Ethereum: After a dampened sentiment, ETH notices some shift in demand

The Ethereum [ETH] Merge expectations remain high especially now that D-day is less than two weeks away. The same cannot be said for ETH’s demand that has been heavily affected by macro factors especially in the first week of September. Nonetheless, the demand for ETH achieved a swift recovery in the last three days as the tides shifted.

ETH, along with most of the top cryptocurrencies, appeared to be headed downward earlier in the week as sentiments dampened. Instead, the market delivered a mid-week pivot that has triggered more upside. ETH responded with a bullish push back above $1,700, albeit briefly at press time.

Assessing ETH’s current demand

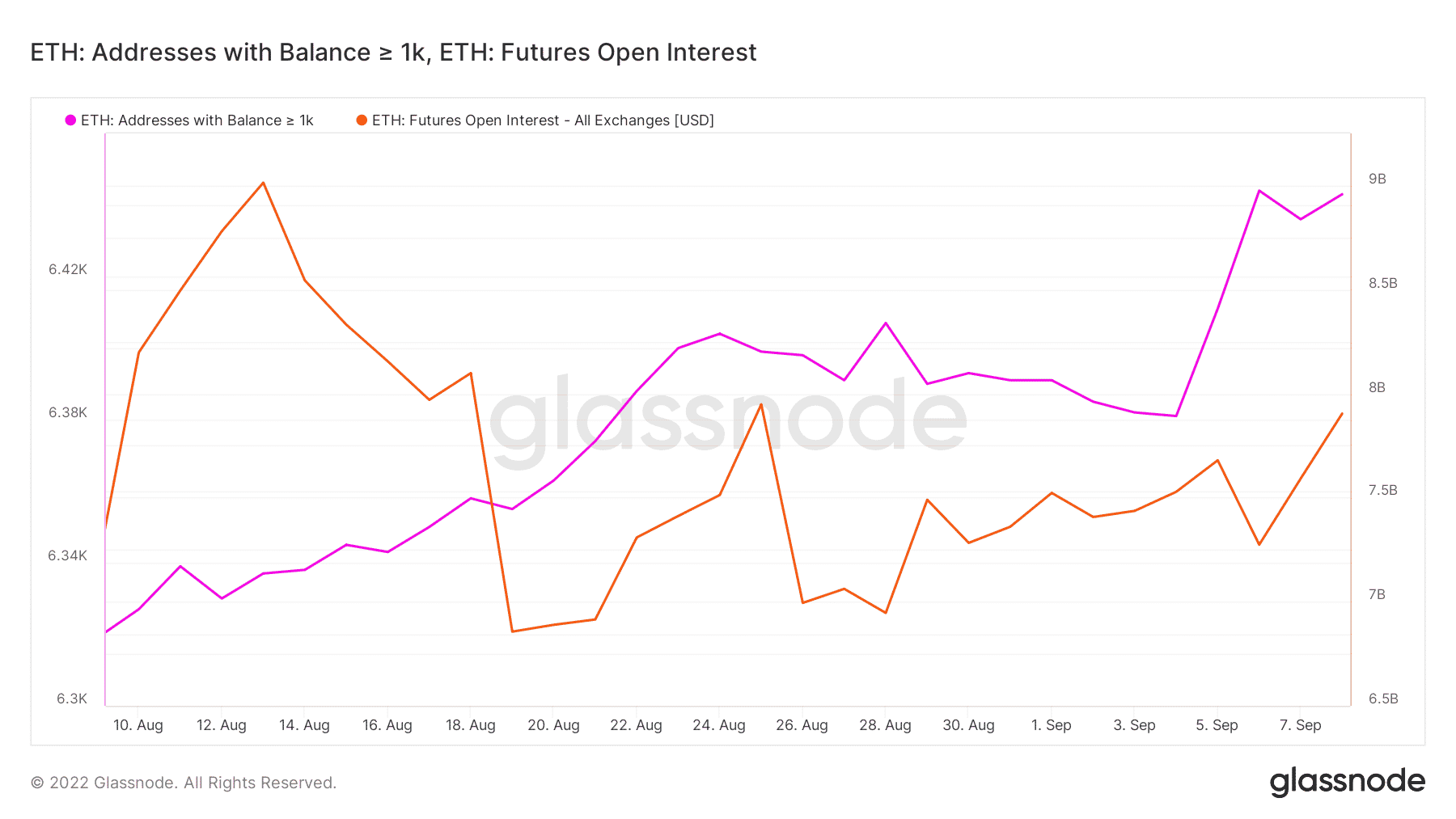

ETH whales have resumed accumulation, thus supporting the upside. This is evident by the increase in the number of ETH addresses holding more than 1,000 ETH. The same addresses had previously reduced, earlier in the week, confirming outflows and supporting the slight price drop.

The investor sentiment shift observed in the addresses holding more than 1,000 ETH also reflects a shift in open interest. The futures open interest metric registered an uptick since 6 September, consistent with the mid-week bullish recovery. This confirms the demand shift in favor of the bulls.

ETH’s options volume put/call ratio indicates a similar observation after a pivot in the last two days. The number of call options currently outweigh the put options, placing weight on the bullish side.

ETH demand might not be there yet

ETH’s current performance is an underperformance compared to the expectations. Many investors anticipated a major rally, perhaps above $2,000 by now. The level of ETH demand currently in the market has fallen short of those expectations. Likely because of the dampened sentiment in line with the unfavorable macro-economic conditions.

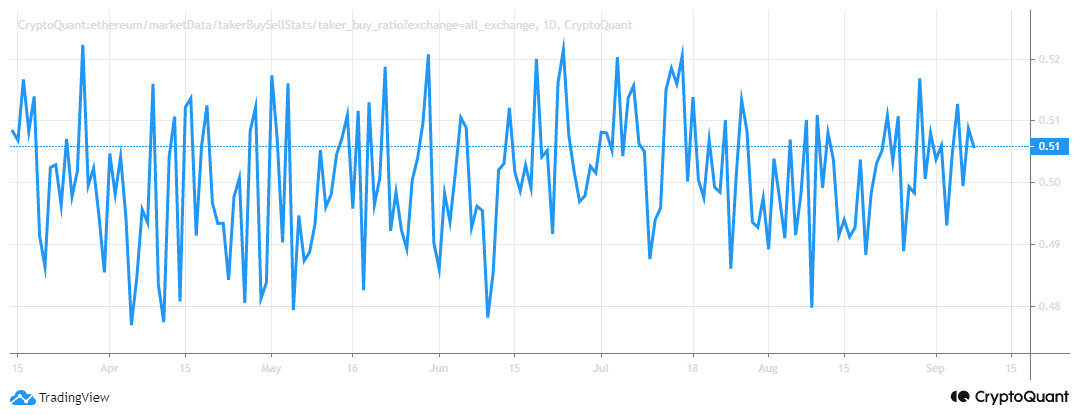

The demand levels reflect in Ethereum’s taker buy ratio which is currently at 0.51. The ratio assesses the futures market shorts vs. long volumes and its current figure suggests that there is still quite a significant amount of short volumes in the market.

A taker buy ratio above one confirms that futures buy volumes are more than the sell volumes. In this case, ETH is not there yet, even as the merge draws near.

One of the potential implications is that the countdown to the merge has done little to influence higher demand for ETH. The potential upside might still be limited but there is still enough time for that to change especially if market conditions allow.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)