Chainlink [LINK] can aim for near-term recovery with these metrics

LINK holders have been on quite the rollercoaster of a ride during the 2022 bear market. And, especially, towards the bottom (so far).

Its price has been characterized by up and down price movements that are a swing trader’s dream come true. However, its performance in July has been relatively subdued, but could this be the calm before the storm?

LINK has been one of the most active cryptocurrencies during this year’s bear market. It maintained decent price movements even while some of the top digital currencies went through periods of relative price dormancy.

It also happens to be among the few coins that maintained their price level above May lows.

The cryptocurrency has unexpectedly turned out to be one of the lowest gainers among the top cryptos by market cap in the latest rally.

LINK rallied by just 32% which is a bit of a relative underperformance considering the high volatility in June. It peaked at $7.60 during its latest rally but has already pulled back by 12% to its press time price of $6.63.

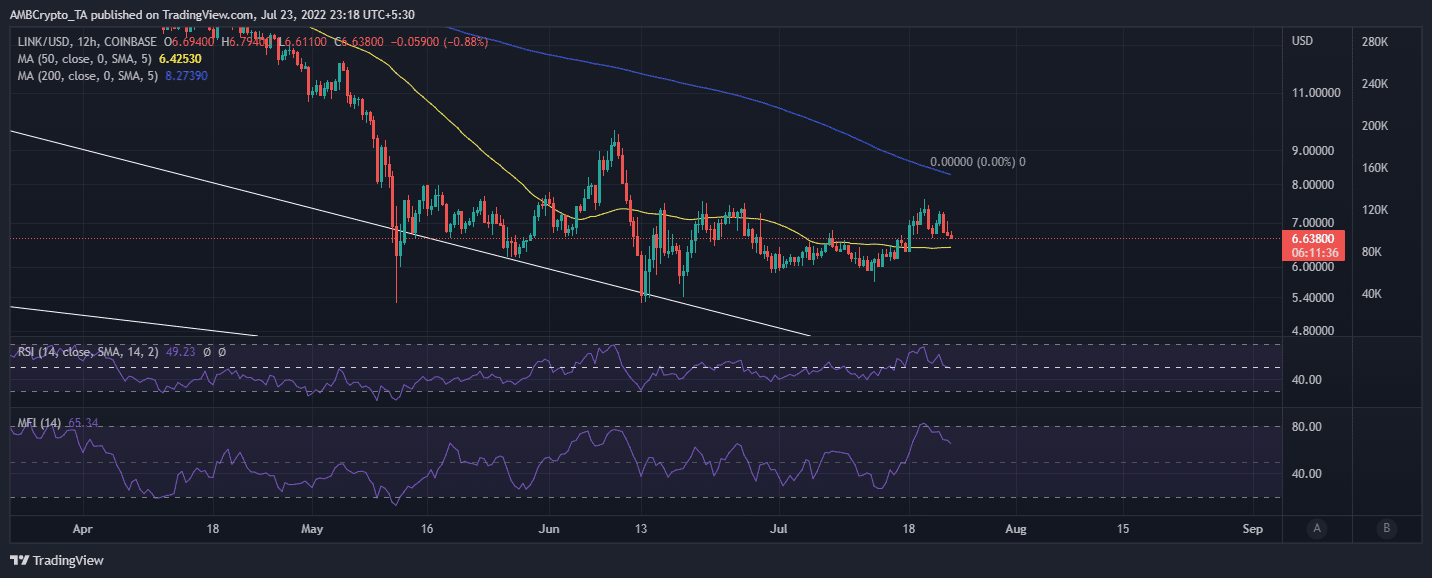

Can 50% RSI act as a buy zone?

The 50% RSI level has historically been treated as a resistance level during most bullish periods.

It often times provides support during a bearish performance. LINK’s price has pulled back to the 50% level but can this same level provide enough support to push the price back up?

Such an outcome means there would have to be enough accumulation near the current price level to summon back the bulls.

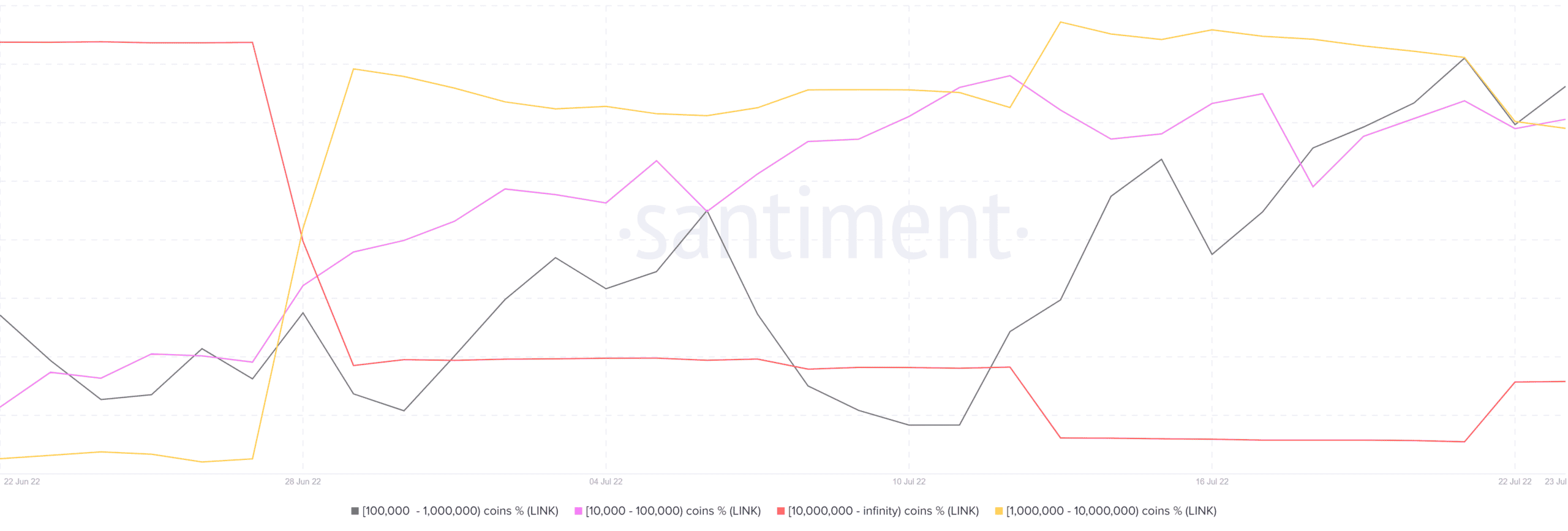

LINK’s supply distribution reveals that addresses with the largest balances are already buying back at the current discount.

Addresses holding more than 10 million LINK coins currently hold the largest share of the coins in circulation. They increased their balance by 1.01% in the last 24 hours of press time.

Most of the other top addresses holding between 10,000 to million coins trimmed their balances, thus contributing to the selling pressure.

However, there were signs of re-accumulation which suggests the increased probability of a bullish bounce back.

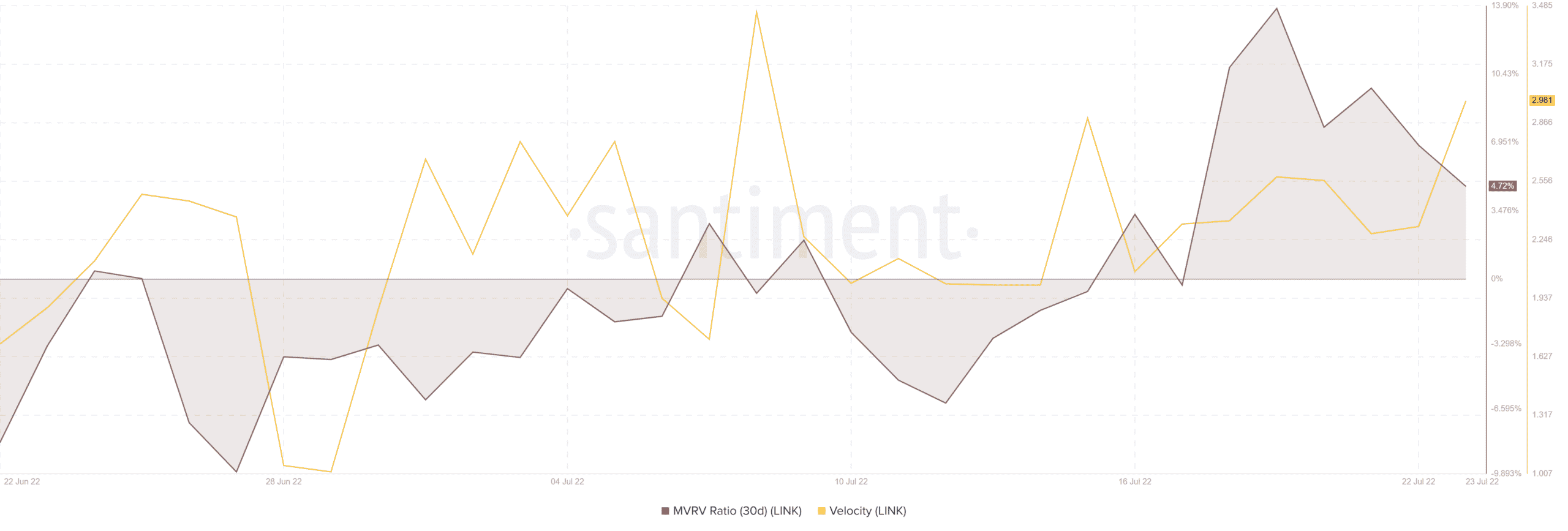

At press time, LINK’s MVRV ratio was down to 4.72% from its four-week peak of 13.76% as many traders took profit during the latest rally.

Furthermore, its velocity increased significantly in the last 24 hours of press time. This is an important observation because the bearish pressure notably slowed down during the same period.

The higher velocity confirms the ongoing tug of war between the bulls and the bears.

The buying pressure is doing a healthy job of absorbing the selling pressure.

A rally is to be expected if there will be enough volumes to overtake the downside pressure.