Chainlink traders can take advantage of zigzag price patterns if…

LINK investors are still biting their fingers almost a week after its 50% drawdown from its September top. The cryptocurrency is still stuck near the current monthly low despite positive developments that might contribute to healthy long-term growth.

Here’s AMBCrypto’s price prediction for LINK

Chainlink did reveal some positive developments lately but they have not had an impact on LINK’s price action so far.

The network recently revealed that it secured its place in service provision for the cargo and marine industries. This development highlights the expansion of its services into some key industrial pillars through the Ontonomi parameric insurance platform.

Parametric insurance platform @OtonomiPlatform is using #Chainlink oracles to help supercharge its mission of bringing fully automated insurance contracts to the marine and cargo industries. https://t.co/Rt0371Zprm pic.twitter.com/KYs0o0BbwB

— Chainlink (@chainlink) October 18, 2022

This development means Chainlink can contribute to higher efficiency in global logistics. But is this enough to contribute to more demand? A look at LINK’s supply distribution reveals that the current sell pressure is due to the whales’ selloff.

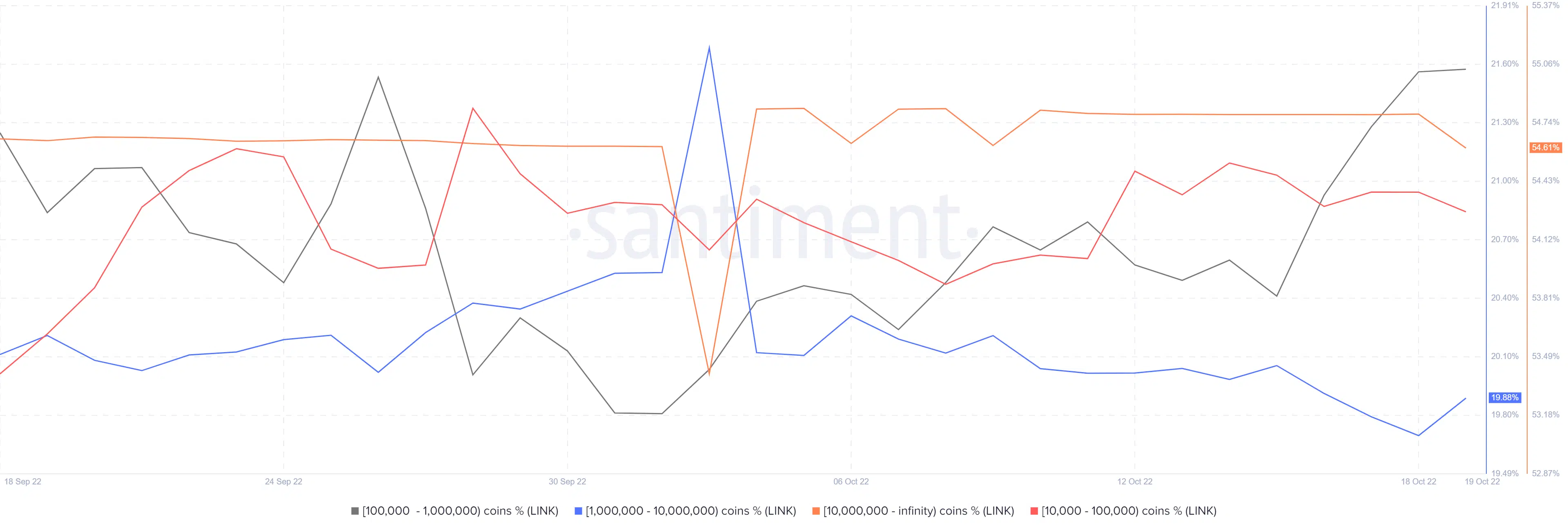

LINK addresses holding more than 10 million LINK controlled 54.61% of the total circulating supply, at press time. The same whale category registered outflows in the last two days, during which LINK’s price action dropped by roughly 4%.

Whales holding between 10,000 and 100,000 LINK also contributed to the selling pressure. The downside would have been higher were it not for the fact that another large whale category has been accumulating.

Addresses holding between 100,000 and 10 million coins saw their balances increase substantially in the last two days. The ongoing tug of war has thus restricted LINK within the current range.

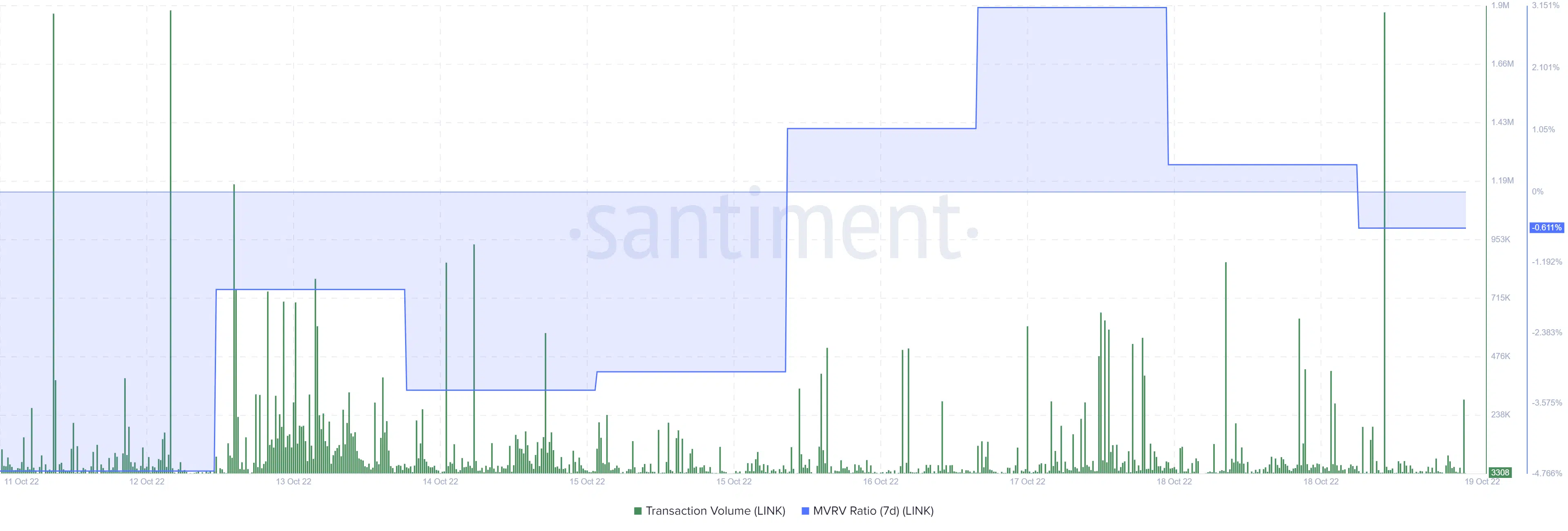

LINK’s 7-day MVRV ratio dropped in the last two days in tandem with the price drop, as well as the selling pressure from top addresses.

However, the transaction volume metric did register a large spike in the last 24 hours at press time.

Interestingly, LINK’s weighted sentiment metric continued its bounce back in the last two days. This is a confirmation that investors’ sentiment has improved of late and this might have something to do with the current price level.

LINK traded at $6.829 at press time after failing to push above its 50-day moving average.

LINK bears slapped down the bullish attempts observed earlier this week. This outcome occurred after the RSI failed to cross above the 50% level.

Investors should also note that the RSI continues to show relative weakness since the start of October as sell pressure continues to hammer down any rally attempts.

Conclusion

There is still a significant probability of more downside despite the recent observations. Nevertheless, the price already demonstrated some upside in the last 24 hours at press time.

This indicates that the current short-term support range at the $6.6 price level is still holding strong. In other words, traders can still take advantage of the zigzag price pattern for some short-term gains.