Expect sluggish Bitcoin [BTC] hashrate growth in 2022 unless…

Bitcoin mining operations across the globe took a huge hit in 2022. Specifically, miners are seeing their profit margins dwindle as Bitcoin’s price falls and Bitcoin’s mining difficulty continues to rise. Needless to say, miners and other related attributes have faced the wrath of this concerning problem.

Not so usual anymore

Even though BTC showcased some vital signs to survive, miners and their related operations continue to dwell in the past. Key events such as China’s Bitcoin mining ban have changed the mining landscape indelibly, both as a result of the migration and 2021’s bull market.

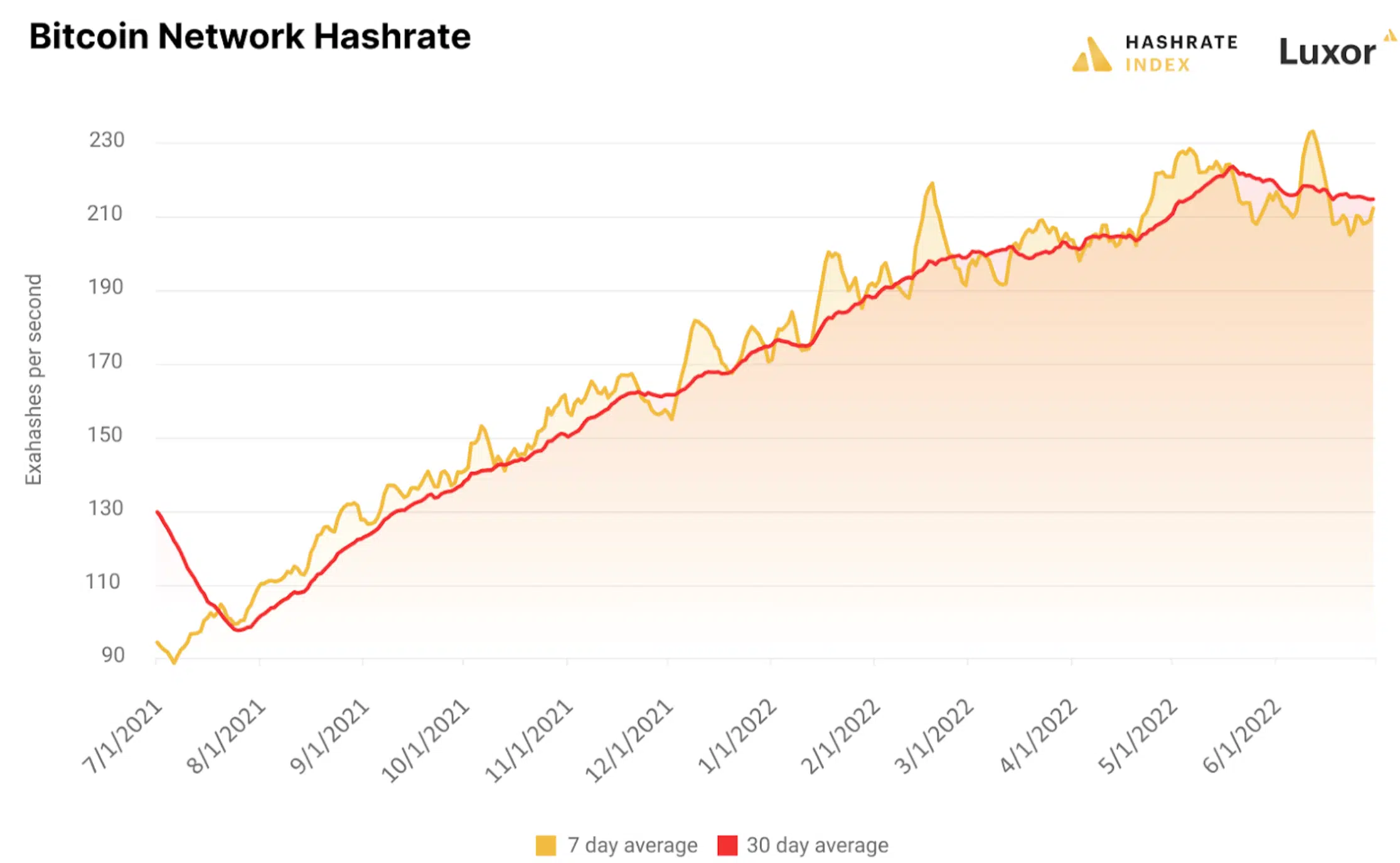

Bitcoin mining profitability soared to multi-year highs in 2021. Now, it’s approaching all-time lows. BTC’s network hashrate underlines this scenario. Consider the graph attached below, for instance.

Bitcoin’s 7-day moving average hashrate grew by only 7% in Q2 2022. Compare that to 15% growth in Q1 2022 and 27% in Q4 2021 – Indeed, a grim scenario.

Source: Hashrate index

Here, plenty of miners are starting to shut off as their costs outweigh the profits they can squeeze in this hostile hashprice environment. However, this could take a turn for the worse, as revealed by a recent blog.

“We expect sluggish hashrate growth for the rest of the year unless Bitcoin’s price reverses course. Indeed, rising energy costs, credit crunches, and waning BTC price gives us the perfect recipe for constrained hashrate growth and capitulation from over-leveraged, high-cost miners.”

In addition, 2022 has been one of the most punishing years yet on Bitcoin mining rig prices.

Bloodshed

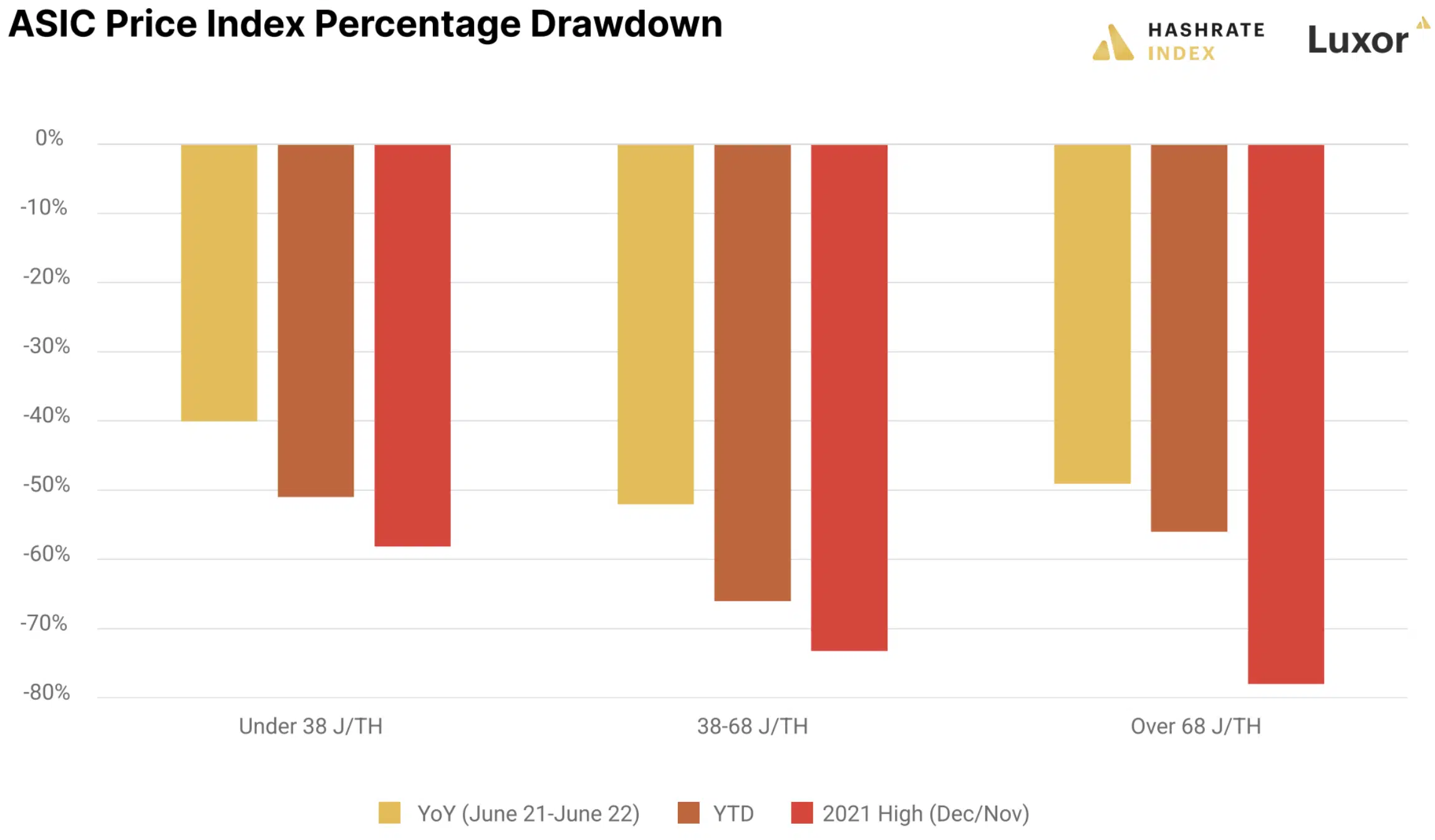

From the beginning of the year to the close of Q2, the tiers in Bitcoin mining ASIC Price Index have dropped significantly.

The findings were – Under 38 J/TH (-51%), 38-68 J/TH (-66%), and over 68 J/TH (-56%).

Mid-gen machines are still working with all-in power costs under $0.07/KWh). BTC miners who traditionally try to hold 100% of their mined BTC are shedding inventories to pay bills and stay solvent.

As if this wasn’t enough, mining equipments fell in demand as well. Unlike the lack of capacity in 2021, the TSMC recently claimed that the demand for chips has dropped significantly too. Companies are cutting orders by a huge margin in the second quarter. It’s worth pointing out, however, that 2nm technology will soon be in mass production by 2025.

Only time will tell what the mining landscape will look like by then.