Bitcoin [BTC]: These factors might initiate a reverse exodus for struggling miners

Bitcoin’s mining industry has taken a severe hit in 2022. Given factors such as massive price corrections, inflation, etc., many miners have even exited the Bitcoin network. Why? Well, mainly to make ends meet.

Now, many have raised concerning questions about the profitability of this industry. But, where’s the answer?

Alas, some relief

Bitcoin miners made more than $15 billion in revenue over the course of 2021, according to The Block’s Research. This highlighted a year-over-year increase of 206%, a staggering number to say the least. However, 2022 hasn’t been kind. That being said, struggling miners might just have something to look forward to given the (slow) market recovery.

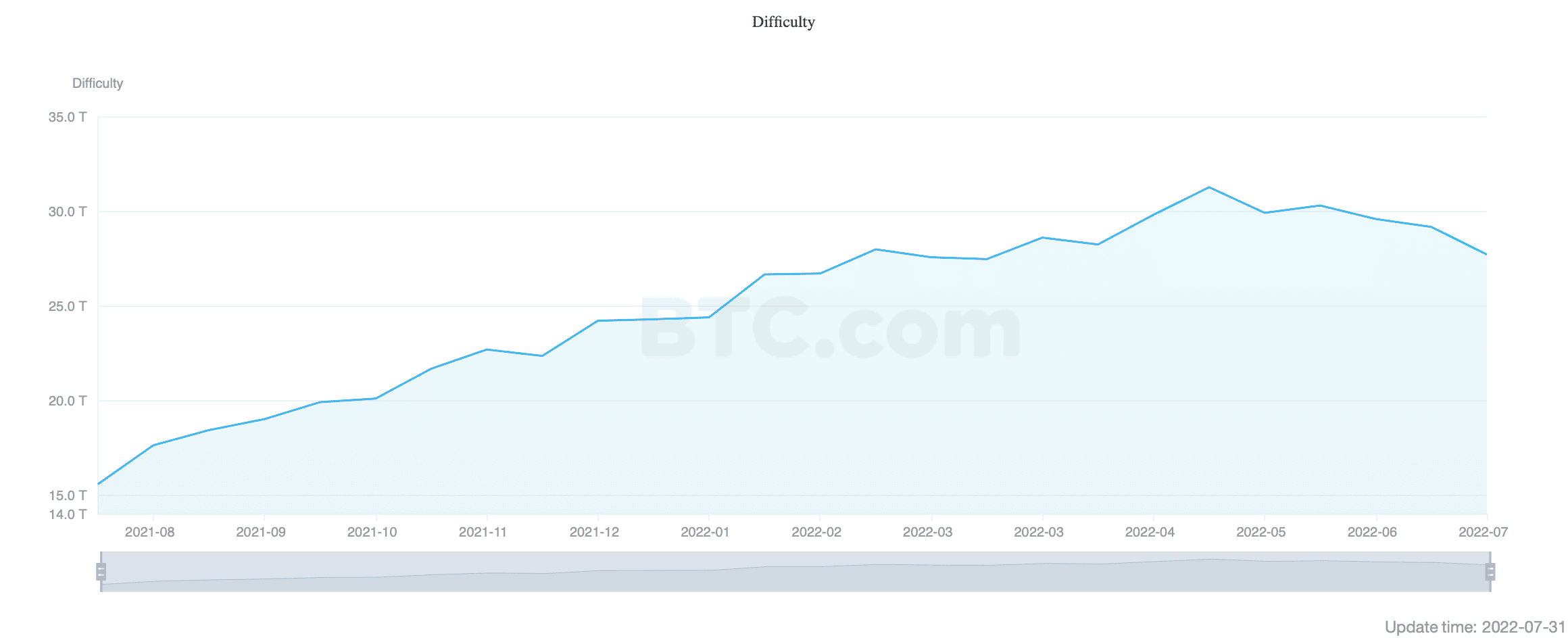

Bitcoin mining difficulty has been adjusting for a while now. With the hashrate falling as more miners go offline due to declining profitability, mining difficulty has been following pretty much the same trend.

The falling difficulty level (27.69 T at press time) can be seen in the graph below.

But, is there anything different this time? Well, for starters, the said decline coincided with some recovery across the market. At the time of writing, Bitcoin’s price remained above the $23.7k-mark. I.e. More cash flow on each Bitcoin mined for respective BTC miners. Indeed, a sign of some relief.

Following the same, the rise in Miners’ BTC balance could paint a rather promising scenario. That’s exactly the case here. Despite the current crypto-chaos, the balance of BTC miners hit a 4-year high.

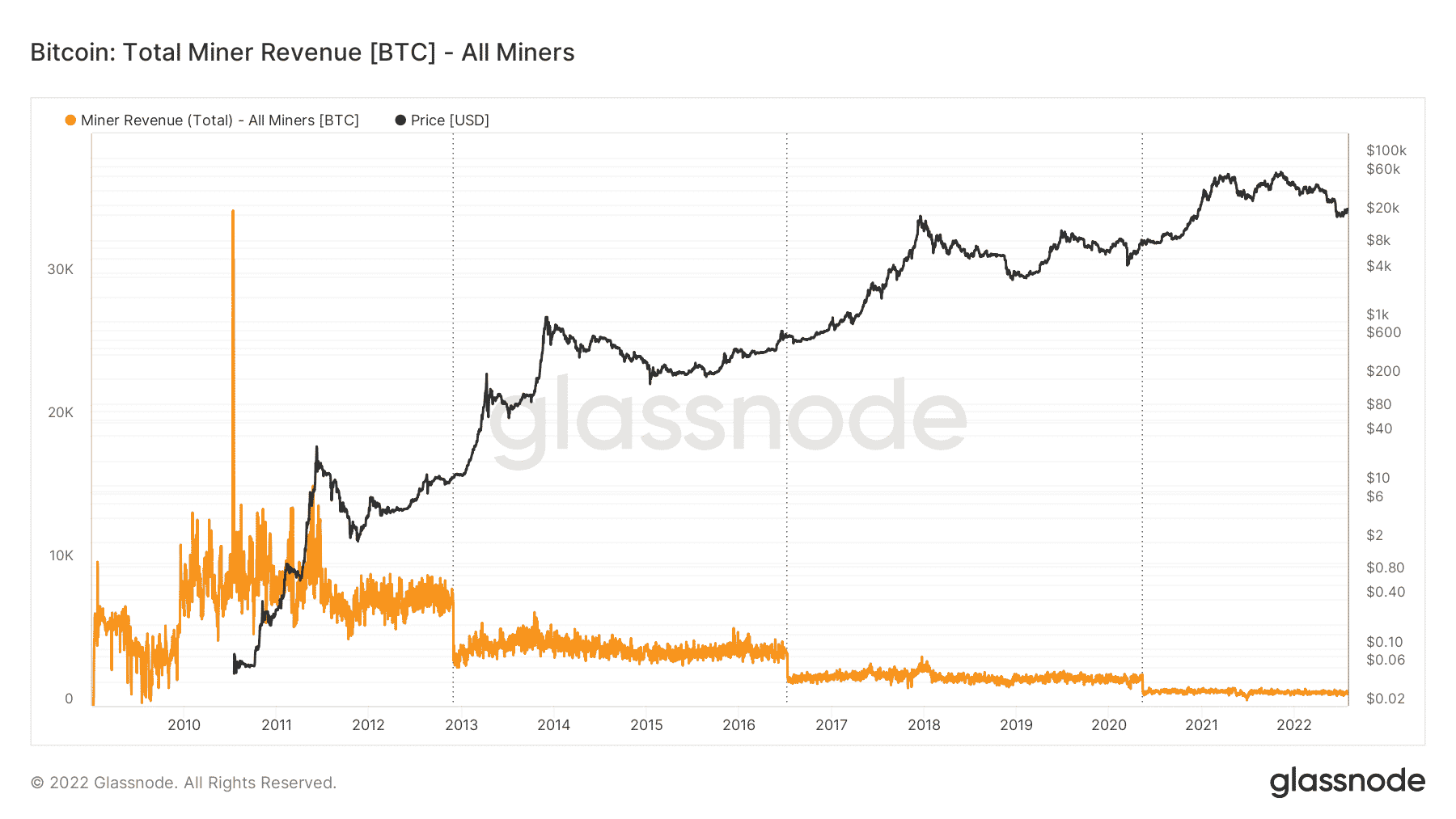

Glassnode’s graph attached herein seemed to support the statement too.

In total, companies that mined the first cryptocurrencies own 1,845,303 BTC, which is ~9.6% of the current supply of BTC.

Sunshine + rain

While these developments project a steady uplift, miners are not completely out of the woods yet. In fact, at the time of writing, the total miner revenue continued to trade downhill.

Nonetheless, IF Bitcoin continues to recover and difficulty declines, miners might continue their operations until the next bull market appears. Until then, BTC holders need to showcase their support, despite everything, as remains the case right now.

Here, it’s worth pointing out that the number of wallets with a balance of 10,000+ BTC has increased significantly since the beginning of the month.