Potential profit-seeking APE investors can redeem themselves in what’s left of Oct

Investors that missed a chance to get into Apecoin [APE] may have just gotten another chance. The monkey-themed digital coin has been on a bearish trajectory since the last week of September. It retested an ascending support but more importantly, interesting observations have happened this weekend.

Here’s AMBCrypto’s Price prediction for Apecoin [APE] for 2022-2023

APE joined the list of top 10 cryptocurrencies by whale trading volumes in the last 24 hours according to Whalestats. This observation indicated that whales were buying back APE at a discount. This also meant that there was a high likelihood of a bounce from APE’s current price level.

JUST IN: $APE @apecoin now on top 10 by trading volume among 5000 biggest #ETH whales in the last 24hrs ?

Peep the top 100 whales here: https://t.co/kOhHps9vr9

(and hodl $BBW to see data for the top 5000!)#APE #whalestats #babywhale #BBW pic.twitter.com/OaomRD2c5f

— WhaleStats (tracking crypto whales) (@WhaleStats) October 16, 2022

The volume spike underscored the potential for an upcoming major price move especially after the recent downside. Some of Apecoin’s on-chain metrics have already shifted following the downside and the volume change.

More monkey business

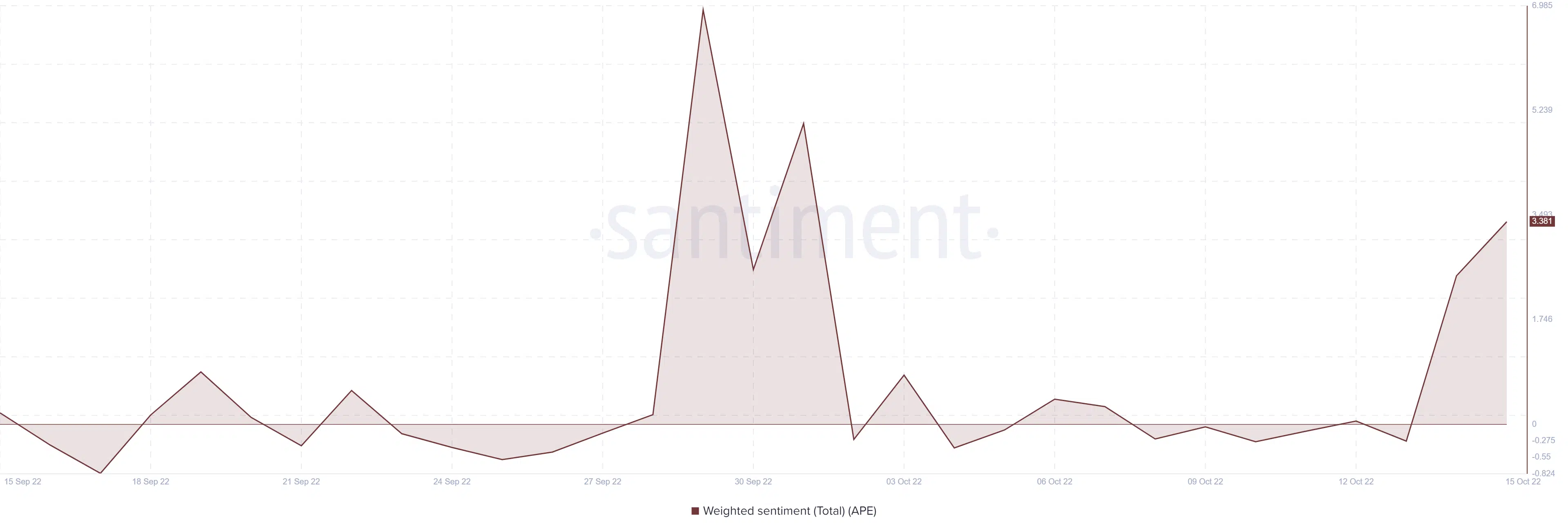

One of the most notable recent observations pertaining to APE’s demand was a weighted sentiment increase. The weighted sentiment registered a sharp pivot on 13 October, the same day that it bottomed out last week.

The sentiment shift considering APE’s price action suggested that the observed volume uptick represented a bullish pressure. In addition, the cryptocurrency was up by 1.19% at press time. This further confirmed that APE experienced higher buy pressure than sell pressure in the last 24 hours.

APE might be headed for a bullish relief rally now that significant buying pressure was flowing back in. A look at the long-term price action also revealed that the current accumulation was taking place on an ascending trend line. The price sat right on the same ascending support at the time of writing.

While the support line didn’t necessarily guarantee a bullish reversal, it surely increased the chances of one happening. Especially after the recent increase in buy pressure in the last three days.

Furthermore, APE’s 90-day Mean coin age metrics pivoted on 6 October. It confirmed that sell pressure may have started wearing off in the first week of the month. This was because it indicated that more traders opted to hold their Apecoin rather than selling.

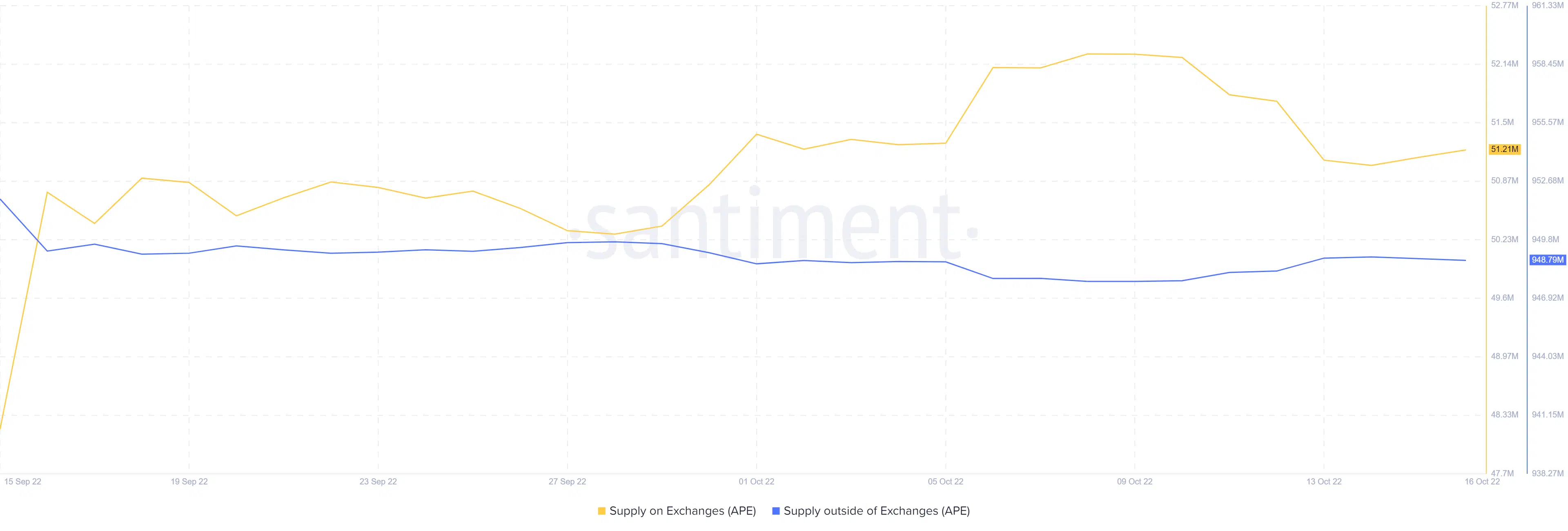

The 90-day mean coin age metric further strengthened the probability of a sizable bullish bounce. A look at the supply of APE on exchanges solidified these expectations. APE experienced a significant increase in the supply outside exchanges in the last seven days.

Interestingly, the supply on exchanges registered a drop during the same period. This outcome confirmed that APE coins had been flowing out of exchanges and into private wallets in the last few days. This was a healthy sign of a bullish demand.

At the time of writing, Apecoin had more than enough signs pointing towards a bullish pivot. However, investors should exercise caution because market changes can occur at any time.