Tron’s [TRX] possible price recovery and how its closing in on BSC in terms of TVL

There is no gainsaying in denying the fact that this has not been a really good year for Decentralised Finance protocols (DeFi). Rug pulls, scams, hacks, exploits and failures of some of these protocols have made investors and regulators alike increasingly sceptical about DeFi as the future of finance. So far this year, over $1.6 billion in cryptocurrency has been lost to DeFi exploits. This has surpassed the total amount lost in 2020 and 2021 altogether.

However, in the face of these tragedies, the TRON Blockchain appeared to have had a good month. According to data from DefiLlama, with a Total Value Locked (TVL) of $5.8 billion, the Tron chain currently ranks as the third largest blockchain within the DeFi ecosystem closely trailing BNB.

Data from DeFi Llama also revealed that while the month of May has so far been plagued with declines for most chains within the ecosystem, TRON has seen a 46.33% growth in the last one month. Similarly, in the last 7 days, a 14.63% growth has been recorded.

In light of these strides within the DeFi space, how has the chain’s native token, TRX performed since the beginning of the month?

It’s a Bird! It’s a Plane! It’s TRX!

Riding heavily on the cryptocurrency market price retracement, May appears to have been a good month for the TRX token on a price front. Standing at $0.0835, the TRX token has rallied up by 32% in the last 29 days. Between 5 May and 8 May, the token marked a high in the $0.089 region. In the last 24 hours, the price of the token saw a 3% spike.

At $6.38 billion at the beginning of the month, the market capitalization for the TRX token also recorded some growth. Currently standing at $7.83 billion at press time, the token so far pulled a 22% increment in the last 29 days.

In addition to the above, movements on the price charts have been indicative of a bullish bias for the TRX token all month long. Positioned below price since the beginning of the month, the 50 EMA showed strong bullish activity and showed that the token has maintained an uptrend since May started.

A quick look at the Relative Strength Index (RSI) and (MFI) showed that both indicators marked highs in the overbought territory on 5 May and 8 May respectively. Although a reversal kicked in pushing both indicators downwards as the month progressed, at the time of press, a recovery was underway. The RSI marked a position at the 61 index and the MFI registered an index of 80.39.

Only Highs

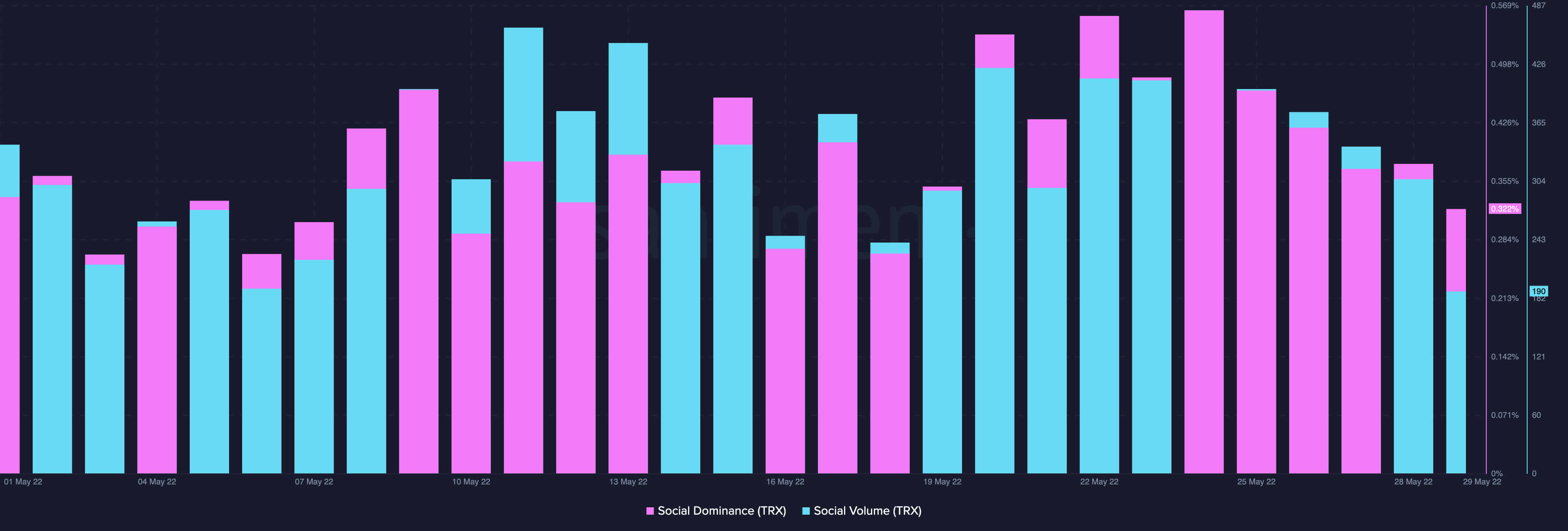

On-chain analysis revealed that the TRX token achieved an all round growth with highs marked on a social front and a developmental front.

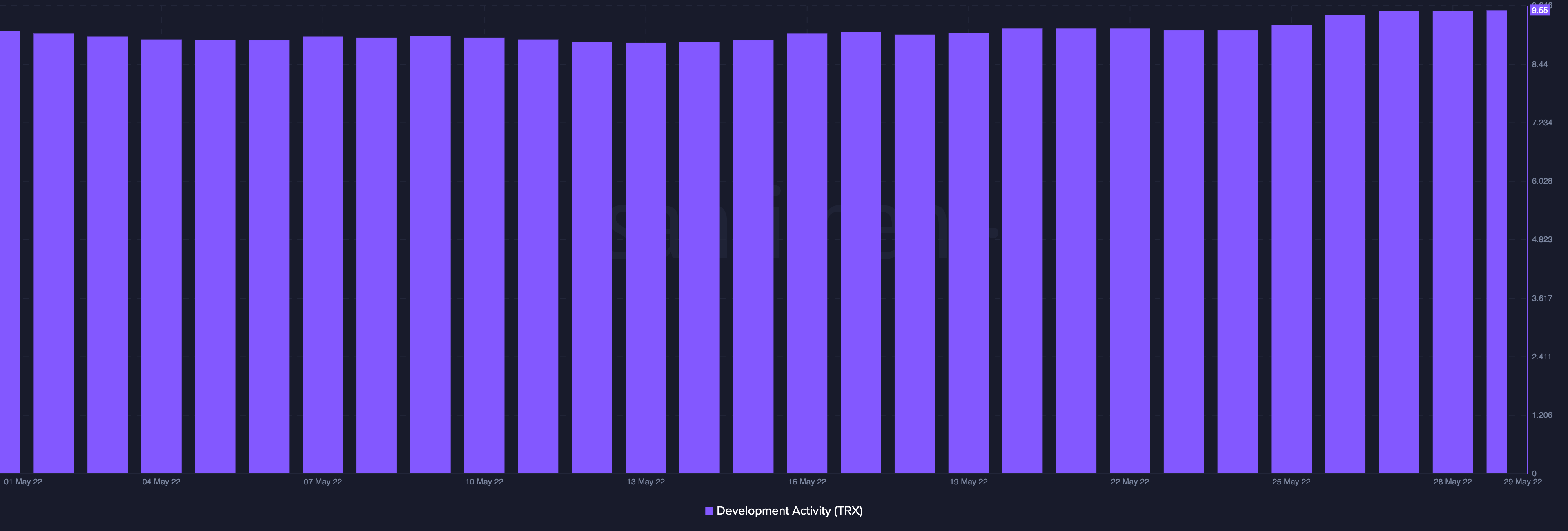

Since the beginning of the month, the Development Activity of the TRX token has maintained its position between the 8 and 9 regions. At the time of press, this stood at a high of 9.55.

Similarly, on a social front, the token recorded significant strides. Reaching a high of 483 on 24 May, the lowest position marked by the Social Volume of the token throughout the month was 193, a position it recorded earlier on in the month. The Social Dominance also marked a high of 0.562% on May 24 with a low of 0.266% marked on May 3.

Housing only 9 protocols, the Tron blockchain might be a long way from overthrowing Binance Smart Chain with over 350 protocols currently running on its ecosystem.