Analyzing DOGE’s performance amid Musk backing out of the Twitter acquisition

The meme coin status was one of the key driving factors behind Dogecoin’s [DOGE] success in 2021. Fast forward a year later and it is no longer as hyped. However, the coin has received a lot of support from Tesla CEO Elon Musk but the latest events might cast a dark cloud over DOGE.

Elon Musk has reportedly opted out of the plan to acquire the Twitter microblogging platform. How does this affect Dogecoin? Well, the Tesla techno king previously expressed his support for the meme coin. As soon as Musk submitted his bid to acquire Twitter, there was speculation that he would turn Dogecoin into the microblogging platform’s official currency.

Dogecoin’s fate is once again covered by a cloud of uncertainty now that Musk has withdrawn his Twitter acquisition plans. DOGE’s price action had not responded negatively at press time, hours after Musk’s exit from the deal was announced. In fact, Dogecoin experienced a slight upside in the last 24 hours. It traded at $0.069 at press time after a 0.73% upside in the last 24 hours.

DOGE’s price action delivered a ranging performance in the first week of July after a solid uptick since mid-July. Its Relative Strength Index (RSI) has been hovering within the 50% range while the Money Flow Index (MFI) registered some outflows. This was expected especially after the price briefly pushed into the MFI’s distribution zone above 80.

Behind the scenes

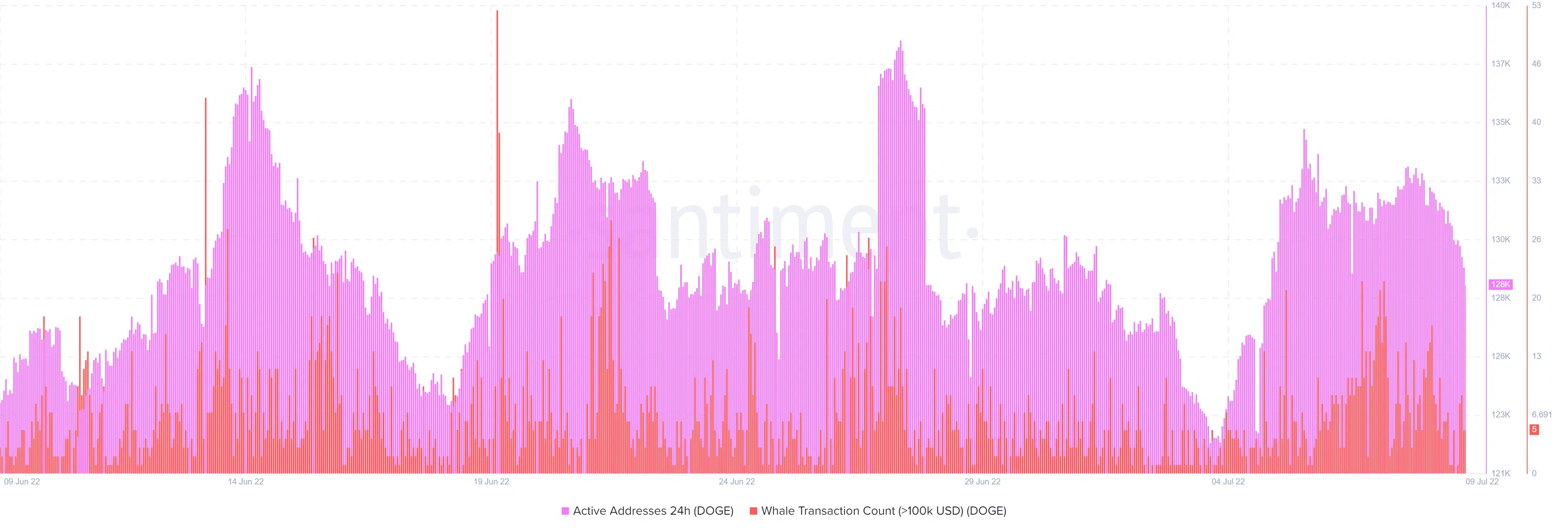

Despite the slight upside, many investors remain cautious about DOGE’s performance. There was a notable drop in 24-hour active addresses from 133,670 to 128,960 addresses between 8 and 9 July. Whale transactions also saw fewer actions, tapering out from as high as 21 whales on 7 July to 5 whale transactions by 8 July.

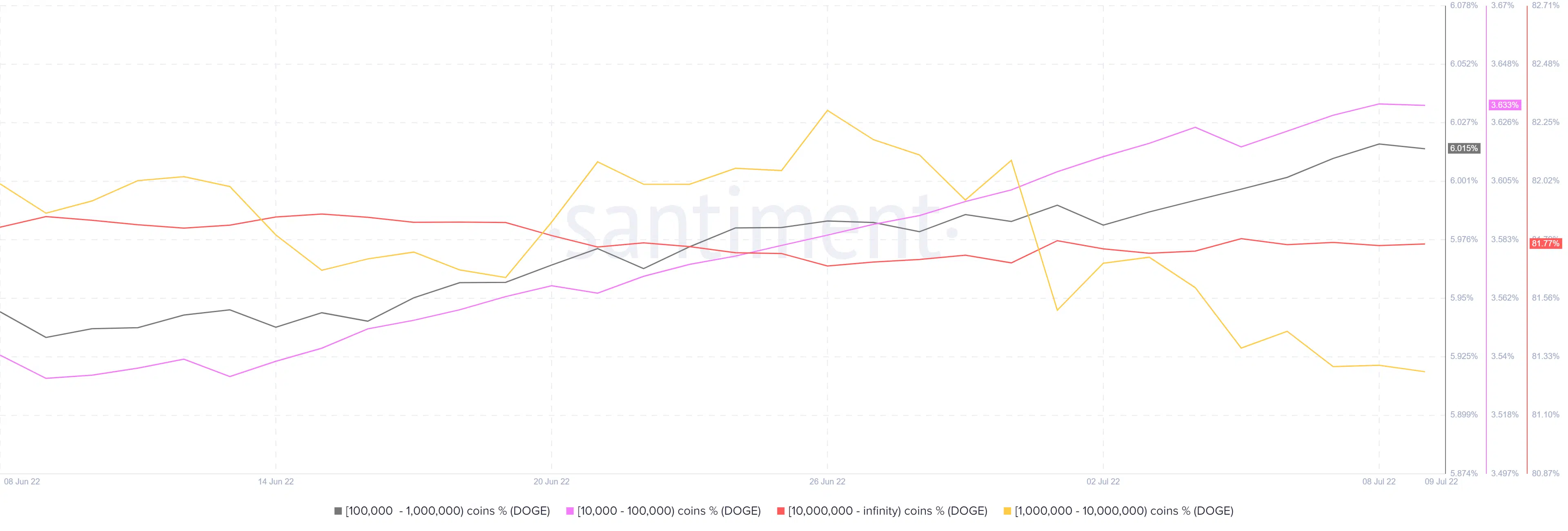

DOGE’s supply distribution reveals a tug of war between different whale categories. For example, addresses holding between one million and 10 million DOGE have been selling since 26 June, while addresses holding between 10,000 and one million Dogecoin have been accumulating during the same period.

Addresses holding more than 10 million coins had the least activity during the last two weeks. Their balances increased slightly and this is important because it means they have not been heavily selling off their holdings. This is good for DOGE’s upside and may explain why its price experienced a slight upside.