UNI’s key performance indicators can help you make profitable trades

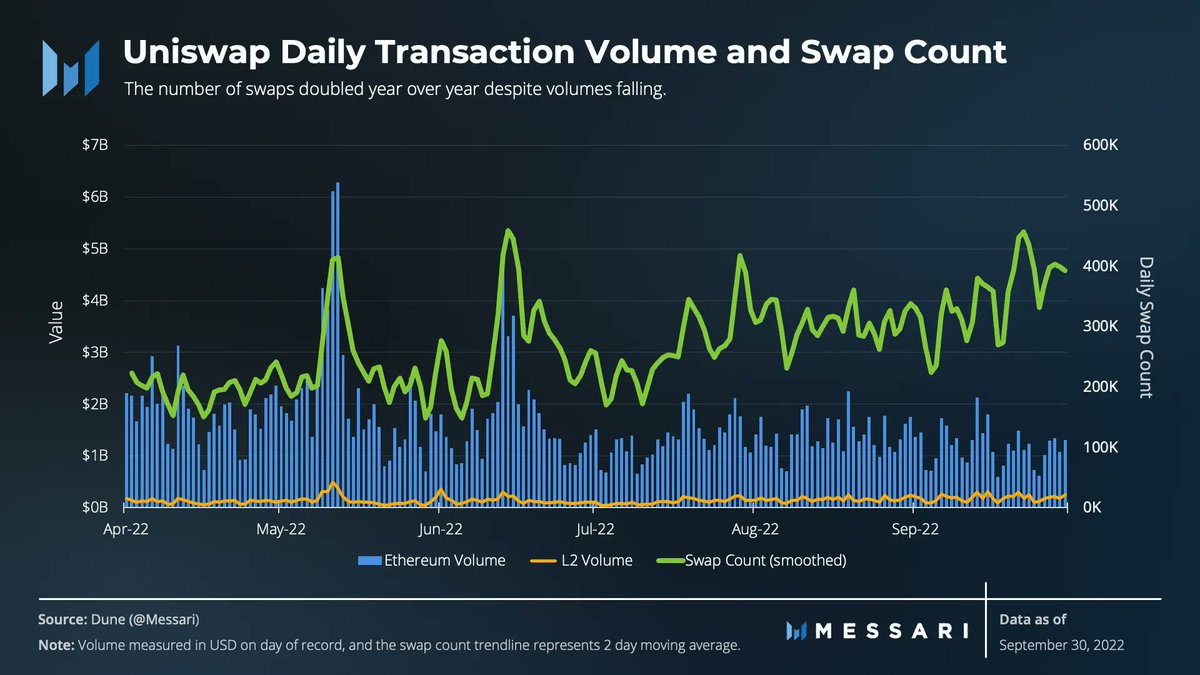

The period between July and September was marked by a decline in key performance indicators for Uniswap [UNI], Messari found in a new report.

In its latest report titled “State of Uniswap Q3 2022,” the blockchain analytics platform assessed the performance of Uniswap in the last quarter.

As for its key performance indicators, Messari found that trading volume on Uniswap in Q3 totaled $120.92 million. On a quarter-on-quarter basis (QOQ), this represented a 30% decline in trading volume on the platform. In Q2, trading volume on the decentralized cryptocurrency trading protocol equaled $172.80 million.

Trading volume on Uniswap had been on a consistent decline since Q4 2021. As found by Messari, assessing the year-over-year (YoY) performance of Uniswap’s trading volume revealed an 18% decline in trading volume on the platform.

Also, Messari discovered that end-of-period liquidity on Uniswap declined persistently since the beginning of the year. Between the year’s first two quarters, this decreased by 37%.

Between July and September, end-of-period liquidity on Uniswap was flat as it fell further by merely 0.5%. Interestingly, while this fell in Q3, it increased by 11% on a YoY basis.

The persistent fall in the cryptocurrency market led to a decline in the fees paid to liquidity providers on Uniswap. Between Q1 and Q2, liquidity provider fees on Uniswap fell by 21.8%.

Between July and September, it declined further by 38.8%. According to Messari, on a YoY basis, fees paid to liquidity providers on Uniswap dropped by 52.9%.

It was not all bad

While the report confirmed a 30% decline in trading volume on Uniswap in Q3, the protocol saw an increase in swap counts within the same period. According to Messari, this grew by 32% between July and September.

As for the decline in trading volume, Messari discovered that it was “isolated” to Uniswap’s deployment on Ethereum Chain. On Optimism, Arbitrum and Polygon, trading volume rallied within the period under consideration.

Also, seeing growth within the period under review was the amount of liquidity on Uniswap. The market share of Uniswap’s liquidity closed Q3 at a high of 0.40%.

As for chain utilization, Messari took the total volume of V3 pools in a given day divided by the total liquidity supplied across all V3 pools and found that utilization for Uniswap V3 went up by an average of 23% across the three Ethereum Layer-2 scaling solutions.

Well, according to data from DefiLlama, the TVL across DeFi protocols has been on a persistent decline since the beginning of Q4. So far this month, it has fallen by 2%.

With projections of further tightening of the global financial markets, it is possible that the general cryptocurrency market is not done declining just yet.

![Bitcoin's [BTC]](https://ambcrypto.com/wp-content/uploads/2025/05/Kelvin-_20_-400x240.webp)