Will Bitcoin’s potential short squeeze help BTC escape $20K trap

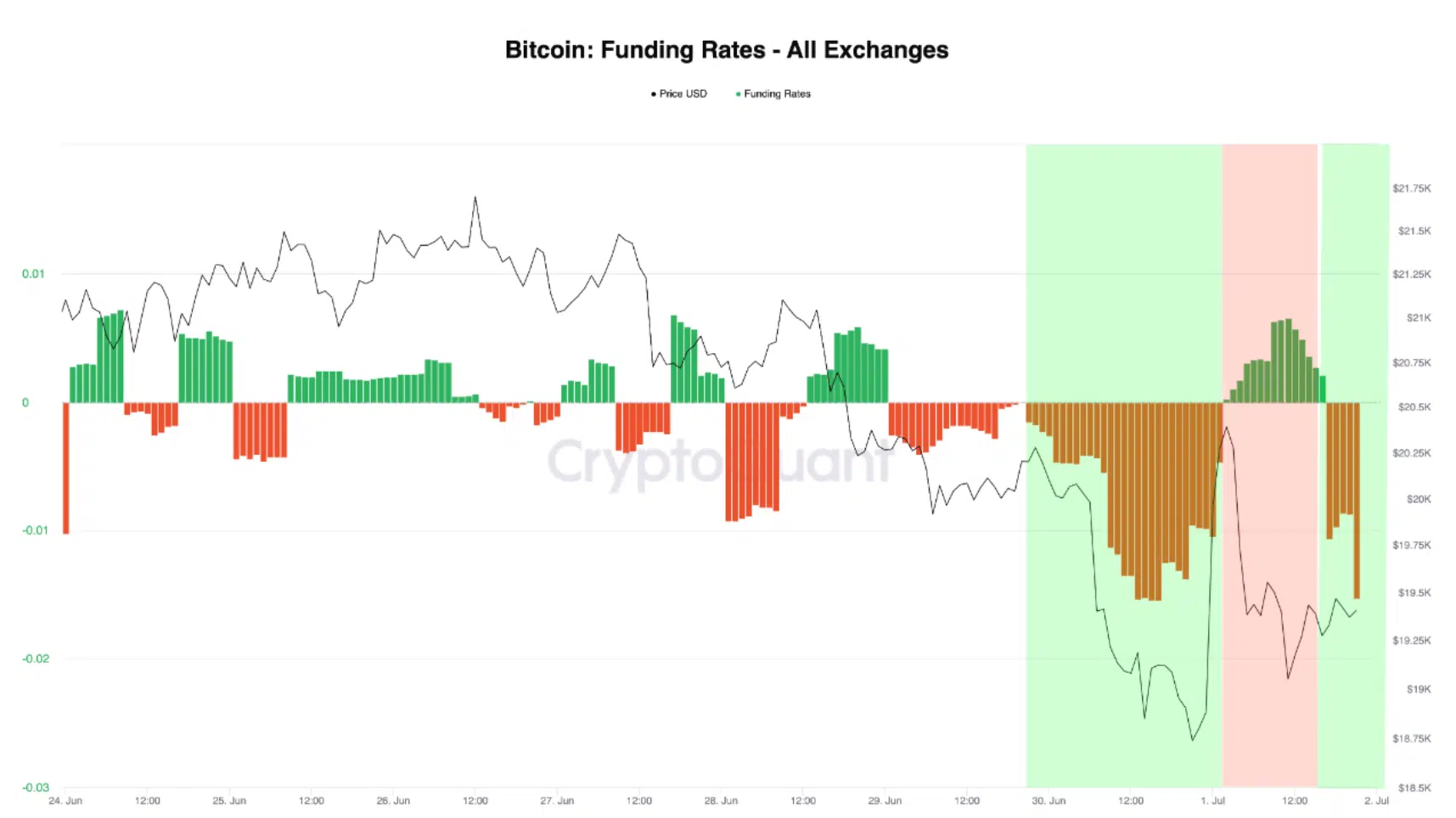

Bitcoin, the largest cryptocurrency showcased some vital signs of life post a consolidation $20k phase. Although, the effort wasn’t enough as liquidations surrounding the crypto market intensified. On-chain data shows Bitcoin funding rates have sunk into deep negative values. This could pave a potential short squeeze, thus, affecting BTC’s price.

Es-squeeze me?

Bitcoin funding rates continued to showcase a grim scenario as the metric slipped into a deep negative value. This could incorporate or rather pave way for a short squeeze in the market.

The funding rate measures the periodic fee that Bitcoin futures long and short traders exchange between each other. At the moment, there are more shorts in the market, ergo, the overall sentiment is bearish. Clearly, futures traders are piling up shorts in the market.

Could this aid BTC to escape the $20k trap? Well, as pointed out by a CryptoQuant analyst, BTC may see a slight uplift in the short term because of the current funding rates.

A similar pattern can be seen above in the chart where the funding rate reached an alarming low state. There, the price reversed upwards sharply and caused a short squeeze, which further amplified the price swing.

A short squeeze occurs when mass liquidations of short traders take place due to a sudden sharp swing in the price.

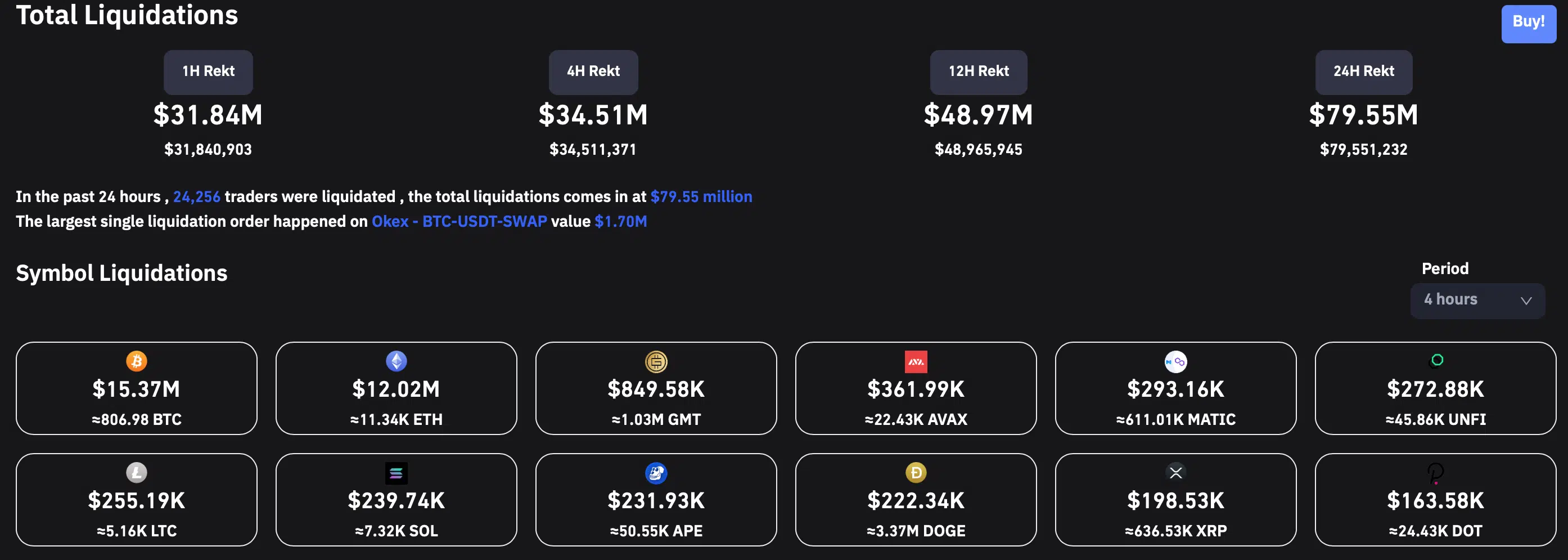

Notably, in the past 24 hours, 24,160 traders were liquidated, and the total liquidations came in at $79.26 million. The crypto market, on 2 July, recorded more than $250 million liquidated as losses that have increased across other cryptocurrencies. At press time, the stat stood at around the $79.55 million mark.

Needless to say, the king coin led the charge as per data from Coinglass. Comparing the two trends above, it’s possible that a swing in the price could cause a squeeze, thus, bringing some relief.

What to expect?

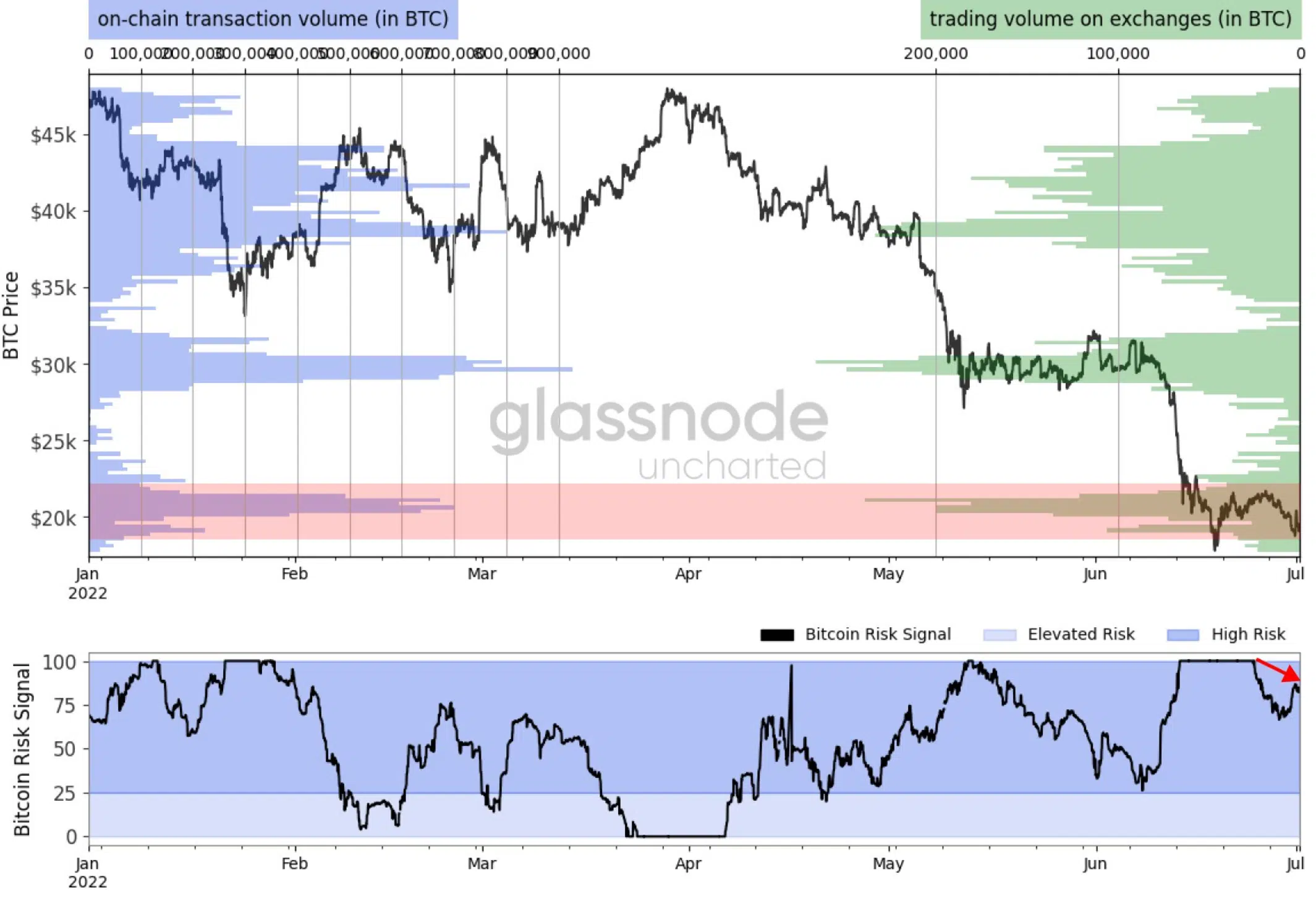

BTC’s price action has squeezed into $18-$21k in the past two weeks. June saw red signals in both the markets- spot at -30% whereas the derivatives at -11%.

Now the entire financial market eagerly awaits the Fed’s reaction to inflationary pressures. Whatever the case, one thing is clear- BTC holders, be it small or large, continue to support the largest cryptocurrency.

At press time, addresses holding <1 BTC were adding to their balance in 2022 at a remarkable pace. Interestingly, since January, they (small holders) added 113,884 BTC.