Here is what Bitcoin and Ether investors are doing in a post-Terra market

Coin flows can tell us a lot about the movements of coins and tokens through the crypto market, as well as investors’ reactions to the market. However, does the latest data match what’s really going on at the exchanges?

Let me ETH a look at this

Glassnode’s weekly coin flows update revealed that Bitcoin and Ether investors were taking very separate routes in managing their assets.

? Weekly On-Chain Exchange Flow ?#Bitcoin $BTC

➡️ $8.6B in

⬅️ $8.3B out

? Net flow: +$280.7M#Ethereum $ETH

➡️ $4.8B in

⬅️ $5.7B out

? Net flow: -$952.9M#Tether (ERC20) $USDT

➡️ $5.2B in

⬅️ $5.4B out

? Net flow: -$193.3Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) May 23, 2022

While Bitcoin overall saw inflows of around $280.7 million, Ether recorded $952.9 million in outflows.

But does the ETH supply on exchanges back this up? Data from Santiment showed that ETH supply on exchanges had been rising since about late April.

Source: Santiment

On the other hand, while BTC did record coins coming back to the exchanges in early May as the price dropped, this trend did not last. Coins quickly took a u-turn and began to quickly depart from the exchanges again.

Source: Santiment

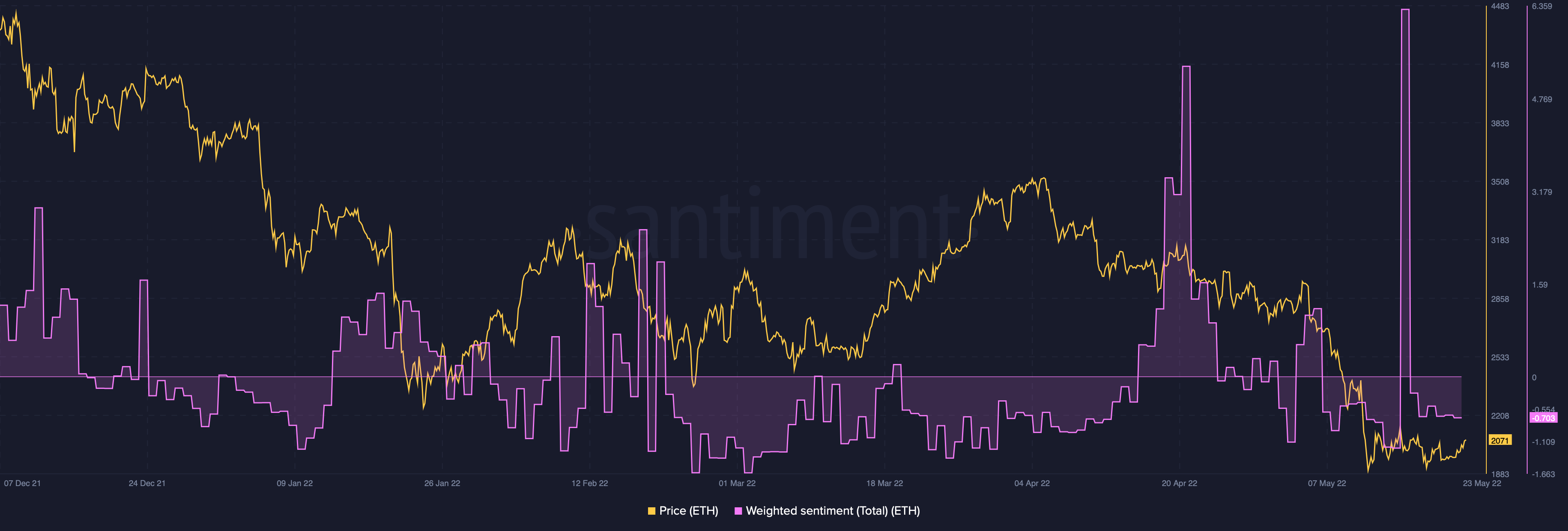

Another factor to take into consideration is the role that weighted sentiment could be playing when it comes to ETH. Ether investors recently experienced a euphoric spike on 16 May – which ended when the top alt plunged below the psychological price of $2k. Since then, sentiment has been largely negative, which could actually be helping ETH climb once more.

Source: Santiment

At press time, ETH was trading at $2,070.27.

That being said, one area of concern remains to be Ethereum’s development activity. This metric has surged since late April. However, when compared to development activity in 2020 and 2021, the drop is undeniable.

BTC-ing off more than you can chew

So what should you know about Bitcoin and Ether right now? It’s highly likely that following the crash of the Terra ecosystem, more adventurous alt coin investors are questioning their favorite projects. Adding to that, many might have chosen to retreat to the relative safe haven of Bitcoin as fear reigns in the market.

Ethereum Fear and Greed Index is 24 — Fear

Current price: $2,036https://t.co/lRuGS6T0Hdhttps://t.co/FHpB0kv0ho pic.twitter.com/3O47WC14pn— Ethereum Fear and Greed Index (@EthereumFear) May 23, 2022