Forecasting Dogecoin’s [DOGE] potential to bounce back from this level

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Dogecoin strived to bounce back after a rising wedge breakdown, can it find renewed buying pressure?

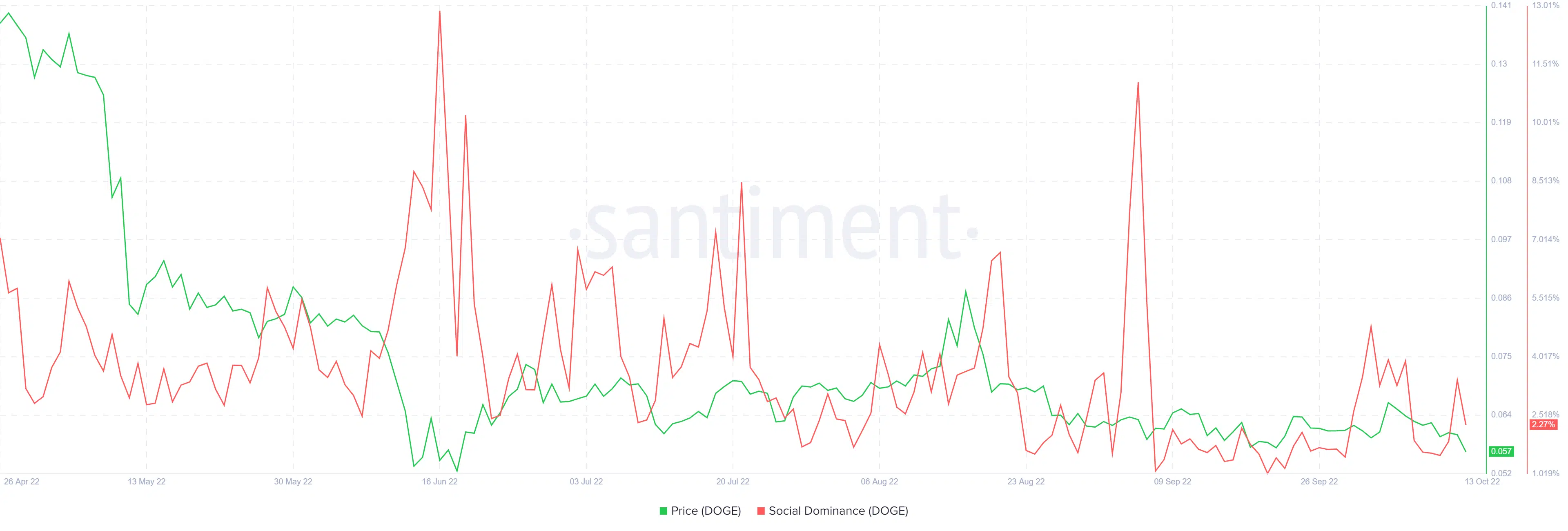

- The meme-coin marked a slight uptick in its social dominance.

Owing to the broader market fallout, the slip below the $0.173-level in December last year positioned Dogecoin (DOGE) to find fresher lows to date. This phase led the dog-themed crypto to match its yearly lows in June and September this year.

The sellers have exhibited strong reversal inclinations from the six-month trendline resistance (yellow, dashed). The recent bearish pull has realigned the altcoin below its 20 EMA (red) and the 50 EMA (cyan) to depict a selling edge.

A sustained close below the $0.057 level can set the scene for an extended bearish pull. At press time, DOGE was trading at $0.057, down by 5.4% in the last 24 hours.

DOGE saw a patterned breakdown, can the buyers stop the bleeding?

The bearish pressure rekindled at the long-term trendline resistance. Consequently, the resultant reversal has kept DOGE bulls under control. The $0.0607 zone highlights the high liquidity area that the bulls failed to uphold over the last few days.

Given the recent tendencies of DOGE to revive from the $0.057 level, the buyers would look to induce a rally. But a sustained decline below this level could expose the crypto to a near-term downside before a revival. In these circumstances, DOGE could test the $0.048-$0.052 range before a likely bullish rebuttal.

An immediate reversal above the $0.057-mark would position DOGE to test the trendline resistance in the $0.062 zone.

Nonetheless, the buyers should look for the RSI’s close above the midline to gauge the chances of a bull run. Furthermore, the CMF’s higher troughs bullishly diverged with the price action.

With its social dominance witnessing a slight surge since its September lows, DOGE has struggled to drive up its price over the past month.

Should the price action follow, the buyers would look for a rebound from its immediate support. Moreover, DOGE’s Reddit social active users marked a significant spike over the last few weeks.

All in all, DOGE stood in a dicey situation. Its current technical readings flashed a bearish edge with hopes of a near-term recovery. A sustained close above the $0.057 level can confirm this narrative. In either case, the selling triggers and targets would remain the same as discussed above.

Finally, the dog-themed coin shares a 43% 30-day correlation with the king coin. Thus, keeping an eye on Bitcoin’s movement would complement these technical factors.