BNB investors should read this before cutting their losses in November

BNB, like most other cryptos in the market, registered a promising performance over the last few weeks, thanks to the bullish market condition.

Not only did BNB’s price increase by more than 15% in the last seven days, but growth was also marked in other aspects as well. For instance, BNB witnessed a slight increase in staking numbers as the value of BNB staked went from $19.3 million in September to $19.4 million in October.

Here’s AMBCrypto’s Price Prediction for BNB for 2023-24

4/ #BNB staking stats:

BNB Chain saw a slight increase in staking numbers from September to October:

♦️ ~0.5% increase in $BNB staked (19.3M to 19.4M)

♦️ 4th largest staking market cap

♦️ ~11.9% staking ratio pic.twitter.com/G6U5Wu3BQG— pSTAKE for BNB (@pSTAKE_stkBNB) November 1, 2022

Moreover, Stader BNB recently announced that they have crossed $20 million worth BNB staked with them. This new milestone was undoubtedly a piece of positive news for BNB.

It's celebration time at Staderverse?

We've crossed $20M worth #BNB staked with us.We're overjoyed & appreciate the support from @BNBCHAIN

& our partners @WombatExchange @ImpossibleGD @ape_swap @izumi_Finance @beefyfinance @Coneswap @Ellipsisfi @MidasCapitalxyz @OpenLeverage pic.twitter.com/Vm5wrQbajj— Stader.BNB (@stader_bnb) November 2, 2022

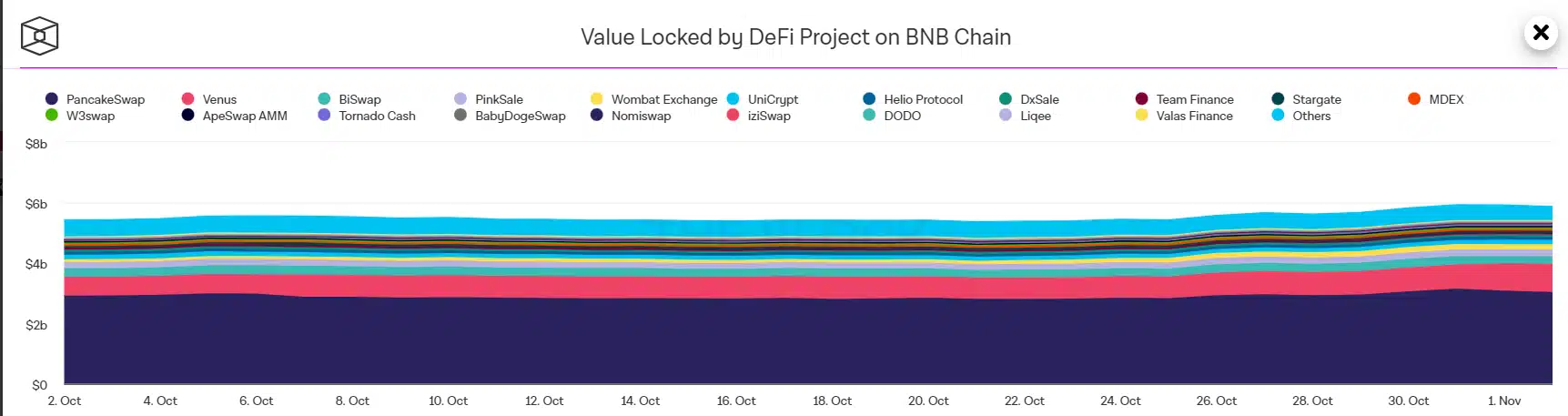

The Block’s data also supplemented these developments. According to the chart attached below, the Total Value Locked (TVL) by DeFi projects on the BNB chain was about to touch $6 billion.

Furthermore, BNB’s network, at press time, had 51 total validators (26 active and 25 inactive).

At press time, BNB was up by over 3% in the last 24 hours and was trading at $333.83 with a market capitalization of over $53.4 billion.

That being said, it’s important to take a look at BNB’s on-chain metrics to put things in proper perspective.

This should be concerning

CryptoQuant’s data revealed that BNB’s Relative Strength Index (RSI) was in an overbought position, which indicated that the good days might come to a halt soon.

BNB’s MVRV Ratio registered a downtick, suggesting a possible sell-off in the coming days. Furthermore, BNB’s velocity also decreased lately. Moreover, the daily on-chain transaction in loss registered a spike on 1 November, which was yet another negative signal.

However, this might help

Though most of the metrics gave a negative notion for BNB’s price in the coming weeks, a few of them looked optimistic.

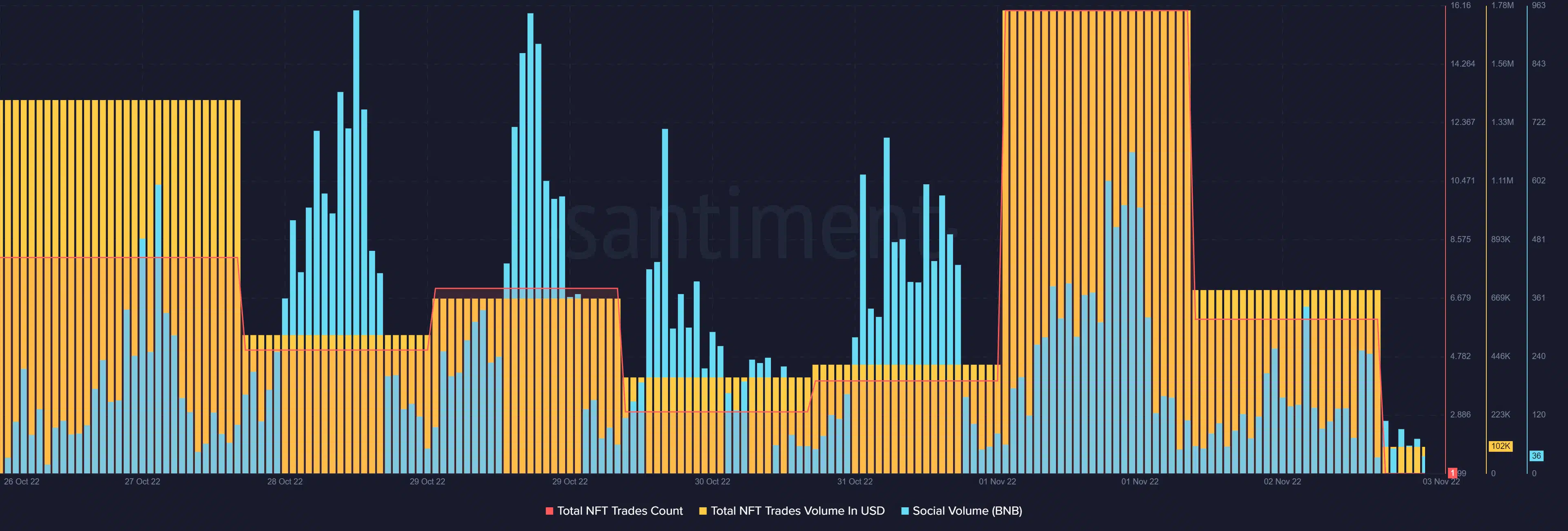

For instance, BNB’s NFT ecosystem managed to show growth. BNB’s total NFT trade count and trading volume in USD went up recently, reflecting BNB’s popularity in the NFT community.

Moreover, BNB’s popularity was further established after its social volume went up over the last week, with a slight downfall on 2 November.