Going long on Chainlink [LINK] in Q4? Read this report first

Good news recently came in for Chainlink [LINK] after what seemed like a month of ups and downs. According to a recent tweet from LunarCrush, LINK was among the “largest movers in the top 100” on 4 October as “Bullish” Chainlink news was trending following SmartCon.

This was a promising development for LINK as it increases the possibility of LINK’s next bull-rally.

?Insights:$LINK is among the largest movers in the top 100 today as “Bullish” #Chainlink news is trending following SmartCon.

?Price: $7.76 +7%

See top trending $LINK posts and news: https://t.co/hebkvPOpg9 pic.twitter.com/Nbn87TNMYP

— LunarCrush (@LunarCrush) October 4, 2022

Furthermore, Chainlink posted a tweet mentioning a few more updates, including integrations across Ethereum [ETH], Polygon [MATIC], and Avalanche [AVAX].

⬡ DAILY WRAP-UP ⬡

Integrations across #Avalanche, #Ethereum, & #Polygon.@lasmetaio | VRF & Automation | Starting & settling rounds & distributing payouts@Smart_Piggies | VRF & CPF & Automation | Supporting NFTs & Web3 options@FinanceVolare | CPF | Securing options trading pic.twitter.com/kaASqq9ViO

— Chainlink (@chainlink) October 4, 2022

Interestingly, LINK also registered nearly 2% of 24-hour gains, corresponding with LunarCrush’s findings. However, the altcoin did not manage to go green on its seven-day chart as it displayed a negative 3% seven-day performance.

At the time of writing, LINK was trading at $7.77.

So many “LINK”s to go green

Another interesting piece of information was revealed by WhaleStats, a Twitter handle that offers updates regarding whales’ movements. According to the tweet, LINK was among the list of cryptos that the top 100 Ethereum whales were holding. This was good news as it represented growing whale confidence in LINK.

? The top 100 #ETH whales are hodling

$140,543,282 $SHIB

$84,379,054 $BIT

$49,065,440 $LOCUS

$42,005,466 $UNI

$40,184,654 $LINK

$38,848,548 $BEST

$38,189,279 $MKR

$38,128,112 $MOCWhale leaderboard ?https://t.co/N5qqsCAH8j pic.twitter.com/LpQimafnLR

— WhaleStats (tracking crypto whales) (@WhaleStats) October 4, 2022

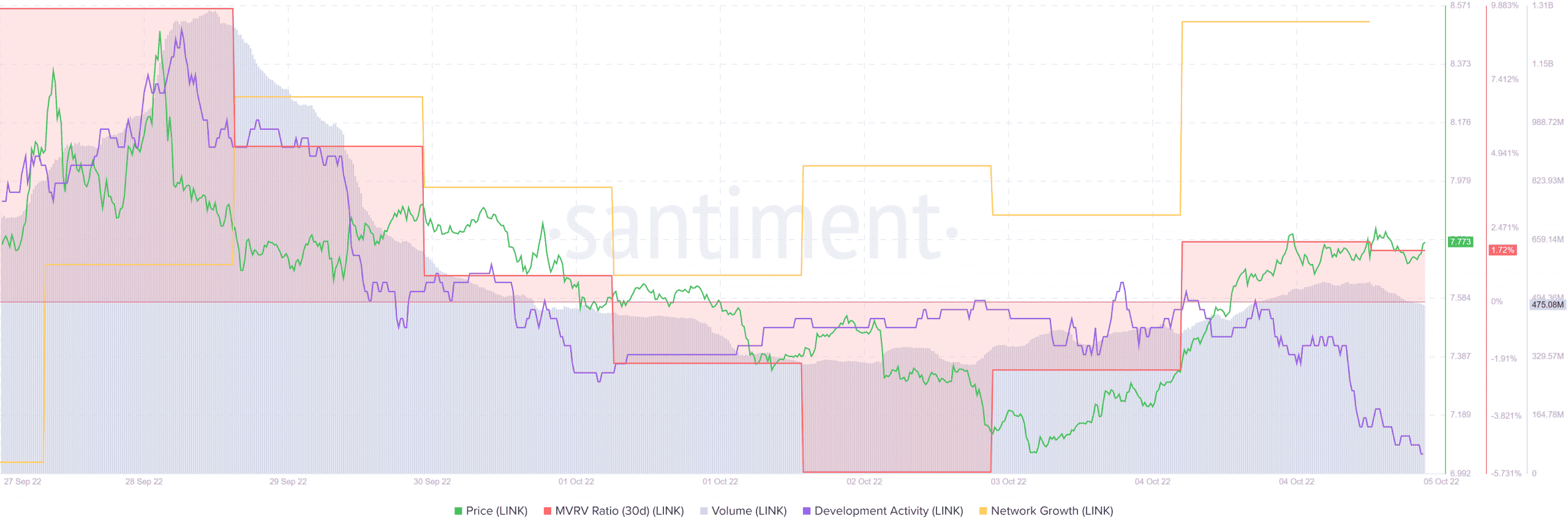

Furthermore, a look into LINK’s on-chain metrics also gave hope for a price surge soon, as most of them were in support of LINK. For instance, LINK’s Market Value to Realized Value (MVRV) Ratio registered an uptick, which was a positive signal.

Furthermore, LINK’s volume also went up last week after a significant downfall. This only drives the chances of a price higher. Moreover, LINK’s network growth also registered an uptick, yet another positive signal for the blockchain.

Nonetheless, a few metrics did not favor the alt. Developer activity witnessed a decline, which was a red flag for a network because it represented that fewer developers were making efforts to improve the blockchain.

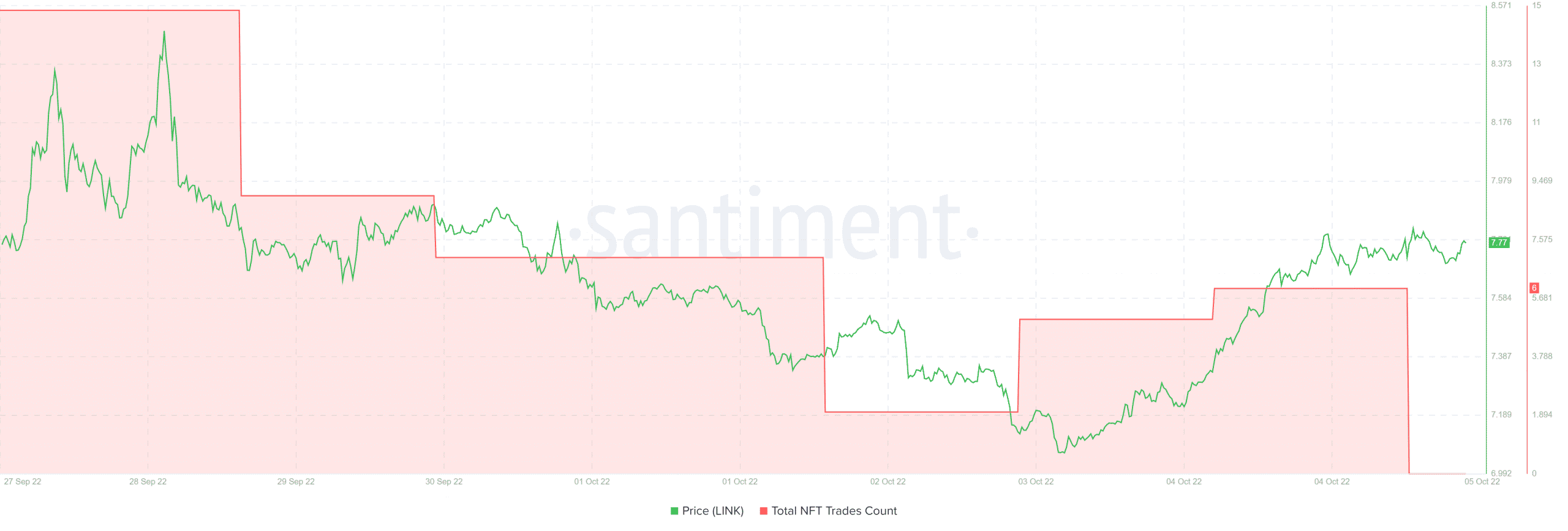

Furthermore, CryptoQuant’s data revealed that LINK’s net deposits on exchanges were high as compared to the seven-day average, indicating higher selling pressure. Interestingly, LINK’s NFT space was also not heated as total NFT trade counts decreased over the last week.

A no-go for LINK then?

Though all the aforementioned updates and on-chain metrics indicated that investors can expect better days ahead, a few factors questioned an upcoming rally.

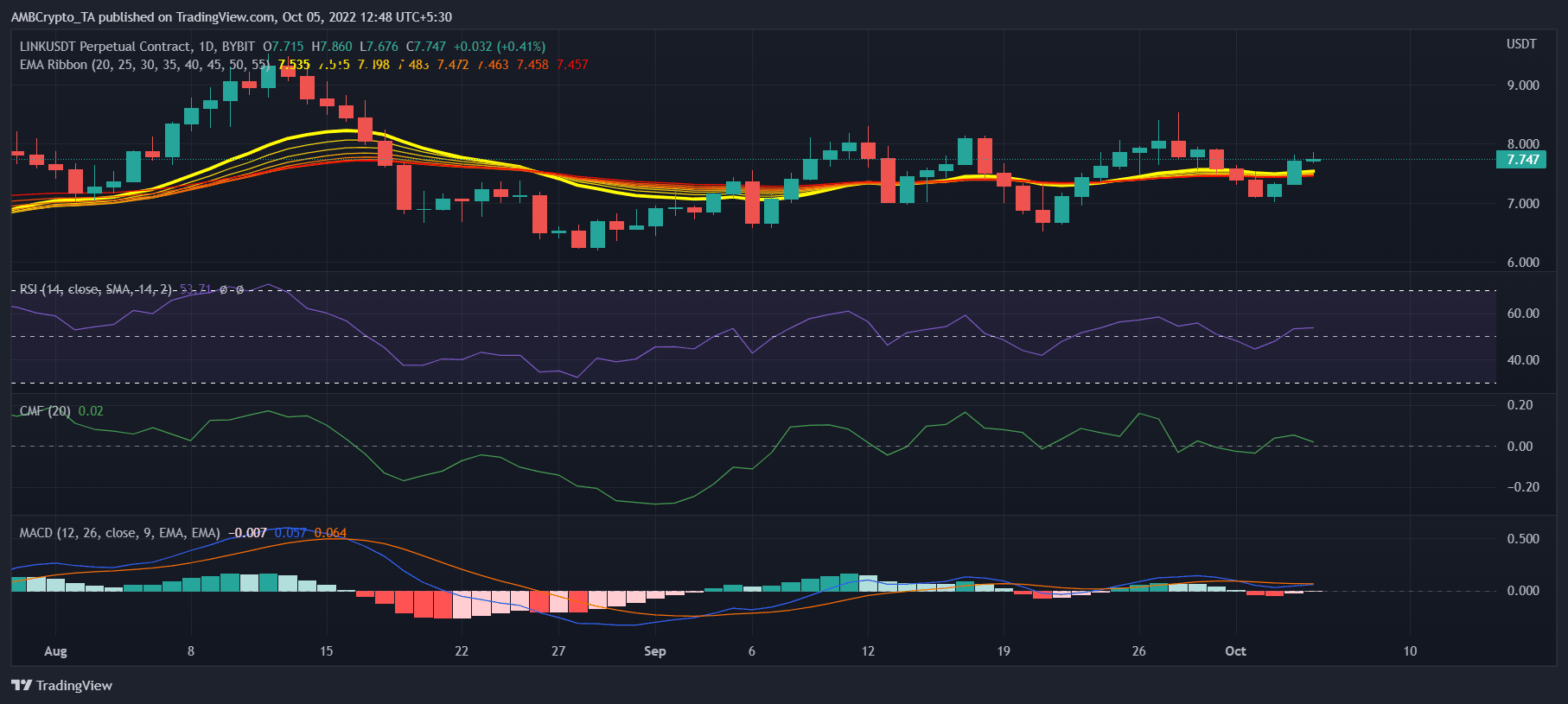

LINK’s daily chart revealed that the Relative Strength Index and Chaikin Money Flow (CMF) were resting just above the neutral position, which didn’t clearly suggest bullish or bearish behavior.

Moreover, the Moving Average Convergence Divergence (MACD) also registered a bearish crossover, further reducing the chances of an uptick.

The Exponential Moving Average (EMA) Ribbon’s data showed that LINK’s 20-day EMA was tussling with its 55-day and later registered a bullish crossover. This may increase the chances of a northbound breakout.