Chiliz: Gauging if CHZ’s current bull run can offer ‘buying’ opportunities

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Over the last few days, Chiliz saw consistent gains as the buyers strived to reclaim a near-term edge.

- The altcoin’s Open Interest unveiled mixed signals at the time of writing.

Chiliz’s [CHZ] recent bullish rebuttal from its three-month support induced a solid upturn over the last few days. The resultant gains put the altcoin back on a bullish track.

Read Chiliz’s [CHZ] Price Prediction 2023-2024

Given the altcoin’s sway beyond the limitations of the 20/50/200 EMA, buyers could aim to maintain their edge in the coming sessions. Nonetheless, the wider market conditions beheld the potential to invalidate this edge.

At press time, CHZ was trading at $0.2321, up by nearly 15% in the last 24 hours.

Can the sellers propel a rebuttal?

The bulls pulled off a solid rally after finding reliable grounds from its long-term support in the $0.15 region. This recovery entailed a whopping 54.5% ROI in just the last six days. In the meantime, CHZ witnessed a bullish flag breakout in the four-hour timeframe.

After the patterned break, CHZ reclaimed its spot above the $0.22 support. Also, the 20 EMA (red) and the 50 EMA (cyan) looked north and strived to close above the 200 EMA (green). A potential bullish crossover can aid the near-term bullish inclinations.

A convincing rebound from the $0.24 ceiling can aid the sellers in keeping the buying pressure under their check. An immediate or eventual bearish rebuttal can find the first major support near the $0.20-$0.21 range.

A close above the $0.24 mark would reaffirm the bullish intentions to extend the ongoing rally. In these circumstances, the first major resistance range stood in the $0.27-$0.29 range.

The Relative Strength Index’s growth above the midline hinted at a shift in momentum toward the buyers. Furthermore, the MACD line (blue) jumped above the zero mark to reiterate RSI’s bullish stance. Should the signal line (orange) find a convincing close above the equilibrium, the buyers could look for timing entries.

Open Interest analysis revealed this

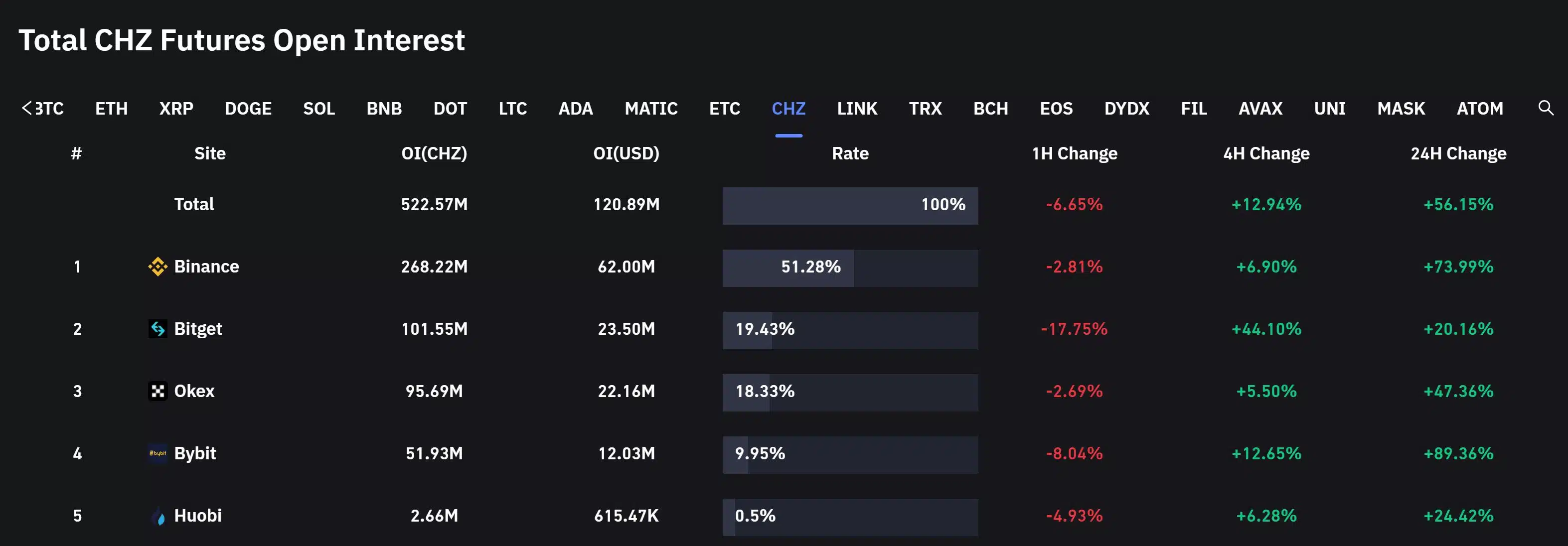

According to data from Coinglass, the total CHZ futures Open Interest across exchanges registered a whopping 56.15% growth over the last 24 hours. On the other side, the price action marked an over 14% daily gain.

This is a bullish sign as it represents additional aggressive buying. But The buyers should keep a watch on a plausible reversal of this rising trend in the coming sessions.

The potential targets would remain the same as above. Traders/investors should keep a close watch on Bitcoin’s movement as the alt shared a 41% 30-day correlation with the king coin.