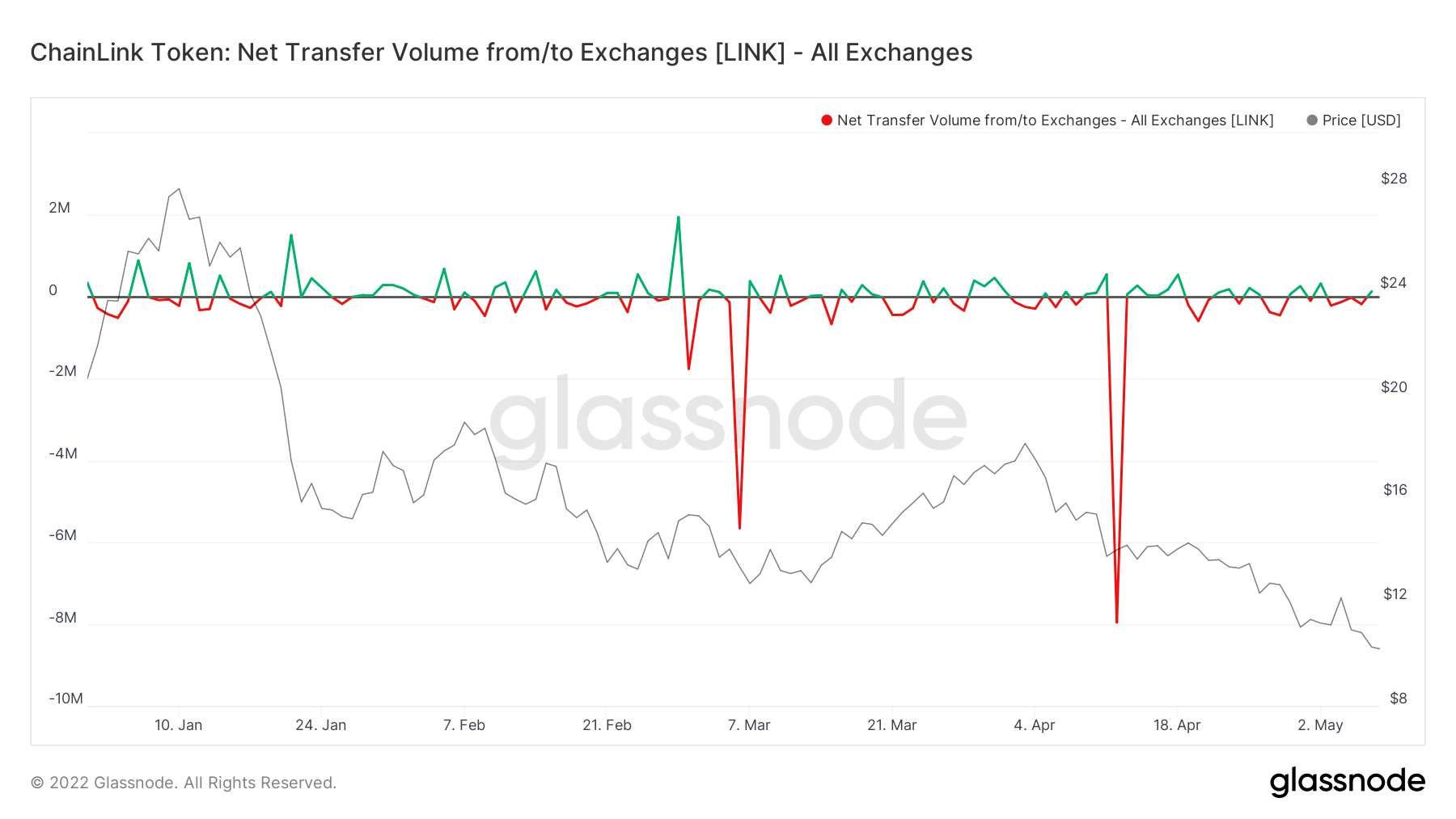

As per data from Glassnode, the net exchange volume stood at approximately 135K on 7 May, whereas the exchange netflow volume on 6 May stood at an approximate value of -176K. The shift of the exchange netflow volume depicts the sentiment of the investors to liquidate their holdings, especially given the latest price trajectory of the LINK token.

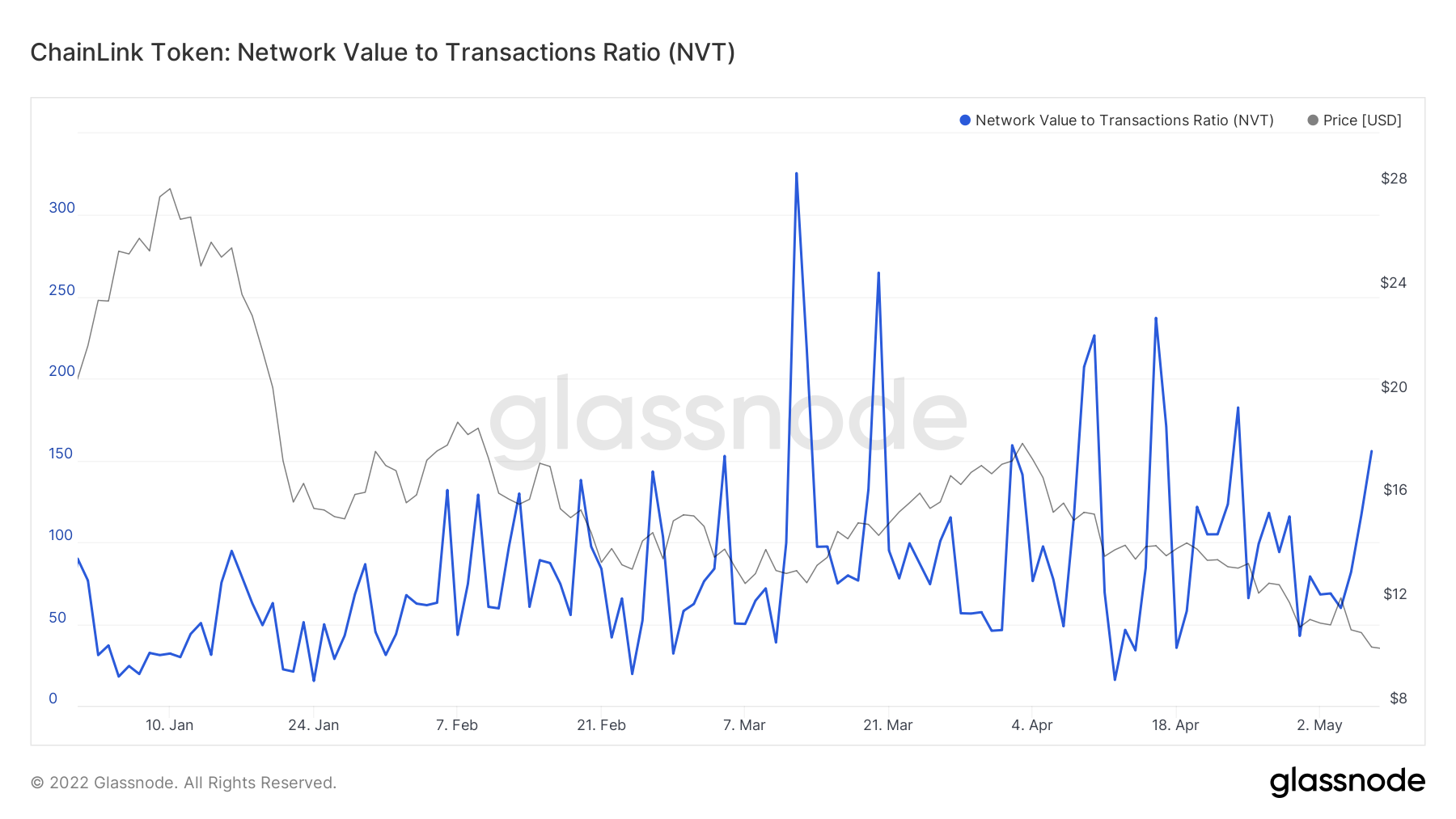

The Network Value to Transaction Ratio (NVT Ratio) also stands at a high score of 155.73 at the time of writing. The high NVT Ratio further strengthens the bearish sentiment currently going on in the market. The high score further points towards the inability of the volume in terms of the ongoing volume.

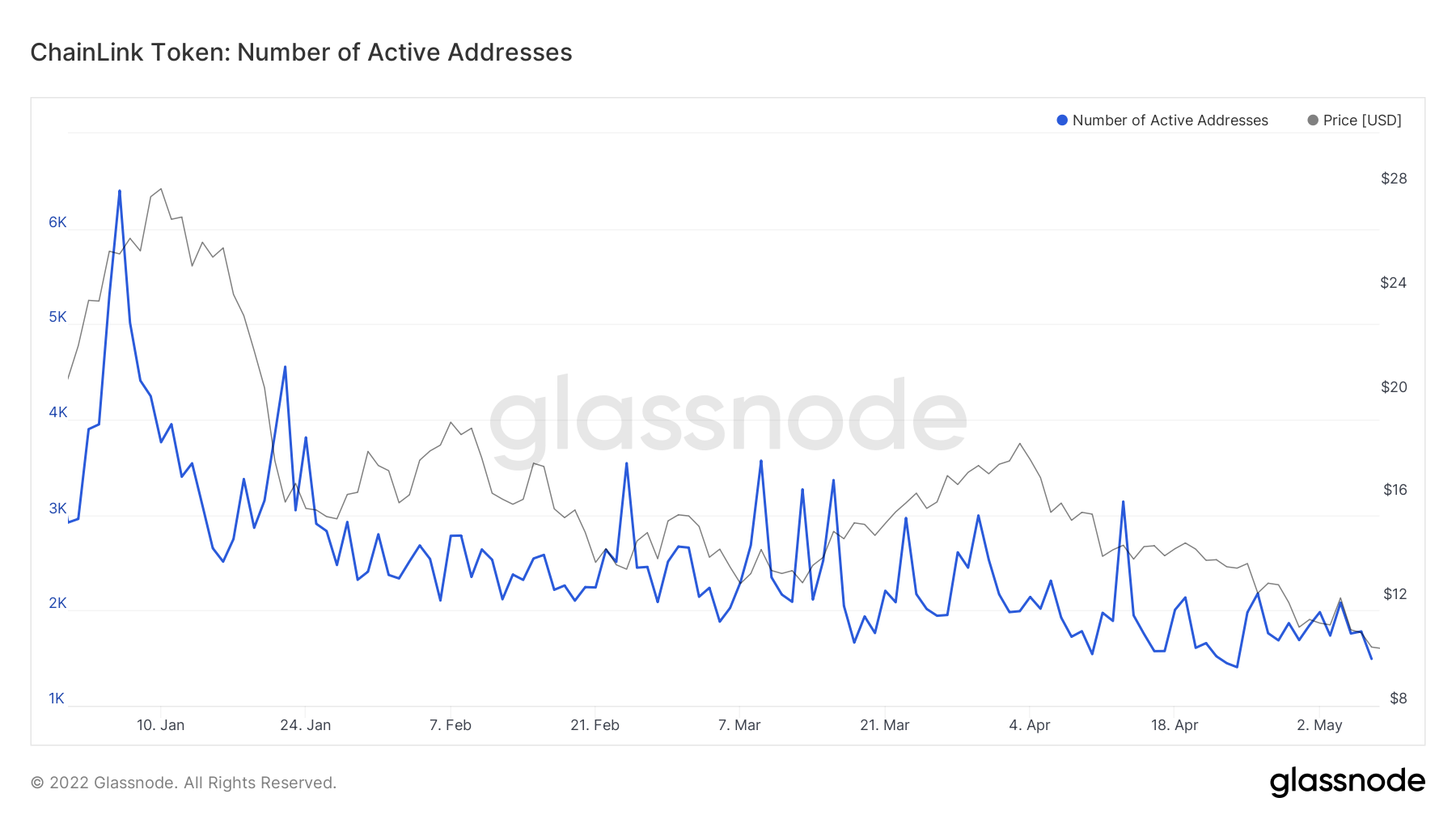

Contrary to the ongoing trend in the market, the number of active addresses was low at the time of writing. The number of active addresses stood at 1,492 which may further indicate the confidence of investors in the stability of the token.

Data as per Santiment further pointed out key stakeholder addresses are now in the phase of accumulating the token. On 7 May 2022, the supply of the token by top addresses stood at 614.92 million.

Despite the price trajectory (green) of the token witnessing a downtrend in the last four months, the accumulation by top whales (red) stayed somewhat the same, indicating the anticipation of a forthcoming bullish market.