Making the DeFi space secure for everyone with SolarDex

DeFi is a booming space with a wide variety of investment options available for users. However, this range of alternatives also means that the average user can get intimidated and fail to utilize their full potential. Additionally, rug pulls in the DeFi space make investors wary of investing in projects and liquidity pools.

SolarDex is a platform that aims to solve these problems by functioning not only as a standard DEX with limit and swap orders but also as a liquidity provider. The exchange’s goal is to slow down the traction of rug pulls in the Solana ecosystem. This is done by locking liquidity for a period of 3 months after creating a liquidity pool.

Anyone can list a token on the exchange, given they follow the lock-in period for its liquidity pool. Commenting on the issues associated with Solana DEXes, Richard, CEO of SolarDex remarked that since liquidity isn’t locked on these platforms, users do not feel very secure and confident in their investments, SolarDex intends to provide a solution to this issue.

What is SolarDex?

SolarDex is the first US-based Solana DeFi exchange that allows users to trade tokens on the Solana network. The platform works on eliminating rug pulls with the help of a smart contract that automatically locks liquidity for a period of 3 months.

Key features

Some of the major features of the SolarDex platform include:

- Auto liquidity lock: As mentioned earlier, SolarDex has a one-of-a-kind mandatory liquidity pool lock-in feature that eliminates the need for third-party liquidity locks. This helps to minimize the risk of rug pulls.

- Liquidity caps: The platform would use Liquidity Cap as a transparent means of showing how much liquidity is in a pool so that investors are kept in the loop about the actual value of their tokens.

- Token swaps: Users get to trade on a pool as soon as it is formed with the help of the SolarDex swap instructions. Tokens are transferred from one user’s account to the swap’s source token account which is then transferred from the swap’s destination account to the user’s destination account.

- Order books: The SolarDex Orderbook is a decentralized Layer 2 exchange with an order book developed on the Solana network. It was developed keeping in mind both the traditional centralized exchange traders and the traders who use decentralized exchanges.

Tokenomics and use cases

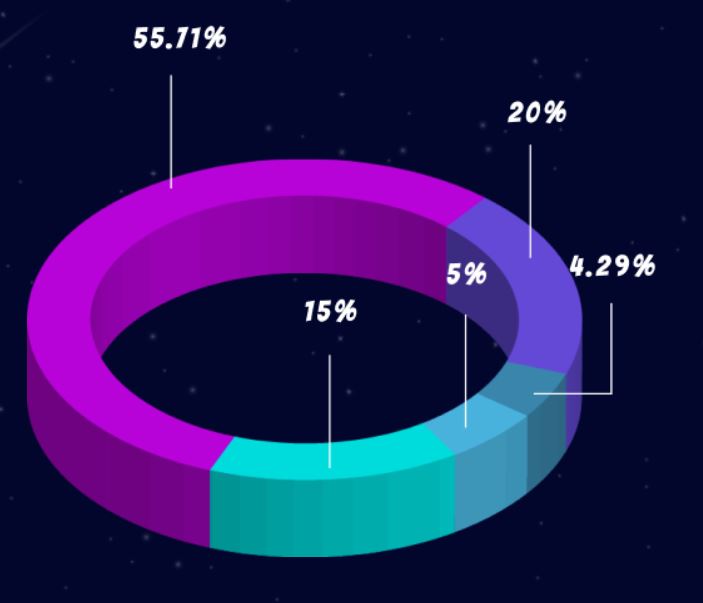

Solar is the non-mintable native token of SolarDex and has a total supply of 100 million tokens. A 55.7% share of the token has been set aside for the sale, while another 20% is kept aside for liquidity. A 15% share is for the centralized exchanges and another 5% is for the team. The remaining 4.29% is for staking.

The token would be used for farming/staking, governance, and voting on proposed listings and upgrades, covering exchange fees and Lotto.

Conclusion

SolarDex platform is working on functioning as a centralized investment tool while also staying true to the nature of fundamental ideas of DeFi by keeping fund administration completely non-custodial.

The platform also plans to incentivize users by obtaining a Solar Sentry NFT to earn exchange fees and participate in the Solar ecosystem.

For more information on SolarDex, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.